As meme coins continue to dominate headlines with viral momentum, utility-driven DeFi projects are quietly gaining traction behind the scenes. Mutuum Finance (MUTM) is one of those emerging names. While PEPE faces resistance and sentiment swings in October, MUTM is preparing for a critical phase that includes both token listing and the activation of its core protocol. This sets up a clear contrast between speculative hype and structured fundamentals.

Pepecoin (PEPE)

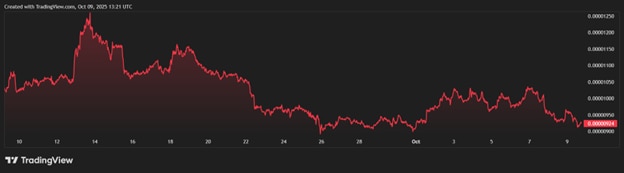

Pepecoin currently trades in the $0.000009–$0.000010 range, with a market capitalization of approximately $3.8–$4.5 billion, making it one of the largest meme coins on the market. Resistance zones have formed around $0.000012–$0.000014, while support tends to cluster between $0.000007–$0.000008. Analysts who expect continued upside forecast 145–165% gains, which would place PEPE around $0.000022–$0.000025 in a favorable environment.

Historically, PEPE’s strongest rallies have been powered by speculative bursts and social media waves. However, its limitations are clear. There is no fundamental utility, no revenue stream, and no protocol backing. Price action is largely crowd-driven, and large holders often take profits at resistance, stalling upward momentum.

Mutuum Finance (MUTM)

Mutuum Finance takes a very different approach. It’s an Ethereum-based DeFi protocol built to generate real value through lending, borrowing, and tokenomics that link platform activity directly to token demand. Instead of relying on hype cycles, MUTM is growing through utility, structured rollout, and transparent pricing.

The presale uses a fixed-price, staged structure that rewards early participants and keeps pricing clear for new buyers. MUTM is currently priced at $0.035 in Phase 6, up from $0.01 in Phase 1, a 250% increase since the presale began. To date, the project has raised over $17 million, sold more than 750 million tokens, and attracted over 16,800 investors. This wide distribution across thousands of addresses reduces whale concentration and supports healthier liquidity dynamics once trading begins. In a market where many tokens rely purely on hype, Mutuum Finance stands out for its strategic execution.

PEPE vs MUTM

PEPE’s upside depends almost entirely on short-term sentiment and hype waves. Its large market cap places natural limits on potential growth, and without mechanisms to generate sustained demand, rallies tend to stall as whales take profits at key resistance levels. With no utility, no revenue model, and no built-in token demand, price movements are tied to timing and crowd behavior, a dynamic that becomes harder to sustain in a maturing market.

MUTM, in contrast, is built on a structural economic model rather than speculative flows. Its dual lending markets support both mainstream and specialized tokens. mtTokens accrue interest over time, rewarding depositors, while a buy-and-distribute mechanism channels platform revenue into MUTM token purchases. As users lend, borrow, and stake, these systems generate organic, recurring token demand, something meme coins simply lack.

Analysts believe this design gives MUTM a significant edge in potential price appreciation. Once the beta platform launches on schedule and early adoption builds, projections suggest $0.25–$0.45 post-listing is realistic. That represents an 8x–12x increase from the current presale price of $0.035.

Beta Platform, Oracles, and Security

A key differentiator for Mutuum Finance is timing. According to the roadmap, the beta platform will go live around the token listing, giving users immediate access to lending and borrowing features. This alignment between product availability and market debut often accelerates liquidity discovery, as participants can use the platform from day one rather than waiting months for utility.

To support this, Mutuum is building a multi-layer oracle infrastructure that combines aggregated feeds with fallback oracles to ensure accurate, tamper-resistant pricing. The project has completed a CertiK audit, earning a 90/100 token score, and launched a $50,000 tiered bug bounty to encourage external security testing. These steps are designed to build trust well before the public launch.

Timing Is Key

Many analysts have compared MUTM’s presale mechanics and tokenomics to early Aave, citing its dual market structure and revenue-driven demand loops. The difference lies in market maturity. Aave launched during DeFi’s formative years; MUTM is entering a more competitive, security-focused environment. If it can maintain momentum and execute its roadmap cleanly, that alignment could help it outperform PEPE’s speculative ceiling.

Phase 6 is now over 60% allocated, and the price will rise to $0.04 once it sells out. This narrowing window is attracting investors who are looking beyond short-lived hype cycles. For those watching both momentum and fundamentals, MUTM is emerging as one of the few projects capable of challenging meme coins not with speculation, but with structure and sustainability.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

Disclaimer: This is a sponsored article. ABP Network Pvt. Ltd. and/or ABP Live do not endorse/subscribe to its contents and/or views expressed herein. Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Cryptocurrency is not a legal tender and is subject to market risks. Readers are advised to seek expert advice and read offer document(s) along with related important literature on the subject carefully before making any kind of investment whatsoever. Cryptocurrency market predictions are speculative and any investment made shall be at the sole cost and risk of the readers.