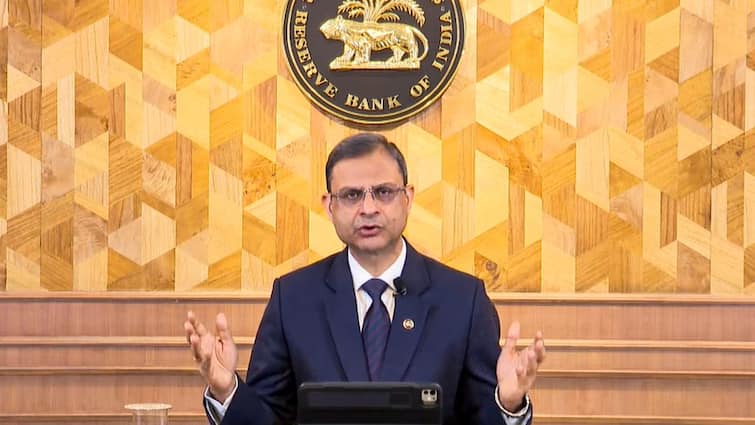

The Reserve Bank of India’s Monetary Policy Committee (MPC) revealed its fiscal policy on Wednesday. Sharing inflation estimates for the financial year, panel chair Governor Sanjay Malhotra said the inflation projection for FY26 has been lowered to 2.6 per cent.

The panel also shared its decision on key rates and opted to maintain a status quo unanimously. The RBI has held the repo rate at 5.50 per cent since August, after a cumulative one percentage point cut earlier in the year.

Revising its inflation projections for the 2025-26 fiscal year, the panel said CPI is estimated at 1.8 per cent for Q2, 1.8 per cent for Q3, and 4 per cent for Q4.

Meanwhile, inflation in the first quarter of the upcoming 2026-27 fiscal year (FY27) is expected to touch 4.5 per cent.

Notably, according to ICRA, inflation projections inched close to 2.6 per cent for FY26, aligning with the recent Goods and Services Tax (GST) rationalisation.

“Inflation will continue to remain benign even in FY27 and without a GST cut, it is tracking below 2 per cent in September and October,” said Dr Soumya Kanti Ghosh, Group Chief Economic Advisor at SBI. He added that October CPI could touch nearly 1.1 per cent — the lowest in two decades.