A NITI Aayog report on India’s automotive exports has flagged high logistics costs, both inland and port-related, as significant constraint on export competitiveness and on achieving economies of scale with inefficiencies in transportation from manufacturing clusters to ports eroding margins and weakening India’s competitive position relative to global peers even as data from Society of Indian Automobile Manufacturers (SIAM) on Tuesday posted steller performance in shipments of automobiles – from passenger to commercial vehicles.

India’s automotive exports reach a broad international footprint, with key destinations including Japan, Mexico and various markets across Africa and Latin America. In global automotive demand, passenger vehicles account for about 71 per cent, and India has captured around 1 per cent of this market, as per NITI Aayog.

Pawan Goenka, Past President SIAM and Chairman, Steering Committee on Advancing Local Value-add & Exports (SCALE), Ministry of Commerce & Industry, recalls that in the last four and a half years, India’s automobile exports have grown nearly 20 per cent annually, three to four times higher than the rest of the world. “My vision is to see 50 per cent of our production going into exports. The auto industry’s importance is not just in numbers but in its economic contribution, advanced manufacturing, and the strongest MSME ecosystem,” says Goenka.

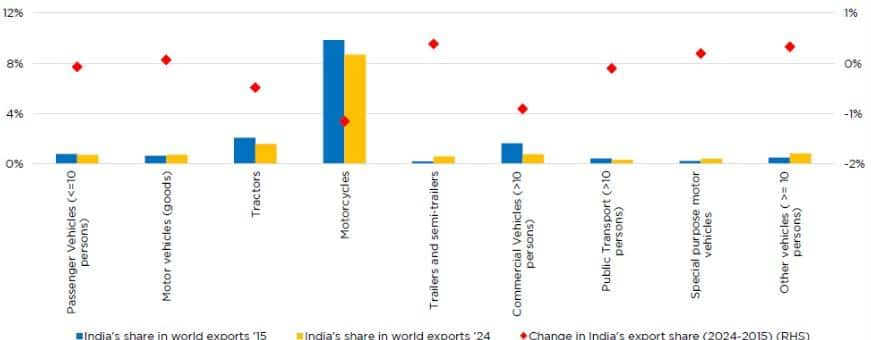

Change In India’s Share In Global Auto Exports

Global Attraction

Propelled by a strong international market access drive, India’s passenger vehicles saw their highest-ever exports in Q3 of the current fiscal, 2025-26, of 2.25 lakh units, registering a growth of 11.7 per cent over Q3 of 2024-25, as per SIAM.

In addition, the segment also posted its highest-ever exports during January–December 2025 of 8.63 lakh units, registering a growth of 16.0 per cent as compared to the same period last year. The demand has been steady across most markets, including in the Middle East, Africa and Latin America. Exports of three-wheelers posted a good growth of 70.1 per cent in Q3 of 2025-26 with exports of around 1.27 lakh units, as compared to Q3 of last year.

Three-wheeler exports reached 4.26 lakh units in calendar year January-December 2025, posting a growth of 42.7 per cent, compared to the same period of last year. Increased exports to Sri Lanka and African nations have contributed to this growth.

“Exports witnessed double-digit growth across vehicle segments in 2025, compared to calendar year 2024,” agrees Shailesh Chandra, President, SIAM. “The industry will also continue to monitor geopolitical developments to ensure resilience in supply chain and export volumes,” he assures.

Two wheelers also recorded their highest ever exports in Q3 of 2025-26 of 1.37 million units, registering a growth of 24.3 per cent over Q3 of 2024-25. During January-December 2025, 4.94 million units of 2Ws were exported, which is the highest exports of the calendar year period, with a growth of 24.2 per cent, as compared to January-December 2024.

Overall, the growth in exports during the quarter was driven by a combination of improving macro-economic conditions in key markets of Africa, steady demand from South Asian markets and industry-wide recovery in motorcycle demand, SIAM reported.

PVs Lead The Way

Citroën India’s broader growth story mirrors the trend. Vehicle exports rose 18.8 per cent in 2025, driven by strong demand from Africa and ASEAN markets. This sharp increase reinforces India’s strategic role as a key manufacturing and export hub within Citroën’s expanding global portfolio,” agrees Shailesh Hazela, CEO & Managing Director, Stellantis India.

For Hyundai Motor India, exports contributed 16,286 units of the total monthly sales of 58,702 units. “We delivered 26.5 per cent year-on-year growth in export volume in December, reaffirming our commitment to offering world-class products manufactured indigenously,” says Tarun Garg, MD, CEO of HMIL.

Skoda Auto Volkswagen India (SAVWIPL) too marked a major landmark in its internationalisation strategy with cumulative exports surpassing 715,000 units, firmly establishing India as a strategic global production base for the group. The group expanded its global footprint by exploring and entering new markets in the Gulf and ASEAN regions.

Piyush Arora, Managing Director & CEO, SAVWIPL, credits the performance to the strength of the company’s Make-in-India strategy supported by deeper localisation, scale and a robust product pipeline.

“This is visible across manufacturing, sales and exports. The momentum of this year reinforces our belief that India will be an even larger contributor to the Group’s global growth journey,” says Arora.

Maruti Suzuki India exported 3.95 lakh vehicles in 2025, staying on course as India’s top PV exporter for the fifth consecutive calendar year. The company re-entered Europe with the commencement of exports of e VITARA in August 2025. In 2025, Maruti Suzuki exported 18 models to over 100 countries.

With the commencement of export of Suzuki’s first battery electric vehicle (BEV), the e VITARA, from the Hansalpur facility, over 13,000 units have already been exported to 29 countries, predominantly in Europe.

“This is a proud moment for the company as we record our highest-ever calendar year exports of 3.95 lakh units,” notes Hisashi Takeuchi, Managing Director & CEO, MSIL, describing the landmark as a reflection of India’s manufacturing strength and the trust of customers worldwide. “At a time when global trade is passing through a turbulent phase, we regard this 21 per cent growth as a responsible contribution in supporting the nation’s export momentum aligned with the national vision of ‘Make in India, Make for the World’,” says Takeuchi.

In the 2- and 3-wheeler segment, TVS Suzuki’s total exports registered a growth of 40 per cent, with sales increasing from 104,393 units in December 2024 to 146,022 units in December 2025. Two-wheeler exports grew by 35 per cent with sales increasing from 96,927 units in December 2024 to 130,709 units in December 2025.

Neighbouring countries and the Middle East have been the steady markets for India’s commercial vehicles, which are also catching up with 0.25 lakh units exported with a growth of 13.6 per cent in Q3 of 2025-26, as compared to Q3 of last year. During January-December 2025, 0.92 lakh units of CVs were exported, with a growth of 27.1 per cent, as compared to January-December 2024.

Low Share In Global Export Market Is Worrying

The fifth edition of NITI Aayog’s Trade Watch Quarterly, while lauding India’s growing manufacturing depth, competitiveness, increasing integration into global value chains and a broad export footprint across advanced and emerging markets, observes that India has done well in specific segments of the automotive export market and would do well to tap significant opportunities to increase market share in the USD 2.2 trillion global automotive export market.

India contributes USD 30 bn in exports, which accounts for just 1.4 per cent of the world’s demand. Global demand for automobiles, measured by imports, increased from USD 937 bn in 2015 to USD 1.3 trillion in 2024, reflecting an average annual growth of about 4 per cent over the period.

Against this backdrop, India’s automobile exports expanded from USD 9.4 billion to USD 13.2 billion, registering a CAGR of 3.5 per cent. India’s automotive export patterns reflect clear areas of specialisation, offering a strong base for future diversification and deeper integration into global automotive value chains. India’s backward integration into global value chains has also improved, rising from 32 per cent in 2015 to 46 per cent in 2024, according to NITI Aayog.

While global EV imports surged nearly 30 times between 2020 and 2024, India’s participation remains negligible at 0.1 per cent of global exports and imports. In motorcycles, India commands a higher share of global demand, close to 9 per cent,t supported by robust growth in both world demand and India’s exports. In tractors, India accounts for over 1.5 per cent of global demand, reflecting its established competitiveness in this category.

On the import side, India’s finished vehicle imports have grown faster than exports, with a CAGR of about 7 per cent from 2015 to 2024, indicating rising domestic demand for select vehicle categories. Imports are concentrated in PVs and niche segments, reflecting consumer preferences and technology-intensive models rather than broad-based dependence on foreign supply. NITI Aayog highlights high logistics costs, both inland and port-related and inefficiencies in transportation from manufacturing clusters to ports, combined with elevated shipping costs that can weaken India’s competitive position relative to global peers. India’s logistics cost currently stands at 8 per cent of GDP.

The report emphasises reducing tariffs, boosting two-way trade and cross-border platform participation and reorienting production toward high-demand segments such as PVs to enhance competitiveness and global positioning. Strengthening quality standards, certification systems, and technology adoption, alongside fostering forward linkages in global supply chains, will be critical.

Coupled with domestic market strength, these actions can help India scale high-quality production, broaden market diversification, and capture a larger share of global automotive trade, the report suggests.

(Mukherjee is a contributing writer for ABP Live English. A business journalist for more than 15 years, she has written extensively on the economy, policy, and international relations in Indian newspapers and magazines)