Bank credit to Indian Medium, Small and Micro Enterprises (MSMEs) is on a roll, increasing to 17.4 per cent year-on-year in June 2025, compared to an increase of 11.5 per cent in June 2024, even as retail credit takes lead to drive the overall bank credit growth, while other segments stay largely rangebound, says the Finance Ministry Monthly Economic Review for August 2025 and Crisil Ratings.

Boom For MSMEs

The trend in credit to the MSMEs reveals a robust growth trajectory with the credit extended to the micro and small enterprises registering an increase of 19.3 per cent YoY in June 2025, up from 11 per cent YoY in June 2024, says the Finance Ministry Review, citing Reserve Bank of India data. The growth in the MSME segment at 17 per cent of the overall credit is seen steady at a growth of 14 per cent this fiscal, says the CRISIL report.

Better addressability of the segment through digitalisation and formalisation, as well as democratisation of data, and improved risk-adjusted returns have drawn banks towards this segment, but banks are likely to exercise caution in some sub-segments, including export-oriented units.

The YoY growth in outstanding credit by scheduled commercial banks (SCBs) as of end-June 2025 has, however, moderated to 10.4 per cent from 13.9 per cent recorded as of end-June 2024. Interestingly, this decrease in the flow of bank credit coincides with the increase in the overall flow of financial resources to the commercial sector during the same period, points out the Finance Ministry review.

The non-bank sources of credit compensated for the decline in bank credit growth. This shift could be due to large corporations increasingly relying on market-based instruments such as commercial paper and corporate bonds for their funding requirements, while the MSMEs largely rely on bank credit for their funding requirements, finds the Ministry review.

The faster transmission of the monetary policy has made market-based financial instruments a viable source of funding for large corporations. Additionally, as the profitability of large corporations has increased over time, their internal resources have become an important source for business expansion. Collectively, these factors have contributed towards decreasing their demand for bank credit. This can be verified from the fact that the private placement of corporate bonds increased by 47.9 per cent (YoY) as of June 2025, alongside a 48.9 per cent increase (YoY) in resources mobilised by the corporates from equity, debt and hybrid issuances.

Retail Lending Grows On Low Inflation

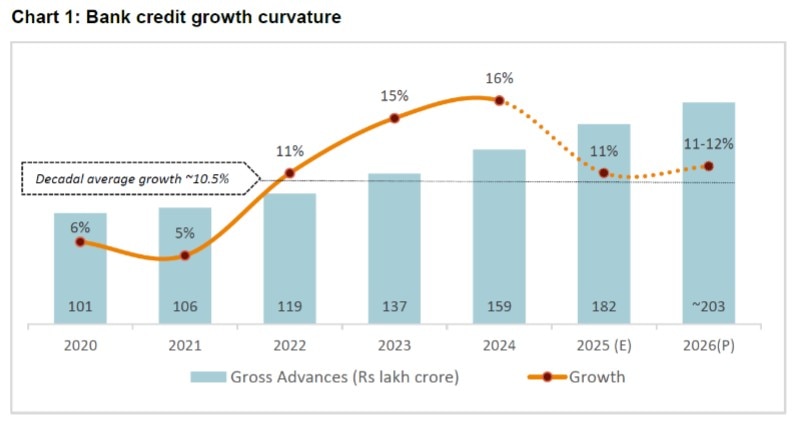

It is, however, retail credit of banks which is driving up bank credit on the back of Government, regulatory support and consumption, which are acting as pick-up drivers for retail credit. Bank credit is seen growing 11–12 per cent this financial year 2025-26, after a slower first half, owing to government and regulatory support, and a pick-up in consumption.

That would be a touch higher than last fiscal and above the decadal average growth as well. In fact, CRISIL reports that retail credit will gain the most and drive the overall credit growth, while other segments will be largely rangebound.

Lingering global uncertainties could, however, affect these estimates. Bank credit growth in the first quarter of this fiscal was muted because of a slower-than-expected revival in retail demand, continuing caution on unsecured lending and substitution by corporate bonds stemming from faster transmission of the repo rate cuts in that market.

In the second half of this fiscal, however, credit growth is expected to pick up as the composite effect of government and regulatory stimuli plays out. This will be supported by the lower-than-expected food inflation and the expected easing of core inflation in the coming months due to the reduction in the goods and services tax.

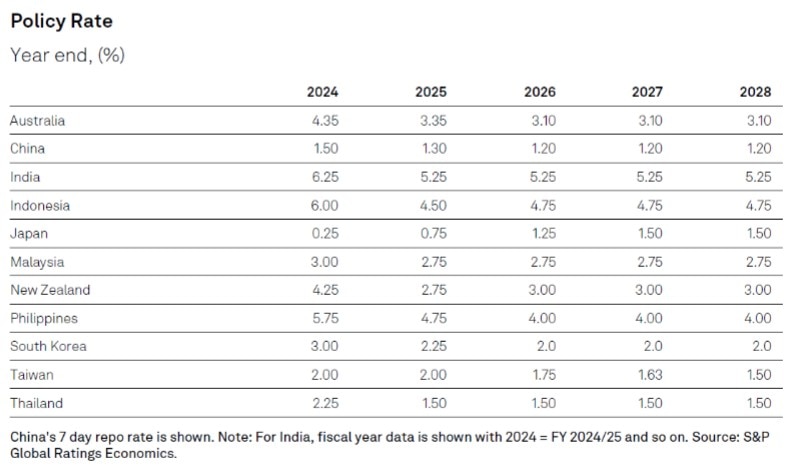

“We have revised our inflation forecast down to 3.2 per cent from 3.5 per cent for this fiscal. This adjustment allows for potential changes in monetary policy, and we expect the RBI to cut the repo rate by another 25 basis points later this fiscal,” opines Dharmakirti Joshi, Chief Economist, Crisil. The monetary policy easing, which will keep lending rates soft, will be an enabler for bank credit growth.

The blow to GDP growth from US tariffs, along with a benign inflation outlook, allows space for the RBI to resume its easing cycle, feel experts, predicting a policy rate cut next week followed by another in December, thus encouraging retail borrowing and bank credit growth.

Deposit growth, a crucial factor for sustainable credit growth, is seen as adequate for the expected uptick in bank credit, aided by the RBI’s measures to enhance systemic liquidity, including a four-phased cash reserve ratio reduction and revision in the liquidity coverage ratio norms. According to Krishnan Sitaraman, Chief Ratings Officer, Crisil Ratings, retail credit, which comprises 33 per cent of bank loans, is expected to grow at 13 per cent this fiscal from 11.7 per cent last fiscal.

“The reduction in the goods and services tax should boost consumption, spurring retail credit demand. Lower interest rates, benign inflation and income tax cuts introduced in the Union Budget are spurs, too,” says Sitaraman.

Within the retail segment, unsecured loans are expected to see faster growth, fuelled by the consumption uptick and the statistical low-base effect of the last fiscal. Home loans remain the largest constituent of retail credit at 50 per cent, and growth here will benefit from lower interest rates. While gold loans are a relatively small proportion of the retail portfolio of banks, the segment has expanded rapidly, and its growth will continue to be robust.

Credit growth in the corporate sector, which accounts for 38 per cent of bank loans, is expected to be marginally lower at 9 per cent this fiscal compared with 9.7 per cent last fiscal, weighed down by a sluggish first quarter.

Of the Rs 171 lakh crore corporate credit pie, banks account for 40 per cent while capital markets contribute to over a third. Ajit Velonie, Senior Director, Crisil Ratings, points out a more than 60 per cent spurt in corporate bond issuances in the first quarter on-year because of the faster transmission of repo rate cuts compared with bank lending rates. This has had an impact on bank credit to corporates, which grew just 3.8 per cent on-year till July 2025.

Infra, Fincos Emerge Drivers

A significant trigger for bank credit is the downstream demand from the ongoing infrastructure buildout, which will continue to drive investments in the cement, primary steel and aluminium sectors. Rajkiran Rai G, MD, NaBFID, highlights infrastructure as the biggest enabler for growth and calls for creating the right financial enablers, ensuring long-term funds flow into long-term infrastructure.

“Projects need to be designed in a way that encourages banks and other institutions to participate in financing. It is time that we need to look at 8 per cent growth or more, and infrastructure will be the biggest enabler,” says Rajkiran.

Other sectors, he stated, like data centres or hospitals, urban infrastructure, along with irrigation, are also witnessing growth, but further investment is required for their development. “We need to design projects in such a way that banks and other institutions will be interested in lending,” he added.

In another emerging trend, India’s finance companies (Fincos) are grabbing market share from banks, finds S&P Global Ratings, which expects rated fincos to grow their loan books at 21per cent-22 per cent over the next two years, higher than 11 per cent 12 per cent for banking sector loan growth. Still, this pace is a moderation compared with previous growth patterns,” says S&P Global Ratings credit analyst Geeta Chugh.

A key driver for the sector is its strong presence in retail lending, which is still underpenetrated in India. Upper-layer fincos have strong capital levels, which will support high loan growth and provide downside buffers. “We also expect earnings momentum to sustain, with slightly higher net interest margins over the next two years. This will add to the buffer,” adds Chugh.

For instance, Jana Small Finance Bank is one of India’s fastest-growing financial institutions in the two-wheeler financing segment, which has partnered with Suzuki Motorcycle. Banks like JSFB have built a strong financing reach to make scooters and motorcycles more accessible to customers in both urban and rural markets with competitive interest rates, quick loan approvals with minimal documentation and flexible repayment plans tailored to address the diverse financial requirements of customers.

As Pradeep Rebello, Business Head – Vehicle Loans, points out, the bank has distribution through 809 branches and a base of 46 lakh customers spread across 25 states.

Though asset quality for fincos is holding up, some pockets of stress persist in microfinance and unsecured loans. Chugh attributes this stress to rapid growth and exuberant lending practices directed toward borrowers with weak credit profiles, without adequate consideration of their repayment capacity.

For instance, last year, approximately 20 per cent of microfinance borrowers held loans from four or more lenders. Unsurprisingly, these borrowers are currently experiencing significant financial stress. On an industry-wide basis, credit costs surged to around 9 per cent last year, and S&P anticipates they will exceed 5 per cent.

(Mukherjee is a contributing writer for ABP Live English. A business journalist for more than 15 years, she has written extensively on economy, policy, and international relations in Indian newspapers and magazines)