India’s economy posted a solid performance in the July-September quarter of FY 2025-26, with official data confirming an 8.2 per cent rise in real GDP, a sharp acceleration from the 5.6 per cent growth recorded in the same quarter last year.

The latest estimates, released by the National Statistics Office (NSO), point to broad-based momentum led by manufacturing, services, and resilient household consumption.

According to the NSO, real GDP for Q2 FY26 stands at Rs 48.63 lakh crore, compared with Rs 44.94 lakh crore a year earlier. Nominal GDP for the quarter rose 8.7 per cent to Rs 85.25 lakh crore, reflecting a steady price environment.

The secondary and tertiary sectors were the key drivers, posting growth of 8.1 per cent and 9.2 per cent, respectively. Manufacturing grew by 9.1 per cent, supported by improved capacity utilisation and a favourable demand cycle. Construction expanded 7.2 per cent, aided by government spending and sustained urban infrastructure activity.

Financial, real estate, and professional services saw a strong 10.2 per cent growth, underscoring the steady revival in white-collar services and business activity. Trade, transport, hotels, and communication services also contributed meaningfully as mobility remained high and festive-season stocking began early.

Household Consumption Leads The Race

Growth in agriculture and allied activities moderated to 3.5 per cent, while the electricity, gas, and water supply segment grew 4.4 per cent, signalling a more measured pace compared with the rapid expansion seen in other sectors.

However, household consumption, a major engine of the Indian economy, remained firm. Real private final consumption expenditure (PFCE) rose 7.9 per cent, up from 6.4 per cent in the same quarter last year. Analysts attribute this improvement partly to pre-festive inventory build-up and a boost from the recent GST rationalisation.

India reduced Goods and Services Tax rates on several items from September 22, with Finance Minister Nirmala Sitharaman noting that the rejig would put Rs 2 lakh crore back into consumers’ hands. This is further expected to enhance discretionary spending, particularly in urban markets.

How Did Indian Economy Fare In H1?

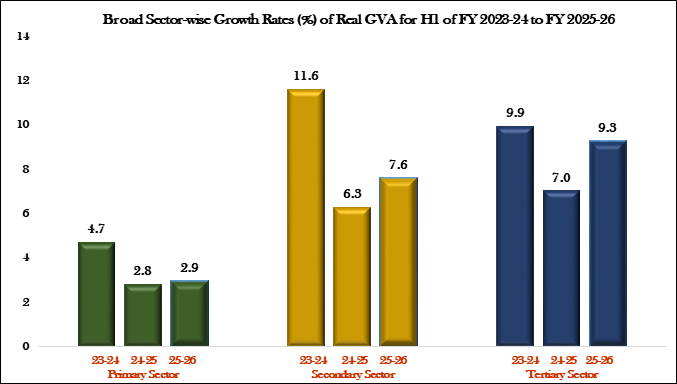

For the first half of FY26 (April–September), real GDP grew 8.0 per cent, up from 6.1 per cent during the same period last year. Nominal GDP expanded 8.8 per cent in H1, signalling continued demand resilience despite global uncertainties.

Real Gross Value Added (GVA) for H1 stood at Rs 89.41 lakh crore, registering a 7.9 per cent increase. The NSO highlighted improvements across sectors, with both manufacturing and services maintaining momentum.

Indian Economy Resilient In Face Of Tariffs

Economists suggest the second-quarter numbers reflect an economy benefiting from domestic policy support, easing inflation, and strong services exports, even as external risks linger.

The IMF, in its recent assessment, projected India’s real GDP growth at 6.6 per cent for FY26 under a baseline scenario that assumes prolonged US tariffs of 50 per cent on Indian goods. However, the Indian government has contested these assumptions, arguing that the impact is overstated and that new free trade agreements could expand export opportunities.

Despite global headwinds, the NSO’s Q2 data reinforces expectations of steady growth, thanks to consumption strength, government spending, and the post-GST boost.

What Is Driving India’s Growth Story?

Manufacturing revival: Improved demand, input cost stability, and better logistics efficiency.

Infrastructure push: Construction grew 7.2 per cent, supported by both public and private projects.

Urban consumption: GST rate cuts and early festive stocking lifted both sentiment and spending.

Services boom: Financial and professional services grew by over 10%, reflecting strong business confidence.

India’s Growth Outlook Remains Strong

With Q2 marking a six-quarter high and H1 growth touching 8 per cent, economists expect FY26 to remain a year of steady expansion. While risks such as geopolitical tensions, volatile commodity prices, and uneven monsoons persist, the underlying domestic drivers appear strong enough to cushion external shocks.

As India aims for higher long-term growth, policymakers emphasise ongoing structural reforms, investments in productivity, and further strengthening of the services and manufacturing ecosystem.