Indian consumers may have to pour out more from their wallets to purchase automobiles as the industry (original equipment manufacturers) might need to consider price hikes in January 2026 to offset challenges of high freight rates and commodity costs, according to Nomura Ratings, just past the key festive months which saw passenger vehicles, two and three-wheeler segments posting their highest ever wholesales in October 2025, buoyed by consumer demand and the recent GST rate reduction.

October 2025 also witnessed record-high auto retail sales growth driven by GST 2.0 and rural resurgence, with 40.5 growth YoY, an all-time high.

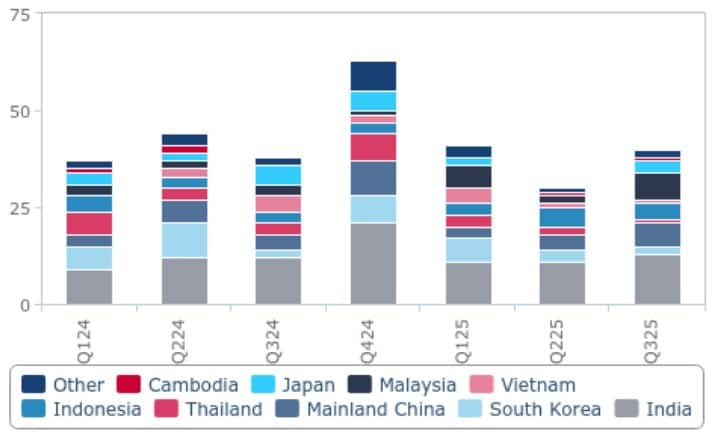

Adding a new dimension to the auto industry growth, India is among the key emerging markets which in Q3 2025 saw a significant rise in automotive manufacturing investments in Asia, as per new research at BMI, a Fitch Solutions arm. Indian investments, along with those in Indonesia, Thailand, and mainland China, were among 40 new projects across EMs valued at USD 10.6 billion by BMI.

This is a significant jump from Q2 2025, when BMI tracked 30 new projects, driven primarily by the growing electric vehicle (EV) sector and regional demand for passenger vehicles and hybrids, especially in India.

GST Keeps Dispatches Moving

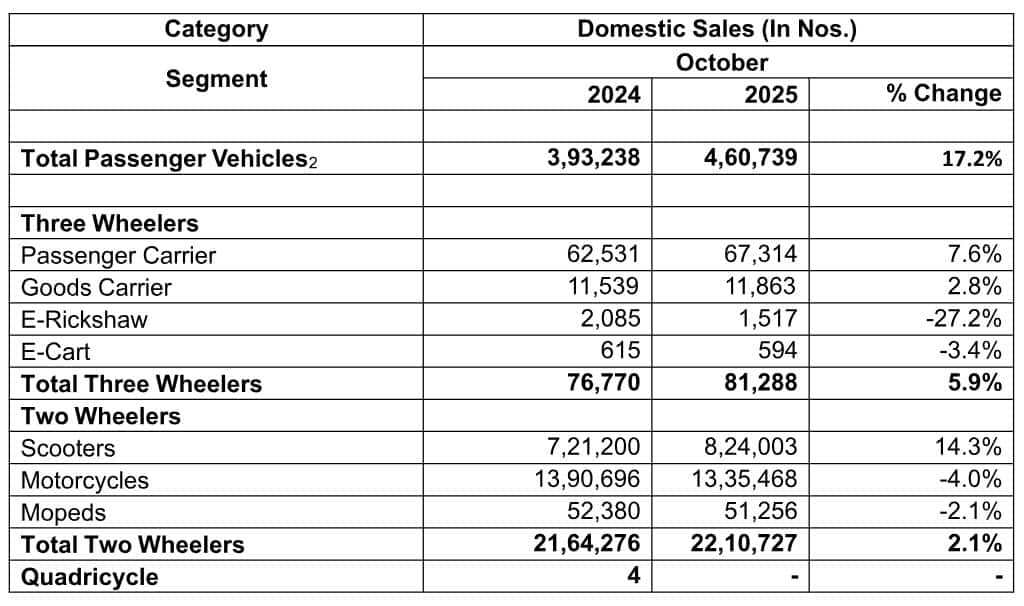

At home, there are growth propellers proactively at work with the GST rate revisions, effective from 22 September 2025, pushing PVs to record sales of 4.61 lakh units, a growth of a whopping 17.2 per cent and two-wheelers (2W) to post 22.11 lakh units with a growth of 2.1 per cent as compared to October of previous year, as informs Rajesh Menon, Director General, Society of Indian Automobile Manufacturers (SIAM).

“In the three-wheeler segment, 81.29 thousand units were sold with a growth of 5.9 per cent, compared to October 2024,” says Menon, underlining the positive show despite being constrained due to certain logistic limitations. The total production of passenger vehicles, three wheelers, two wheelers and quadricycles in October 2025 was 28,01,412 units.

According to Nomura analysts Kapil Singh and Siddhartha Bera, wholesale volumes of PVs were up 8 per cent on-year and 2Ws were up 2 per cent YoY. Importantly, wholesales across OEMs were much higher than estimates in October, supported by festive season demand and recent GST cuts, point out Singh and Bera, who expect demand to remain strong for the next three months.

“OEMs have defied concerns over anticipated supply challenges in October due to lower production days and logistics issues, and in fact managed much better,” says the analysts.

Asit C. Mehta, investment analyst, attributes the broad-based growth in auto sales to improving rural sentiment and festive demand.

“October 2025 was a month driven by the festivals of Dussehra, Dhanteras and Diwali, further complemented by the positive impact of GST 2.0 reforms. This provided a significant boost to the Indian automotive industry,” confirms Tarun Garg, Whole-time Director & Chief Operating Officer of Hyundai Motor India, which achieved total monthly sales of 69,894 units in October 2025, bolstered by monthly domestic sales of 53,792 units and export sales of 16,102 units in October 2025, with an 11 per cent YoY growth.

“We witnessed robust market demand and high consumer enthusiasm leading to second second-highest monthly sales of the Hyundai Creta and Venue combined, with 30,119 units sold,” says Garg, who expects to accelerate this momentum with the new Hyundai Venue.

Bumper Harvest For Auto Majors

The sustained rally of GST review-induced auto sales is visible in other companies as well. Tata Motors exhibited strong domestic PV dispatches at 61,295 units in October 2025 in the domestic and international market, compared to 48,423 units during October 2024, supported by the tailwinds of GST cuts and festive demand.

This was a record-breaking monthly wholesales for the second consecutive month, delivering an impressive 27 per cent YoY growth as SUVs led the charge, selling 47,000 plus units along with all-time high EV wholesales of 9,286 units, riding on 73 per cent YoY growth. The landmark was over 1 lakh vehicle deliveries between Navratri and Diwali, marking a 33 per cent YoY growth.

Saurabh Vatsa, Managing Director, Nissan Motor India, also views October as a good month for the automotive Industry as well as for the. “Nissan Motor India’s reported consolidated sales of 9675 units in October 2025 mark a phenomenal 45 per cent month-on-month growth, reflecting a strong festive demand during Navratri, Dussehra and Diwali, complemented by the positive impact of the GST rate reduction,” agrees Vatsa.

To keep this cheer going, the company is also expanding towards new upcoming product launches, which include the much-awaited Nissan Tekton, a 7-seater B-MPV, and a 7-seater C-SUV, with dealer partners anticipating a strong boost in customer engagement.

As per Nomura data, Mahindra & Mahindra’s utility volume growth increased 31.4 per cent YoY to 71.6k units, boosted by festive demand and GST cuts. Maruti Suzuki’s domestic sales were above estimates, with sales up 10.5 per cent YoY at 176k units, and overall volumes were above Nomura’s estimate at 221k units, up 7 per cent YoY. “The recently-launched Victoris has already reached 30k bookings, while the overall pending bookings for MSIL stand at 200k units. The company’s Vahan retail market share increased to 43.3 per cent for October 2025, while wholesale market share increased to 38 per cent.

Among 2Ws, Bajaj Auto wholesale volumes of 2W were up 4.1 per cent YoY at 266000 units,

TVS Motors’ domestic volumes were at 428000 units, up 9 per cent YoY, and Royal Enfield achieved its highest-ever festive performance, crossing a remarkable milestone of over 2.49 lakh motorcycles sold during September and October with 26 per cent growth over the same period last year. In October alone, the company posted monthly sales of 1,24,951 motorcycles, registering a 13 per cent growth over the same period last year.

Rural Power For Auto Retail

The resurgence has also translated into a sharp rebound in dispatches from showrooms as the 42-day period (Dussehra–Diwali) saw overall retail sales jump 21 per cent YoY with rural India becoming the growth engine, aided by strong monsoon, higher farm incomes and infrastructure spending, shows data from the Federation of Automobile Dealers Associations (FADA).

“October’25 will be remembered as a landmark month for India’s auto retail, where reforms, festivities, and rural resurgence came together to deliver record-breaking results,” says FADA President CS Vigneshwar.

According to him, the 2W surge of 52 per cent was supported by rural demand, GST reductions and the festive rush as dealers reported stronger footfalls and better sentiment, leading to extremely high conversion. “Passenger vehicles with 11 per cent YoY growth, breached the five-lakh mark to close at 5.57 lakh units, the highest ever in India’s retail history. Importantly, inventory levels eased by 5-7 days to 53-55 days, reflecting healthier supply alignment,” says Vigneshwar.

There are, however, several bottlenecks in sight, according to Nomura’s Bera and Singh, even as FADA’s near-term outlook suggests a confluence of encouraging macro and policy factors like the GST 2.0 reforms and “Viksit Bharat by 2047” vision, which will continue to drive affordability, especially in the mass and entry-level segments. Nomura experts highlight

freight rates, which have declined by 5-7 per cent month on month but are still 7-8 per cent

above September 2025 levels. Another worry is commodity costs, which sequentially increased by 100 basis points quarter-on-quarter in 2Ws and PVs, led by precious metals. OEMs might need to consider price hikes in January to offset the same.

Positive Signals Ahead

Vigneshwar feels strong rural cash flows post-harvest, marriage season demand and improved stock availability across categories are expected to sustain retail momentum. “Upcoming new model launches, healthier financing conditions, and stable fuel prices further reinforce a supportive ecosystem for continued growth,” says the FADA president. Insights from the FADA Dealer survey indicate that the momentum from the festive surge is likely to extend into November, though with a natural moderation after an all-time high October.

As a longer-term bet, BMI analysts point out that India has emerged as a key automotive hub through supportive government policies, strategic partnerships, and rapid EV segment growth, exemplified by Suzuki’s export-focused eVitara project and VinFast’s innovative plant, leading to increased local value addition, technology transfer, and expansion into new markets. India attracted 13 projects in BMI’s Q3 2025 Autos Investment Roundup and 11 in its Q2 2025 edition, dominating the APAC region as government initiatives such as the Production Linked Incentive (PLI) scheme, the PM Electric Drive scheme and targeted reductions in import duties on EV components have played a pivotal role in drawing both domestic and international capital.

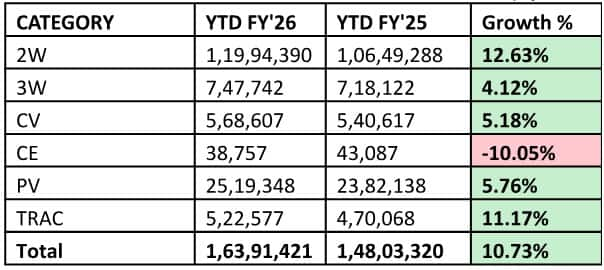

FADA All-India Vehicle Retail Data For FY26 YTD (Apr 25 to Oct 25)

In another positive, BMI insights draw attention to India’s EV segment, which is expanding rapidly, driven by rising demand for affordable models, an increasingly supportive policy environment, launch of new entry-level and mid-market EVs tailored specifically to Indian consumers, which is accelerating EV adoption well beyond early urban markets. As investments in infrastructure and consumer awareness continue to grow, the market is poised to enter its next phase of expansion, characterised by broader regional reach.

Mukherjee is a contributing writer for ABP Live English. A business journalist for more than 15 years, she has written extensively on the economy, policy, and international relations in Indian newspapers and magazines