Mutuum Finance has been moving into a decisive phase as presale demand accelerates and allocations tighten rapidly. Phase 6 has been approaching a full sellout, reflecting sustained interest despite broader market rotations. This momentum has sharpened focus on forward-looking valuation, particularly among participants assessing what crypto to buy now with a longer time horizon. As pricing steps upward and development milestones align, projections extending into 2026 have begun circulating, positioning Mutuum Finance (MUTM) as a candidate for outsized gains relative to its current sub $0.04 entry point.

Mutuum Finance Presale Progress

Mutuum Finance (MUTM) has been recording strong presale traction, with Phase 6 now 98% filled and nearing complete allocation. The presale has raised $19,500,000 since it began, while Total MUTM Holders since presale began have reached 18,500. The current price in Phase 6 stands at $0.035, reflecting a 250% or 3.5x increase from the Phase 1 price of $0.01.

Phase 6 is selling out fast, and the chance to secure tokens at this level is quickly ending. Once Phase 7 opens, pricing will increase by nearly 20% to $0.04, removing access to the current valuation. The MUTM launch price has been set at $0.06, creating a clear pricing ladder that continues drawing attention from traders evaluating the best crypto to invest in before broader market exposure.

The structured nature of the presale has played a central role in sustaining demand. Each completed phase permanently closes lower pricing tiers, reinforcing urgency as allocation levels decline daily. This dynamic has encouraged earlier commitment rather than delayed speculation, particularly as Phase 6 approaches full exhaustion.

Mutuum Finance Price Prediction

Mutuum Finance price projections extending into 2026 have been increasingly centered on the protocol’s transition from presale to active DeFi infrastructure. A $7 price target within one year has been gaining attention when modeling potential outcomes under sustained adoption and expanding protocol usage. This projection is rooted in several factors, including limited early supply at low prices, revenue-linked token mechanics, and the launch of a functional lending and borrowing platform rather than a purely speculative asset.

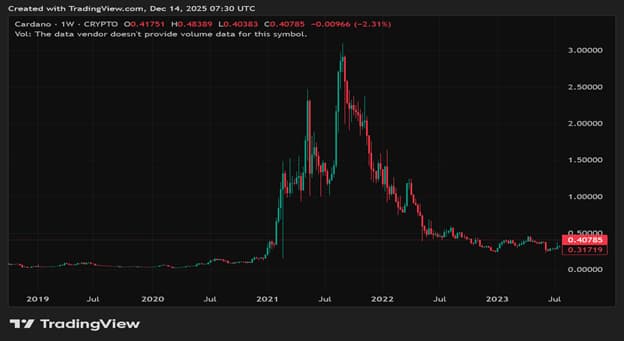

Historical comparison offers additional context. Cardano provides a relevant analogy from the 2020–2021 cycle. ADA traded near $0.02 in early 2020 before rallying to an all-time high near $3.10 in 2021. That move unfolded over roughly 18 months and delivered an ROI of approximately 15,400% from its cycle low. The appreciation coincided with network upgrades, rising developer activity, and growing user adoption, all occurring after a prolonged accumulation phase when price lagged fundamentals.

Mutuum Finance is exhibiting a similar early-stage profile, though within a different market structure. MUTM entered its presale at $0.01 and is now priced at $0.035 in Phase 6, with a confirmed launch price of $0.06. Unlike ADA in 2020, Mutuum Finance is preparing to deploy its V1 protocol on the Sepolia testnet in Q4 2025, introducing immediate on-chain functionality including Liquidity Pools, mtTokens, Debt Tokens, and a Liquidator Bot. This reduces the gap between token distribution and utility activation.

Under a scenario where the protocol captures sustained lending volume and DeFi liquidity rotation resumes, a move toward $7 would represent a progression aligned with historical DeFi expansions rather than an outlier. Such a level would reflect adoption-driven valuation expansion rather than short-term speculation, placing Mutuum Finance among discussions of what crypto to buy now for long-term positioning.

Card Purchases Availability

Mutuum Finance has also expanded accessibility through a recent update allowing participants to purchase MUTM tokens using card payments with no purchase limits. This change has removed a common friction point for new entrants and streamlined participation as Phase 6 nears completion.

The update has been communicated directly by the team and has already contributed to faster allocation turnover as buyers act before the next pricing phase opens. This added convenience has reinforced momentum at a time when remaining Phase 6 supply is thinning rapidly.

As Phase 6 approaches a complete sellout and pricing prepares to step higher, forward-looking projections have gained urgency. Traders assessing the best crypto to buy now have been weighing Mutuum Finance’s structured presale, near-term protocol deployment, and historical analogies like ADA’s 2020–2021 expansion. With the entry window narrowing, positioning ahead of in 2026 has become a defining theme around MUTM.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://mutuum.com/

Linktree: https://linktr.ee/mutuumfinance

Disclaimer: This is a sponsored article. ABP Network Pvt. Ltd. and/or ABP Live do not endorse/subscribe to its contents and/or views expressed herein. Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Cryptocurrency is not a legal tender and is subject to market risks. Readers are advised to seek expert advice and read offer document(s) along with related important literature on the subject carefully before making any kind of investment whatsoever. Cryptocurrency market predictions are speculative and any investment made shall be at the sole cost and risk of the readers.