The company clarified that the discounts will remain valid until December 31, 2025.

The company clarified that the discounts will remain valid until December 31, 2025.New Delhi: In a bid to capitalise on the upcoming festive season demand, Maruti Suzuki on Thursday announced additional festive discounts across its portfolio, over and above the recent GST cut.

The festive season in India typically contributes 25-30 per cent of annual volumes, when consumers prefer making purchases of big-ticket items.

The revised prices will take effect from September 22, coinciding with the GST relief and the onset of Navratri festivities, which is traditionally seen as an auspicious period for vehicle purchases.

The company clarified that the discounts will remain valid until December 31, 2025.

Partho Banerjee, Senior Executive Officer, Sales & Marketing at Maruti Suzuki, said the intent is “to make cars more affordable for two-wheeler customers aspiring to upgrade to four-wheelers.”

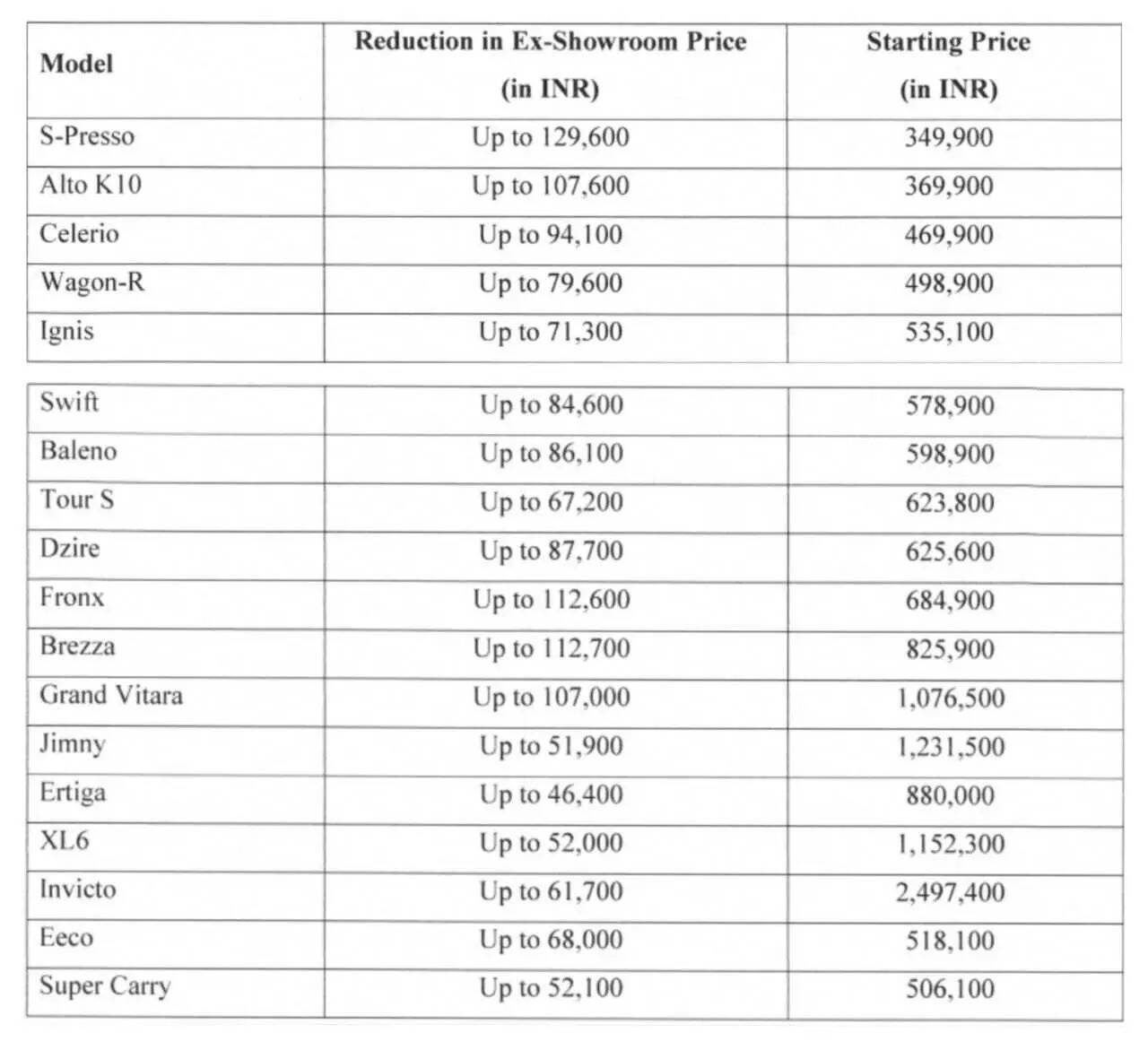

Factoring in all the discounts, Maruti’s entry-level models have received the steepest cuts, with the S-Presso seeing a price reduction of ₹1.29 lakh. The model will now start at ₹3.49 lakh.

Alto K10 now starts at ₹3.69 lakh, Celerio at ₹4.69 lakh, and WagonR at ₹4.98 lakh. At the other end, the Ertiga carries the lowest cut of ₹46,400, bringing its new price to ₹8.80 lakh. The Invicto has received a price cut of ₹61,700, bringing its revised starting price to ₹24.97 lakh.

Industry watchers view this as Maruti Suzuki’s push to revive entry-level car sales during the festive season, even as consumer preferences shift towards SUVs. It may be noted that the company remains the only automaker with a broad entry-level portfolio.

Meanwhile, Hyundai Motor India COO Tarun Garg recently stated the GST 2.0 reforms as the “biggest tax cut in 20 years” and said it could cause “mayhem” in the coming months. He added that the sub-4-metre SUV segment is poised for the strongest growth as it balances both affordability and aspiration.

Model-wise reduction in ex-showroom prices

Model-wise reduction in ex-showroom prices

Cess conundrum

Addressing concerns over dealer burden from unsold inventory and pending compensation cess dues, Banerjee said Maruti is “taking care of channel partners,” adding that the recent move of additional discounting is Maruti’s way of “compensating” dealers, as it is expected to boost sales. “We always believe it is the volume that makes a difference,” he noted.

Under the new GST framework, the existing four-tier structure of 5 per cent, 12 per cent, 18 per cent and 28 per cent has been replaced with a three-slab system of 5 per cent, 18 per cent and 40 per cent.

For the automobile sector, electric vehicles (EVs) will continue to attract 5 per cent GST, while other vehicle categories have been revised to either 18 per cent or 40 per cent.

While the industry has welcomed the discontinuation of the compensation cess levy, it has urged the government to address the treatment of cess balances currently lying in car dealers’ books on unsold inventory.

FADA President CS Vigneshwar has been reiterating that the potential loss for dealers could exceed ₹2,500 crore.

While the government has ruled out relief on the compensation cess, the dealers’ association remains hopeful, continuing detailed representations to officials. It also cautioned that with over 95 per cent of dealer inventory bank-funded, lapsing credits could tighten liquidity just ahead of the critical Diwali season.