Mahindra & Mahindra followed closely at third place, recording a 22 per cent rise in domestic utility vehicle sales at 56,336 units. Total PV sales, including exports, touched 57,598 units.

Mahindra & Mahindra followed closely at third place, recording a 22 per cent rise in domestic utility vehicle sales at 56,336 units. Total PV sales, including exports, touched 57,598 units.The passenger-vehicle industry sustained the robust momentum seen in October, delivering an estimated 4,25,000 units in November 2025, a 21 per cent year-on-year jump, driven by price cuts after the GST reduction and buoyant festive-season demand.

Automakers also sought to leverage this momentum with a slew of launches in November, including the new Hyundai Venue, Tata Sierra and Mahindra XEV 9S.

Top three hold steady

Maruti Suzuki India, the country’s largest carmaker, retained its leadership position with retail sales of 1,70,971 units, up 21 per cent. Pending orders stand at around 1.5 lakh units. “The market is very bullish… Eight of our models do not have a single dispatchable unit in the factory,” said Partho Banerjee, Senior Executive Officer, Marketing and Sales, Maruti Suzuki India, during the post–monthly performance review call. He added that the small-car segment has seen a sharp revival.

“The small car customer has come back in full strength. Retail growth in Alto, K10, S-Presso, Celerio and WagonR is 37 per cent,” Banerjee added.

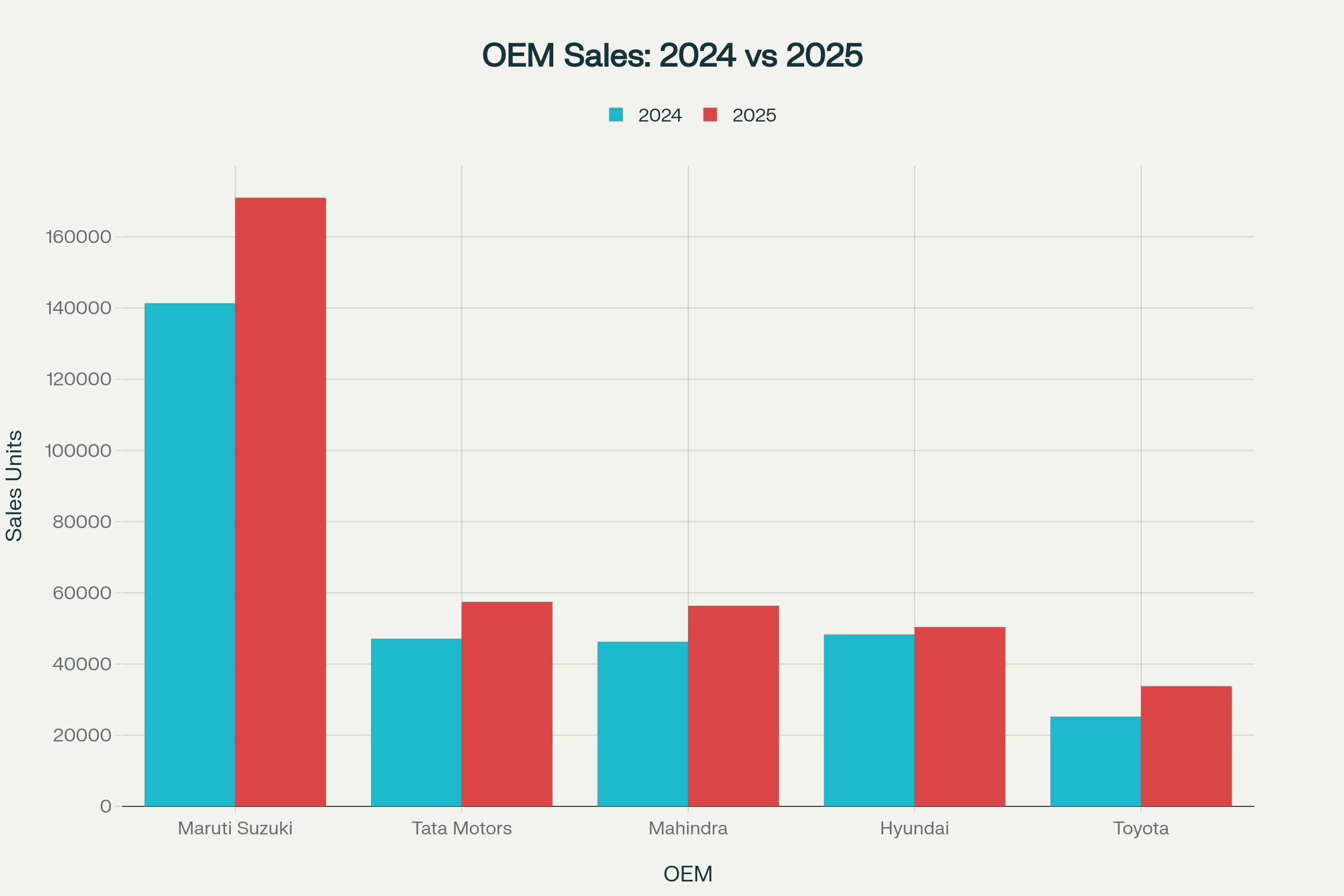

| 2024 | OEM | Rank | OEM | 2025 |

| 141,312 | Maruti Suzuki | 1 | Maruti Suzuki | 170,971 |

| 48,246 | Hyundai | 2 | Tata Motors | 57,436 |

| 47,063 | Tata Motors | 3 | Mahindra | 56,336 |

| 46,222 | Mahindra | 4 | Hyundai | 50340 |

| 25,183 | Toyota | 5 | Toyota | 33,752 |

Tata Motors grabbed the second position with sales of 57,436 units, up from October. Domestic sales grew 22 per cent, with the automaker betting on the upcoming Sierra to strengthen its presence in the mid-size SUV segment. ETAuto earlier reported that Tata aims to expand its SUV market share from 16 per cent to around 25 per cent with the new launch. Mahindra & Mahindra followed closely at third place, recording a 22 per cent rise in domestic utility vehicle sales at 56,336 units. Total PV sales, including exports, touched 57,598 units.

“We also celebrated the one-year anniversary of our Electric Origin SUVs and launched India’s first authentic Electric Origin seven-seater SUV – the XEV 9S – along with the world’s first Formula E-themed special edition SUV, the Mahindra BE 6 Formula E Edition,” said Nalinikanth Gollagunta, CEO, Automotive Division, M&M.

Hyundai posts tepid growth

For Hyundai Motor India, the modest performance seen in October persisted into November, with domestic sales inching up 4.3 per cent to 50,340 units. The tepid growth also pushed the company down to fourth place in the monthly sales ranking, from second place in November last year. “Supported by GST 2.0 reforms, we continue to carry forward sales momentum,” said Tarun Garg, Whole-time Director and COO, Hyundai Motor India. The newly launched Venue has already garnered over 32,000 bookings in its first month, the company said.

Toyota Kirloskar Motor retained fifth place with domestic sales of 26,418 units, supported by the Urban Cruiser Hyryder Aero Edition and Fortuner Leader Edition.

“The recent introductions have reinforced our growth trajectory. Initiatives such as Drum Tao and the Toyota Experiential Museum in Bangalore have further strengthened customer engagement,” said Varinder Wadhwa, Vice-President, Sales–Service–Used Car Business, Toyota Kirloskar Motor.

Among the other major players, JSW MG Motor India’s wholesales for November month accounted for 5,754 units. The company also reported a 32 per cent wholesale growth during January–November 2025 compared with the same period last year.

No signs of cooling

With new launches, GST relief and festive demand, the industry expects to close FY26 with a 5–6 per cent growth, Banerjee said. Maruti Suzuki anticipates strong wholesales in December, with production lines running overtime to meet demand.

While it was widely expected that the post-October momentum would moderate, the November data suggest demand will likely remain resilient. The strong retail traction, coupled with a fresh pipeline of launches scheduled for December, indicates that the industry’s growth trajectory may sustain in the coming month rather than taper off.

“November sales reflect continuity in the demand surge. The trifecta of GST relief, the wedding season and festive tailwinds has tilted sentiment in favour of the car industry. The current momentum signals that manufacturers and suppliers must brace for an accelerated growth curve heading into 2026,” said Puneet Gupta, Director, S&P Global Mobility.