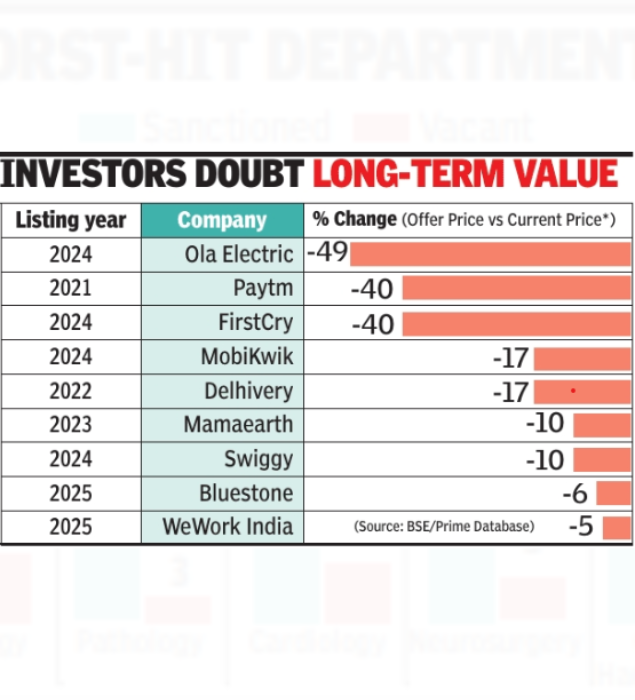

MUMBAI: Even as startups are increasingly rushing to Dalal Street, buoyed by a booming primary market, many of the large, listed companies are trading below their IPO offer price, raising concerns over the long-term value they can generate for investors.Stock prices of close to 10 startups including Swiggy, FirstCry, Paytm, Ola Electric and Delhivery are trading below their offer price, data sourced from the exchanges and Prime Database showed (see graphic) . While market volatility and a broader correction have somewhat had a bearing, a bigger overhang has been the tepid growth of the companies which failed to keep pace with the expectations of the street, said analysts tracking the space.

“The realisation (on part of investors) that performance is not meeting expectations is resulting in disappointment and value correction,” said Nikunj Doshi, of Bay Capital. For many startups, acquisitions have been the way of reporting topline growth but whether they are getting reflected in the bottom line remains to be seen, said Doshi.Since 2021, over 30 startups have debuted on the exchanges, ditching larger private fundraises as regulatory easing and higher valuations in public markets made it smoother for firms to go for an IPO. Following a clutch of billiondollar startup listings floated by players such as Lenskart, Groww and Meesho last year, PhonePe, Zepto, Oyo and Flipkart, among others are gearing up for a debut in 2026.To be fair, most of the recently listed startups are trading above their offer price, but analysts said that the performance of digital companies should be weighed after six months of listing. “These companies are largely funded by VC, PE/HNI investors whose lock in expires after six months of listing and the floodgates of supply open. Some startups saw correction in their prices after six months,” said Doshi. A lock-in expiry is the time when restrictions on selling share ends, allowing shareholders to sell their stakes, increasing supply in secondary market which can be difficult to absorb.Public market valuations for tech-led businesses have meaningfully reset from the peak cycle. For instance, in the case of high-quality SaaS companies, which were earlier trading at mid-teens revenue multiples, current market benchmarks are materially lower, reflecting both multiple compression and a moderation in growth rate versus earlier expectations, said Mehekka Oberoi, fund manager at IIFL Fintech Fund. The next batch of startups may have to list at lower valuations compared to their last private fundings.