Even as Indian merchandise and overall exports log continued growth for September 2025, rising 6.7 per cent on-year to reach USD 36.4 billion in September, as well as for the first half of the financial year 2025–26, as a sign of resilience and adaptability amid a turbulent global landscape, there are fresh challenges.

Reflecting the impact of the additional US tariffs, merchandise exports to the US grew -11.9 per cent on-year to USD 5.5 billion in September after growing by 7.1 per cent in August. Had it not been for the frontloading of shipments, the decline would have been steeper.

New Tensions

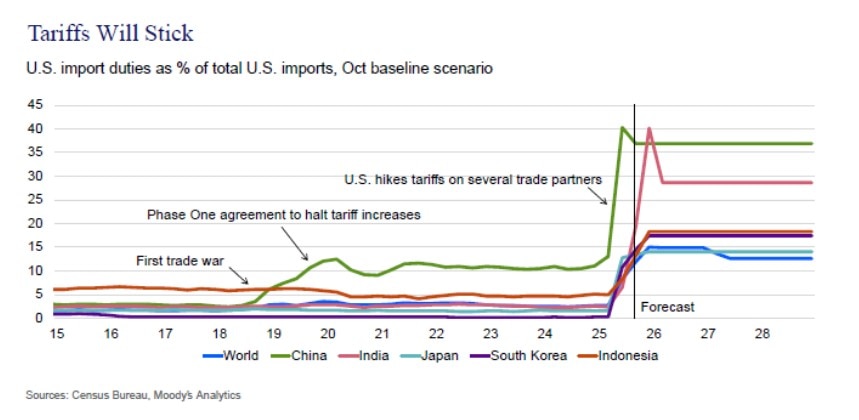

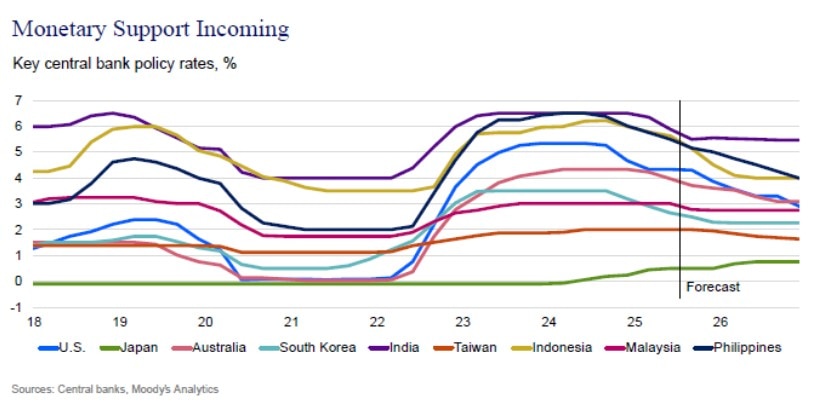

New headwinds are emerging from the US levy of 40 per cent tariff on goods deemed to have been transshipped, and these levies are beyond the broader country-level tariffs already announced, according to Moody’s Analytics. While it remains unclear how the Trump administration defines transhipment, Moody’s view is that the punitive measures appear to target products originating in China and shipping through third countries with lower tariffs.

The tariff will be credit negative for various sectors globally, particularly in South and Southeast Asia (S&SEA), given the region’s high dependence on Chinese inputs, Moody’s has found, after using sector-level trade data to estimate the level of trans-shipment through key regional manufacturing hubs in India, apart from ASEAN and Mexico, across sectors.

The findings suggest that in India as well, the sectors most likely to face trans-shipment risks include machinery, electrical equipment and consumer optical products, including semiconductors. If the US adopts a broader definition of trans-shipment with thresholds set on the value-addition to the content done domestically, that is, within a country, the impact is likely to vary across S&SEA economies, cautions Moody’s Analytics.

As per the latest estimates by the Organisation for Economic Co-operation and Development (OECD), a key international standard-setting organisation, domestic value-added as a share of sectoral exports to the US ranges quite widely, from 43 per cent to 79 per cent across sectors in the S&SEA region. India is one of the countries, besides Singapore, which stand out as having relatively higher shares of domestic value-added across most sectors.

Boom In Exports

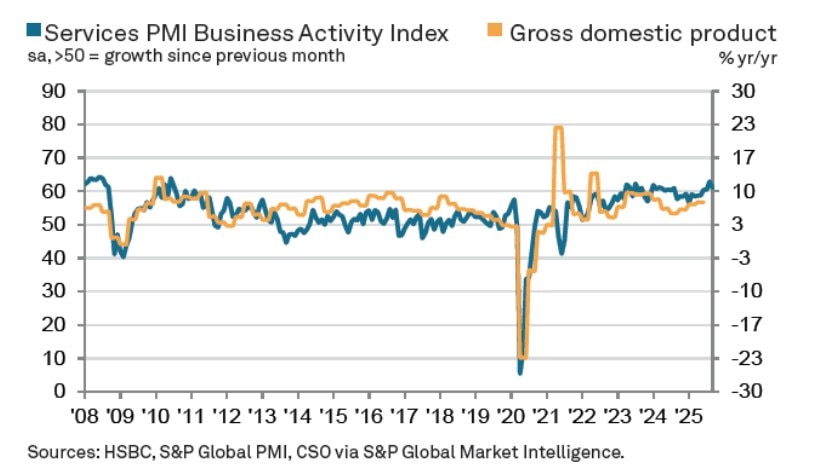

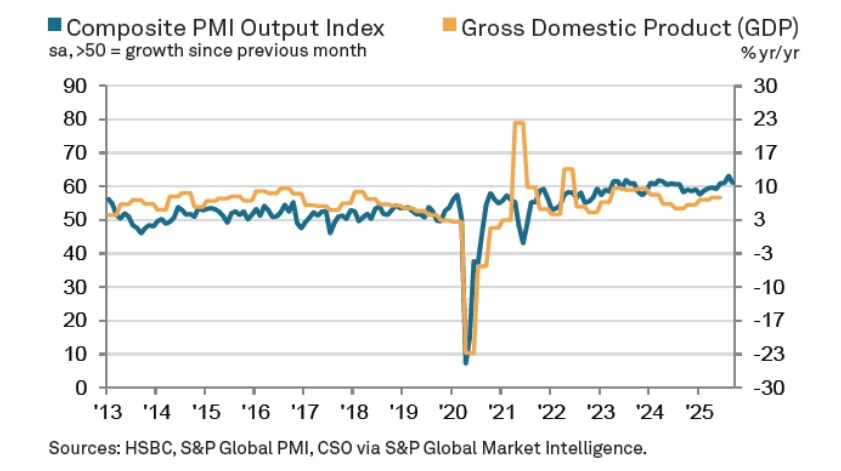

This problem arises at a time when Indian exports have managed to stay resilient even as the industry braces for the landfall of the US tariffs on the commerce terrain. Exports rose for the third straight month, following a similar pace in August.

A rise in exports of oil and gems and jewellery, as well as a steady performance in core export sectors, were key drivers. Gems and jewellery exports grew 0.4 per cent year-on-year in September, but slower rate than the 15.6 per cent growth in August. Oil exports continued their upward trend for the third consecutive month in a row, growing a robust 15.1 per cent, building on the 6.5 per cent increase in August.

Core exports, which comprise the bulk of India’s merchandise exports, maintained a steady growth rate of 6.1 per cent. India’s exports to non-US markets grew 10.9 per cent on-year, outpacing the 6.6 per cent growth in August. This suggests that while the tariffs have dampened US-bound exports, India’s exports to other countries are bearing fruit.

Moody’s Ratings point out that export growth in early 2025 beat expectations as exporters rushed to ship goods before US tariff hikes landed. The flare-up followed Trump’s late-September announcement of new US tariffs on pharmaceutical goods. Within Asia, India is the most exposed to the pharma tariffs, says Moody’s Ratings.

Key Sectors Underperform

As a reflection, exports of drugs and pharmaceuticals grew just 2.6 per cent as compared to 6.9 per cent in August, engineering goods exports grew 2.9 per cent against 4.9 per cent, and organic and inorganic chemicals increased just 1.8 per cent as against 3.8 per cent. Shipments of readymade garments contracted -10.1 per cent as against -2.6 per cent in August. Within this category, exports of cotton yarn contracted -11.7 per cent as compared to -2.3 per cent in August and those of man-made yarn -2.3 per cent against -3.1 per cent in August.

As a double whammy, India’s imports have also outpaced merchandise exports, soaring 16.7 per cent on-year to USD 68.5 billion in September, following a 10.1 per cent contraction in August – widening the trade deficit to a 13-month high, according to CRISIL experts. The strong growth in imports and stable rise in exports resulted in the merchandise trade deficit widening to a high of USD 32.2 billion in September from USD 26.5 billion in August and USD 24.7 billion in September 2024.

Silver Imports Up

The import surge was driven by a 13 per cent on-year increase in core imports, the highest in five months and a significant rebound from the -0.9 per cent growth in August, according to CRISIL data. Imports of gems and jewellery jumped 85.3 per cent on-year despite an unfavourable base effect, marking a turnaround from the 51.2 per cent decline in August.

Gems and jewellery displayed strong growth because of higher gold imports, which jumped 106.9 per cent as compared to 56.7 per cent in August 2025 and a supportive base. Silver imports also surged 139 per cent on-year growth, partly supported by a low base effect. Imports of silver and gold were strong in September despite high global commodity prices.

The World Trade Organization expects global merchandise trade volumes to grow 2.4 per cent on-year in 2025 compared with 2.8 per cent growth last year. SC Ralhan, President, Federation of Indian Export Organisations (FIEO), brings out the silver lining in imports increase. “This surge also reflects strong domestic demand and buoyant manufacturing activity, driven in part by elevated commodity prices and rising input costs,” says Ralhan, urging the government to take bold steps toward import substitution by encouraging local production and enhancing global competitiveness through innovation and scale.

To ensure continued momentum, FIEO has suggested greater availability of export credit at competitive rates, particularly for MSMEs and supporting high-value sectors like electronics, green technology, and processed food, which offer immense potential for long-term value creation and job generation.

(Mukherjee is a contributing writer for ABP Live English. A business journalist for more than 15 years, she has written extensively on the economy, policy, and international relations in Indian newspapers and magazines)