The rollout of next-generation Goods and Services Tax (GST) reforms has sparked sharp reactions from the opposition, with both the Congress and West Bengal Chief Minister Mamata Banerjee challenging the Centre’s narrative of ownership and credit. The remarks come as PM Modi lauded the GST reforms, terming it ‘bachat utsav (saving festival)’ ahead of the festive season. He said the reforms, combined with the recent income tax exemption on annual earnings up to ₹12 lakh, will allow citizens to save more than ₹2.5 lakh crore in just one year.

The Congress on Sunday accused Prime Minister Narendra Modi of claiming sole ownership of the amendments to the GST regime, asserting that the reforms were inadequate and failed to address key demands from the states, including an extension of compensation for an additional five years.

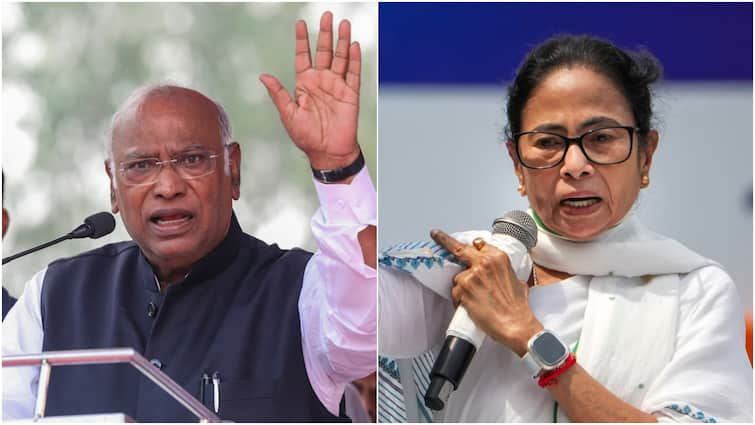

Reacting to Modi’s address, Congress president Mallikarjun Kharge posted in Hindi on X, translating to: “Instead of the simple and efficient GST of the Congress party, your government imposed the ‘Gabbar Singh Tax’ by collecting nine different slabs and collected over Rs 55 lakh crore in eight years. Now you are talking about a Rs 2.5 lakh crore ‘savings festival’ and applying a simple band-aid after inflicting deep wounds on the public! The public will never forget that you collected GST on their pulses, rice, grains, pencils, books, medical treatment, farmers’ tractors – everything. Your government should apologise to the public!”

Congress general secretary and communications in-charge Jairam Ramesh further criticised the move, saying Modi addressed the nation “to claim sole ownership of the amendments made to the GST regime by the GST Council, a constitutional body.” He described the GST as “a Growth Suppressing Tax” due to its high number of slabs, punitive rates, evasion, costly compliance, and inverted duty structure.

Ramesh added that the Congress has been demanding a GST 2.0 since July 2017 and that the current reforms do not adequately address concerns of MSMEs, sectoral issues in textiles, tourism, exporters, handicrafts, and agricultural inputs, or the extension of state compensation. He also questioned whether the delayed GST changes would genuinely spur private investment essential for GDP growth, pointing out that India’s trade deficit with China has doubled over the past five years.

Mamata Banerjee Says Centre Taking Undue Credit

West Bengal Chief Minister Mamata Banerjee accused the Centre of claiming undue credit for lowering GST rates, stating the initiative had originated from her state. “We are losing Rs 20,000 crore as revenue, but we are happy about the lowering of GST. But why are you (Modi) claiming credit for it? We had sought a lowered GST. It was our suggestion at the GST Council meeting with the Union Finance Minister,” Banerjee remarked, as per news agency PTI.

Trinamool Congress (TMC) leader Kunal Ghosh also weighed in, criticising the previous GST structure as “anti-people,” pointing out higher taxes on essential products used by ordinary citizens while luxury items for the wealthy were taxed less. According to news agency ANI, he asserted: “Mamata Banerjee raised her voice, and then the entire nation rose up against it. The Centre was forced to change the GST rates. Now they are trying to take credit for this, but why did you introduce such rates in the first place? Because your tariff was anti-people. The credit goes to Mamata Banerjee and AITC for pointing out the flaws and forcing them to bring these changes.”

Next-Generation GST Reforms to Begin from Navratri

Prime Minister Narendra Modi announced the implementation of the revised GST from September 22, coinciding with the first day of Navratri, calling it a “GST Bachat Utsav” and highlighting its benefits for the poor, middle class, farmers, traders, and entrepreneurs. Modi said, “From tomorrow, across the country, a ‘GST Bachat Utsav’ will begin. In this GST Bachat Utsav, your savings will increase, and you will be able to purchase your favourite items more easily. The poor, middle class, neo-middle class, youth, farmers, women, shopkeepers, traders, and entrepreneurs – all will benefit greatly.”

The reforms reduce GST rates on about 375 items, creating a two-tier structure with most goods and services taxed at 5 or 18 per cent, while ultra-luxury items carry a 40 per cent levy. Tobacco and related products remain under the 28 per cent slab plus compensation cess. Essentials such as ghee, paneer, butter, ‘namkeen’, ketchup, jam, dry fruits, coffee, ice cream, and aspirational goods like TVs, ACs, and washing machines will see lower tax rates, making them more affordable.