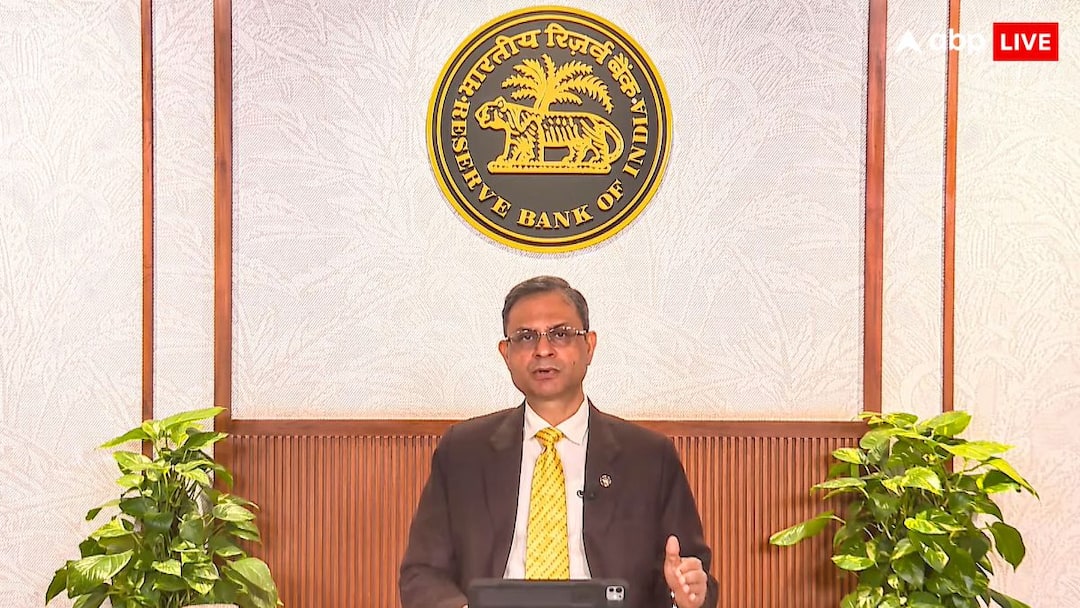

Reserve Bank of India (RBI) Governor Sanjay Malhotra will deliver the Monetary Policy Committee’s (MPC’s) December policy outcome on Friday, followed by a press conference at noon. Both the statement and briefing will be streamed on the same platforms.

When is the MPC meeting?

The meeting is scheduled for December 3–5. The final MPC review of the 2025–26 financial year will be held from February 4–6, 2026.

Where to watch the Governor’s address?

Governor Sanjay Malhotra’s statement will be broadcast live at 10 AM on Friday via the RBI’s YouTube channel, its X handle, and the central bank’s official website.

Expectations From the MPC

Praveen Sharma, CEO of REA India (Housing.com), said an immediate rate cut next month appears unlikely given the RBI’s recent pauses. He noted that this year’s cumulative 100-basis-point reduction has already eased pressure on homebuyers, though a small cut could still materialise if economic and inflation trends remain favourable. For now, he said, borrowers benefit from a stable and supportive credit environment.

Umesh Sharma, CIO–Debt at The Wealth Company Mutual Fund, said post-October data has made the outlook for a December cut harder to gauge. While soft inflation provides “policy space, resilient demand, strong credit growth, and tighter liquidity due to forex intervention complicate the decision.” He added that global cues remain mixed, with uneven Fed communication and fiscal risks at home also in play. In his view, further cuts may have limited impact, and the MPC should maintain a dovish tone while assuring ample liquidity.

Raoul Kapoor, Co-CEO of Andromeda Sales and Distribution, expects a 25-basis-point reduction in the upcoming review. He added inflation is within the RBI’s comfort band and high-frequency indicators show gradual softening, “making conditions suitable for calibrated easing.” A rate cut, he noted, would lower borrowing costs for big-ticket loans, stimulate demand, and support broader economic momentum.

October 2025 MPC review

In October, the MPC unanimously voted to maintain the policy repo rate at 5.5 per cent and retain the neutral stance adopted in June. It also lifted its FY26 growth projection to 6.8 per cent and lowered the inflation forecast to 2.6 per cent.

Why does Repo Rate Matter?

The bi-monthly MPC review sets key interest rates and outlines inflation and growth projections. Movements in the repo rate, the rate at which the RBI lends to commercial banks, directly affect borrowers. A higher repo rate typically leads banks to raise lending rates, pushing up EMIs on home, car and personal loans. Conversely, rate cuts reduce borrowing costs but can also bring down returns on savings instruments and fixed deposits.