The Reserve Bank of India (RBI) has made it clear that the banking industry needs to pass on the benefits of the latest rate cut to the customers swiftly and more efficiently.

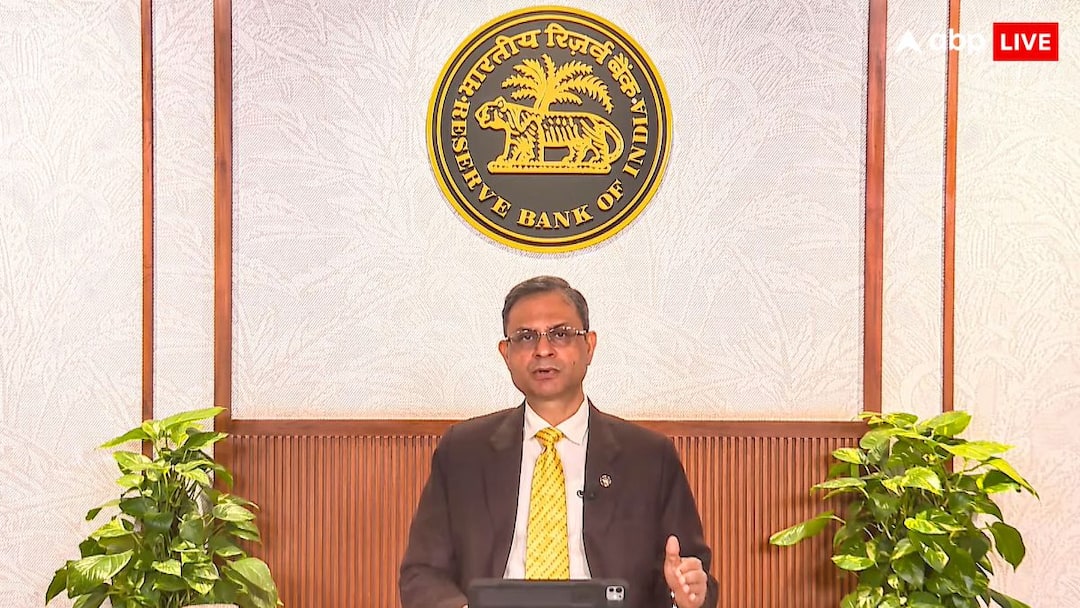

In an interaction with the chief executive officers of public and private sector banks, RBI Governor Sanjay Malhotra on Tuesday asked them to reduce intermediation costs and strengthen operational efficiency, pointing to the significant policy rate reduction already delivered this year, reported Business Standard.

The interaction came merely days after the RBI’s Monetary Policy Committee (MPC) cut the benchmark repo rate by 25 basis points (bps) to 5.25 per cent, its lowest level in three years. Since February, the central bank has cumulatively reduced the policy rate by 125 bps. One basis point equals 0.01 percentage point.

Why Intermediation Costs Matter

Intermediation costs refer to the gap between what banks pay to raise funds, largely through deposits, and what they charge borrowers. High intermediation costs can blunt the impact of rate cuts, limiting how much relief reaches households and businesses.

By pressing banks to lower these costs, the RBI is aiming to improve credit flow, encourage borrowing, and support economic activity.

“He noted that the 125 basis point easing, combined with greater use of technology, should translate into lower intermediation costs and higher efficiency, thereby supporting sustainable growth and deeper financial inclusion,” the RBI said in a statement after the meeting.

How Well Are Rate Cuts Reaching Customers?

RBI data on monetary transmission suggests that progress has been uneven. According to the central bank, the weighted average domestic term deposit rate of banks declined by 102 bps in response to a 100 bps rate cut between February and September. However, the reduction in interest rates on fresh rupee loans over the same period was only 73 bps.

This gap highlights why the RBI continues to engage directly with bank leadership.

While deposit rates have adjusted relatively quickly, lending rates have not fallen by the same extent, raising concerns that borrowers are not fully benefiting from the policy easing.

Customer Service and Grievances in Focus

Beyond interest rates, Malhotra also underscored the importance of customer service. He urged banks to reduce grievances and strengthen internal systems, signalling that operational efficiency must translate into better customer outcomes.

During the December policy review, the RBI proposed a two-month campaign beginning January 1 next year, aimed at resolving all complaints pending for more than a month with the RBI Ombudsman. Tuesday’s discussion reinforced the regulator’s expectation that banks take this initiative seriously and clear long-standing cases.

Digital Frauds and Systemic Risks

The governor also flagged the growing threat from digital frauds, a rising concern as banking increasingly shifts online. He called on banks to put in place more robust, intelligence-driven safeguards to protect customers and maintain trust in digital financial services.

At the same time, Malhotra acknowledged banks’ efforts in areas such as re-KYC and the management of unclaimed deposits. He encouraged lenders to step up proactive outreach and sustain awareness campaigns, particularly for vulnerable and less digitally savvy customers.

“Appreciating banks’ efforts on re-KYC and unclaimed deposits, he encouraged proactive outreach and sustained awareness campaigns. He reaffirmed the Reserve Bank’s consultative approach, referring to recent initiatives in consolidation and simplification of regulations,” the RBI statement said.

Tuesday’s interaction was part of the RBI’s continuing engagement with the senior management of regulated entities.

The meeting was attended by RBI Deputy Governors T Rabi Sankar, Swaminathan J, Poonam Gupta and S C Murmu, along with executive directors overseeing supervision, regulation, enforcement, consumer education and financial inclusion.