Dalal Street Week Ahead: FOMC minutes, Ukraine-Russia talks, manufacturing & services PMI flash data among 10 key factors to watch

HomeNewsBusinessMarketsDalal Street Week Ahead: FOMC minutes, Ukraine-Russia talks, manufacturing & services PMI flash data among 10 key factors to watch Trending TopicsSensex TodayDeepak Nitrate Share PriceSenco Gold Share PriceManappuram Finance Share Price UBL Share PriceHindalco Share Price Dalal Street Week Ahead: FOMC minutes, Ukraine-Russia talks, manufacturing & services PMI flash data among 10 key factors to watchConsidering the significant selling pressure, the market may initially try to rebound next week, but may not be able to sustain given the ongoing sell-on-rally trend. Sunil Shankar Matkar February 16, 2025 / 21:21 IST

Dalal Street Week Ahead

Dalal Street Week Ahead

Equity benchmark indices snapped a two-week winning streak amid rising volatility, losing around 2.5 percent in the week that ended on February 14, the biggest weekly loss in the last eight weeks. Persistent selling by FIIs, uncertainty surrounding US trade policies and tariffs, and weak corporate earnings weighed on the market's mind.

Further, diminishing hopes of a rate cut by the Federal Reserve after higher-than-expected US inflation, at 3 percent, in January, and weak industrial output numbers also dampened the mood.

Considering the significant selling pressure, the market initially may try to rebound next week (February 17), but sustainability is key given the ongoing sell-on-rally trend. Overall, it is expected to consolidate with a focus on FOMC and RBI minutes, Ukraine-Russia peace talks, and manufacturing and services PMI flash data.

The Nifty 50 fell 631 points (2.68 percent) to 22,929, the biggest weekly loss since the week of December 16-20, and the BSE Sensex plunged 1,921 points (2.47 percent) to 49,099. The broader markets were also hit badly with the Nifty Midcap 100 and Smallcap 100 indices declining 7.4 percent and 9.4 percent, respectively, amid the risk of further earnings weakness.

Selling pressure was seen across sectors, with auto, pharma, metals, and realty hit harder than others.

Vinod Nair, Head of Research at Geojit Financial Services, said that risk-aversion continues to rule investors’ minds as corporate earnings are significantly lower than expected, especially in the mid and smallcap space.

Rupee depreciation is also expected to impact sentiments in the near term, which could further drive FII (foreign institutional investor) outflows, and volatility is expected to stay elevated until there is clarity on tariffs and recovery in corporate earnings, he explained.

Here are 10 key factors to watch next week:

FOMC minutes

Globally, investors will keep an eye on the minutes of the US Federal Open Market Committee (FOMC) policy meeting held in January, where the Fed funds rate was unchanged in the 4.25-4.50 percent range, in line with economists' expectations. Federal Reserve Chair Jerome Powell had said in that meeting that the central bank was not in a hurry to reduce interest rates further and would wait to see the progress on the inflation front.

Ukraine-Russia talks

The world will also be watching the possible peace talks between the US, Ukraine, and Russia in Saudi Arabia in the coming days. "This is aimed at ending the Russia-Ukraine war and will be pivotal for market sentiment. A successful outcome could weigh on gold and oil prices, while fuelling a rally in riskier assets," said Kaynat Chainwala of Kotak Securities. European leaders also want to be included in the talks.

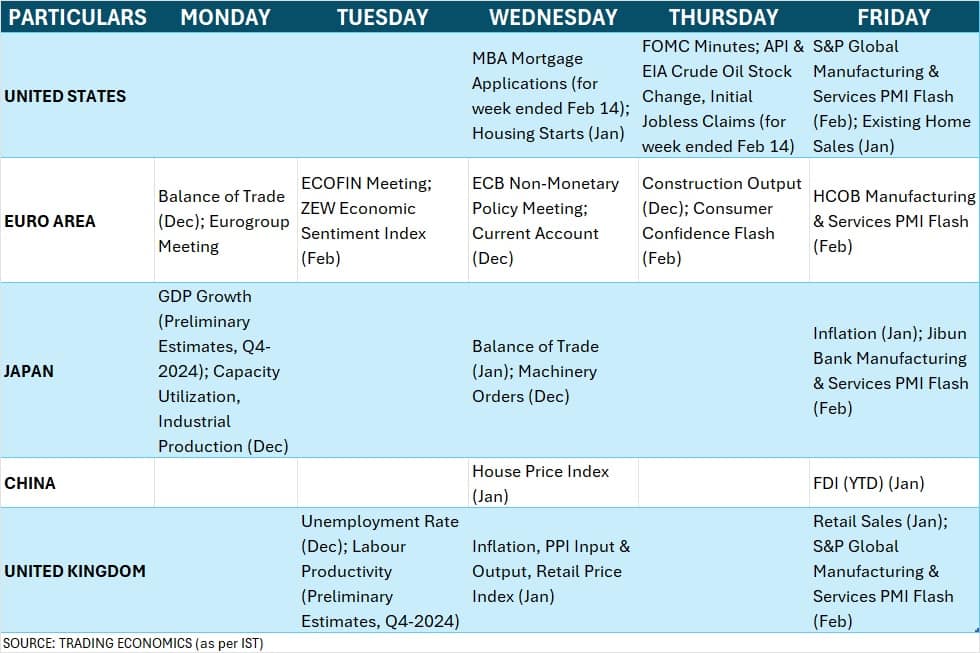

Global economic data

Market participants will be focussed on the manufacturing and services PMI flash data for February that's being released next week by several nations including the US, UK, Japan, and others.

Weekly US jobs data, preliminary estimates Japan's for Q42024 GDP numbers and inflation in January, and UK's retail sales and inflation numbers will also be watched.

Domestic economic data

At home, the focus will be on the balance of trade data for January that's due on February 17, followed by the HSBC Manufacturing and Services PMI flash numbers for Feb, and foreign exchange reserves for the week ended February 14 scheduled to be released on the 21st of the month. According to experts, manufacturing and services PMI flash numbers are expected to be higher than 57.7 and 56.5, respectively, recorded in January.

Minutes of the February meeting of the MPC (Monetary Policy Committee) will also be studied. The RBI's (Reserve Bank of India's) MPC cut the repo rate by 25 basis points (bps) to 6.25 percent on February 7.

FII flow

Market players will keep an eye on FIIs, who continued to sell despite a healthy budget and interest rate cut by the RBI. Also, benchmark indices have been unable to hold on to the recovery seen many times in the past few weeks. Until there is strong earnings recovery and easing uncertainty over the global trade war, FIIs will not be back to Indian equity markets, according to experts.

FIIs have net sold Rs 29,183 crore worth of shares so far in February in the cash segment, however, DIIs (domestic institutional investors) have managed to offset the outflow by net buying Rs 26,000 crore's worth.

The Indian Rupee

The movement of the Rupee against the Dollar will be closely followed, despite sharp appreciation last week following intervention by the RBI. The currency gained 1.15 percent to 86.58 against the USD during the week, but experts expect it to remain under pressure and contribute to market volatility in the near term.

IPOs

Weakness in the secondary market also seems to be impacting the primary market as there are only two IPOs opening for subscription next week. Both are from the SME segment — there's no public issue in the mainboard segment.

HP Telecom India will open its Rs 34-crore initial share sale on February 20, followed by Beezaasan Explotech's Rs 60-crore issue on February 21.

Quality Power Electrical Equipments, from the mainboard segment, will close its IPO on February 18. Ajax Engineering will debut on the bourses on February 17, followed by Hexaware Technologies on February 19, and Quality Power Electrical Equipments on February 21.

In the SME segment, LK Mehta Polymers, Shanmuga Hospital, and Royalarc Electrodes will close their public issues next week, while trading in Chandan Healthcare, Maxvolt Energy Industries, Voler Car, PS Raj Steels, LK Mehta Polymers, Shanmuga Hospital, and Royalarc Electrodes shares will commence on the bourses.

Technical view

The Nifty remains in the grip of bears as it traded below its 10 and 20-week EMAs, and also below the resistance trendline with a negative bias in momentum indicators. But considering the weakness seen last week, and a Tweezer bottom pattern formation on the four-hourly charts, a rebound early next week can't be ruled out. According to experts, in case of a rebound, the index may face a hurdle at 23,250, followed by 23,600, but in case the index breaches 22,900, 22,750 is expected to be the immediate support, followed by 22,600-22,500.

F&O cues

Weekly options data indicated that the Nifty is expected to be in the 22,000-24,000 range in the short term, with resistance at 23,300 and support at 22,800.

On the Call side, maximum open interest was seen at 24,000 strike, followed by 23,300 and 23,500 strikes, with maximum writing at 23,300 strike, followed by 23,900 and 23,800 strikes. On the Put side, 22,000 strike holds the maximum open interest, followed by 22,500 and 22,400 strikes, with maximum writing at 22,500 strike, followed by 22,100 and 22,800 strikes.

The volatility index, India VIX, rebounded last week after falling in the previous two weeks, rising 9.72 percent to 15.02. This is a cautionary signal for bulls.

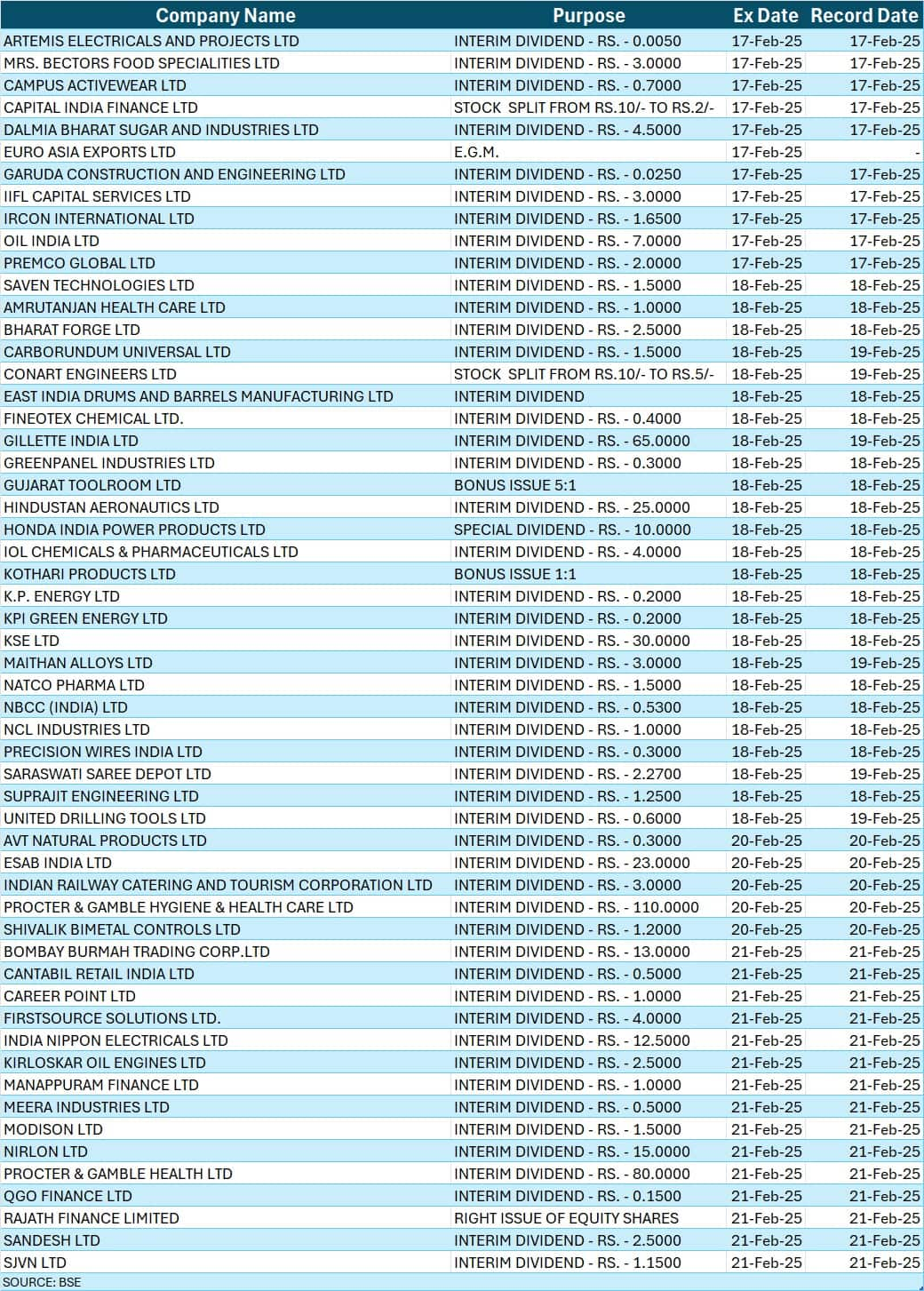

Corporate action

Here are key corporate actions taking place next week:

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Sunil Shankar Matkar first published: Feb 16, 2025 08:32 pm

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Trending news Elon Musk wanted to keep our baby a secret: Influencer who claims to be mother of his 13th child

- Elon Musk reacts after 26-year-old influencer claims she gave birth to his 13th child

- Japan man who spent Rs 12 lakh to 'turn into a dog' rents out his costume at Rs 28,000 for 3 hours

- Expert who studied brain for 15 years shares a hack for sharper memory: 'If you do just one...'

- Bengaluru founder who got Nikhil Kamath's backing, shares journey before: 'Rs 2 crore lost, body paralysed'

Comments

0 comment