In crypto, two very different categories of tokens compete for investor attention: meme coins and utility-driven DeFi protocols. On the meme side, Shiba Inu (SHIB) has captured headlines with massive community-driven rallies and a valuation that now places it firmly among the top meme assets. On the other side, Mutuum Finance (MUTM), priced at just $0.035, yet analysts say it could be the breakout DeFi project of 2025. The contrast between the two highlights an important investor choice: chase hype and volatility, or position early in a project with real structural demand.

Shiba Inu (SHIB)

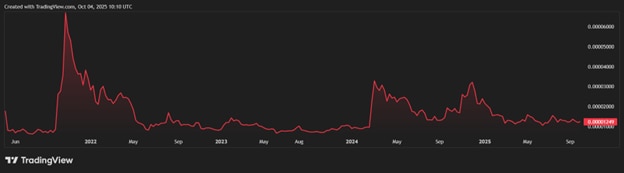

Shiba Inu (SHIB) transformed from a meme joke into one of the most recognizable tokens in crypto. It’s currently trading around $0.0000125, with a market capitalization in the $7–8 billion range, making it a heavyweight among meme and utility-adjacent projects. Its early surges, especially during the 2021 crypto wave, generated enormous returns, driven by massive social momentum, viral marketing, and a strong, dedicated community that consistently rallied behind every roadmap announcement.

Yet today, many of the same forces that powered SHIB’s ascent also set its ceilings. The circulating supply is enormous, nearly 589 trillion SHIB, which means even massive inflows translate into modest per-token gains. Without strong, built-in utility mechanisms, SHIB’s price swings have often been tied to narrative cycles or speculation rather than organic demand. Moreover, with other meme projects or utility-driven tokens emerging, SHIB now competes against newer alternatives that promise deeper protocol features. In a market where speculation alone is no longer enough, SHIB’s path forward increasingly depends on evolving beyond its meme origins.

Mutuum Finance (MUTM)

Mutuum Finance is building a decentralized lending and borrowing protocol with features tailored for sustainability, and investors are taking notice. Currently in Phase 6 of its presale at $0.035, the project has already raised more than $17 million, attracted over 16,800 holders, and sold more than 750 million tokens. According to the protocol’s roadmap MUTM will debut with its beta platform live from day one, allowing users to lend, borrow, and act as liquidators immediately. This instant utility means adoption begins the moment trading opens.

The platform’s dual-lending markets mix protocol-to-contract (P2C) liquidity with pooled peer-to-peer (P2P) dynamics. Interest rates adjust based on utilization: when capital is abundant, borrowing costs drop, encouraging activity; when liquidity is scarce, rates rise, attracting deposits and repayments. For borrowers seeking predictability, stable-rate options provide repayment certainty, with rebalance safeguards to keep the protocol solvent.

Depositors are rewarded with mtTokens, yield-bearing assets that accrue interest in real time while remaining liquid and transferable. This design keeps liquidity active across DeFi and allows users to earn passive income without locking up funds. On top of that, a buy-and-distribute mechanism channels a portion of protocol fees into purchasing MUTM on the open market, embedding structural buy pressure into the token’s very design.

What a Return Could Look Like

For investors, the contrast between SHIB and MUTM becomes even clearer when you run the numbers. A $675 investment in Shiba Inu (SHIB) at its current price of $0.0000125 would secure a very large number of tokens. If SHIB were to rise by 25%, a reasonable assumption given its multi-billion-dollar market cap, that position would grow to roughly $844. While this is a decent return, it highlights the inherent challenge of chasing outsized gains in high-cap meme tokens. Because SHIB’s valuation is already in the $7–8 billion range, meaningful price moves demand enormous inflows, something analysts view as increasingly difficult in the current market environment.

Now compare that to Mutuum Finance (MUTM). A $675 investment in MUTM at $0.035 would already grow to about $1,160 at launch when the token lists at $0.06. When adoption pushes it into the $0.25–$0.50 range within its first months, a target analysts view as reasonable given presale momentum and the beta platform going live, the same stake could climb to between $4,800 and $9,600. This stark contrast illustrates why analysts argue MUTM offers the kind of early-stage asymmetry that meme coins like SHIB, constrained by their size, can no longer replicate.

Feature-Driven Growth Paths

While SHIB depends almost entirely on cultural momentum and community memes, Mutuum Finance ties token demand to functional activity. Every loan, deposit, and repayment creates flow within the system. Every transaction helps generate demand for MUTM.

This is why analysts believe that, while SHIB may continue to thrive as a speculative trade during meme coin cycles, its growth ceiling is limited. Mutuum Finance, on the other hand, is still priced in cents with utility that directly supports expansion. Its roadmap includes a stablecoin, designed to deepen liquidity and anchor borrowing flows, as well as Layer-2 integration, which will reduce costs and scale adoption. Each of these milestones directly increases demand for MUTM, creating a roadmap-driven growth curve that meme coins cannot match.

Meme vs. Mechanics

Shiba Inu (SHIB) has shown what meme-driven communities can achieve, but its lack of utility and massive supply make future exponential gains far more difficult. Mutuum Finance (MUTM), on the other hand, is still in presale with structural mechanics designed to support demand from the very beginning. With a live beta platform at launch, dual-lending markets, mtTokens, and buy-and-distribute dynamics, MUTM is set up not just to list, but to grow.

PEPE may provide entertainment and short bursts of volatility, but MUTM offers a chance to enter early in a protocol where every feature is tied to demand. With presale tokens moving quickly at $0.035 and the next phase set to raise the price by nearly 20%, the question for investors is simple: buy now at a discount, or pay a premium later when adoption and whale inflows push the token higher?

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

Disclaimer: This is a sponsored article. ABP Network Pvt. Ltd. and/or ABP Live do not endorse/subscribe to its contents and/or views expressed herein. Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Cryptocurrency is not a legal tender and is subject to market risks. Readers are advised to seek expert advice and read offer document(s) along with related important literature on the subject carefully before making any kind of investment whatsoever. Cryptocurrency market predictions are speculative and any investment made shall be at the sole cost and risk of the readers.