TL;DR: Driving the newsWhen Russian President Vladimir Putin’s plane lands in Delhi on December 4, it will be his first trip to India since the war in Ukraine began in February 2020. The optics will be simple: two longtime partners shaking hands again after a rough few years. The reasons for those smiles are anything but simple.There are two big bets on the table. One is hard power: India wants five more S-400 Triumf air defense squadrons on top of the ones it has already ordered from Russia and tested in Operation Sindoor this year. The other is financial plumbing: A plan to connect India’s RuPay and Russia’s Mir payment networks and make the rupee-rouble systems work better so that trade can keep going even as Western sanctions get tighter around Moscow.The combination of missiles and financial pipelines highlights the primary challenge facing India’s foreign policy in 2025: How to maintain a close relationship with Russia while avoiding a rift with the West?

Why the S-400 is still important to Delhi?

India signed the original $5.5 billion S-400 deal in 2018, but it did so under a lot of pressure from the US under CAATSA, the law that punishes big defense purchases from Russia. In the end, Washington made an exception for India in 2022, quietly admitting that punishing Delhi would hurt its own Indo-Pacific strategy. Things have changed on the ground since then, but not in India’s skies. China is still upgrading its air force and missile stockpile, while Pakistan is still an unpredictable secondary front. The S-400 is one of the few systems that can lock down Indian airspace like this. It has a long range and layered radar. We all read how S-400 successfully shot down several Pakistani drones during Operation Sindoor along the western front earlier this year. This only adds to the platform’s “game-changer” reputation in Delhi.That’s why the Modi government still wants five more S-400 squadrons, a new missile order, and is may also consider Moscow’s offer to co-produce the Su-57 stealth fighter, even though there has been a lot of talk about moving away from Russian equipment. For Indian planners, this isn’t about nostalgia; it’s about filling in real gaps in their capabilities faster and, in many cases, cheaper than Western vendors will let them.But for Washington and Brussels, another big S-400 deal could be a warning sign. Analysts have said that adding to the original deal could start the CAATSA debate all over again, just as the US Congress and European capitals are already upset about India’s purchases of Russian oil.Every extra S-400 battery India buys is more than just a missile system; it’s a test of how far the West is willing to go to “special treat” Delhi.

Russia’s stealth sweetener, the Su-57, and India’s ‘strategic options’

There are other big things in the air besides missiles. As Putin arrives, Moscow is also showing off the Su-57 stealth fighter, which is more futuristic.A recent article in the South China Morning Post says that Russian officials have said they are willing to give India unusually deep localization and technology transfer on the export version of the Su-57. They even hinted at the possibility of licensed production in India.

The message to the Kremlin is clear: even though Western partners are hesitant to share cutting-edge combat aircraft technology, Russia is still willing to open the black box. The possible Su-57 deal is another way for India to show that it has “strategic options.” It isn’t stuck in one camp, even though trade, tariffs, and Ukraine issues sometimes make relations with the US tense.There is still a question of whether the Indian Air Force really wants a lot of Su-57s. The stealth-jet offer is a political subplot to the Modi-Putin summit. It shows how Moscow is trying to keep India’s defense budget and attention from drifting too far toward American, European, and Indian systems.

Rewiring the money pipes: The rupee, Mir, and RuPay

Payments are the lifeblood of India-Russia ties, while S-400s are the metal spine.Since the invasion of Ukraine, trade between the two countries has grown to almost $70 billion in 2024–25, mostly because of cheap Russian oil. But moving money from point A to point B has gotten harder and harder because US and European sanctions have hit Russian banks, oil companies, and shipping.India and Russia put together a rupee-based settlement system using Special Rupee Vostro Accounts (SRVAs) in Indian banks to keep trade going. This is a modern version of the old rupee-rouble trade from the 1950s. In August, the Reserve Bank of India made rules easier so that Russian companies could invest their extra rupees in Indian government bonds, stocks, and infrastructure. This way, the money isn’t just sitting in bank accounts.

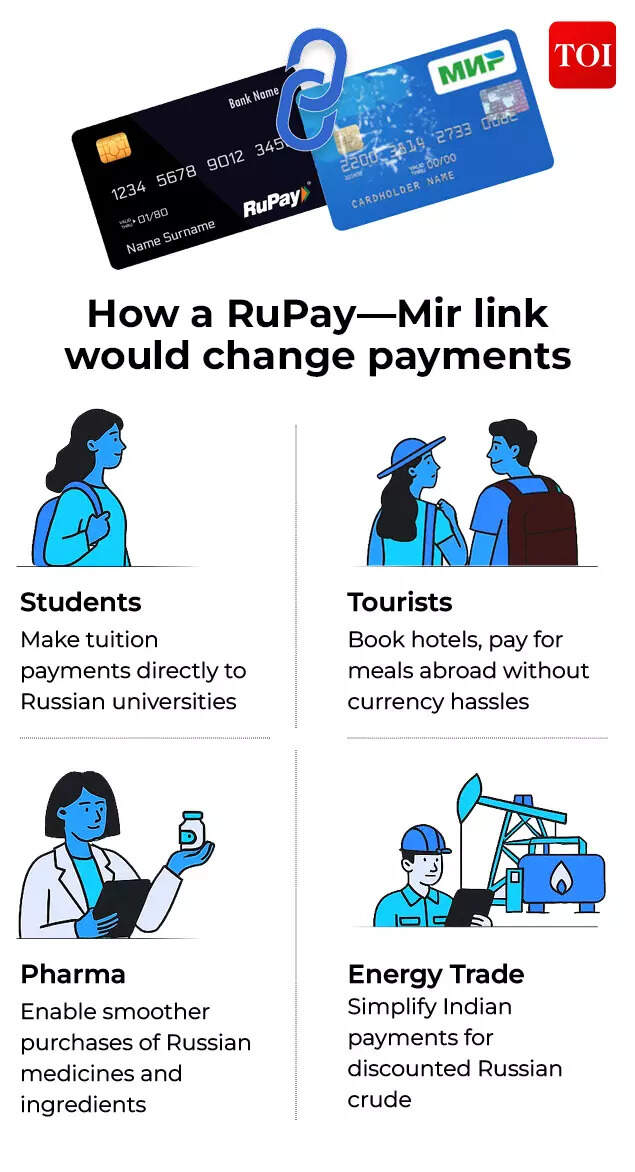

Still, the system is creaking. Indian exporters have said that they are having more and more trouble getting paid for goods they send to Russia because banks are worried about secondary sanctions. Some trade groups have asked Delhi to make the rupee-rouble rate and guarantee framework clearer to help people trust the system again.That’s where the idea for RuPay-Mir comes in. At the summit, negotiators want to get at least a political green light and maybe even a roadmap for both sides to agree to each other’s domestic card networks.In real life, that could mean that Indian tourists in Moscow can use a RuPay card without needing a Visa or Mastercard.

- Mir payments from Russian tourists in Goa or Kerala.

- Over time, merchants in both countries have started to settle through local currency corridors instead of dollar-clearing hubs.

It’s about something bigger: a world where Western financial systems aren’t the only ones that work. That means staying alive for Russia, which is cut off from most of the Western banking system. For India, it’s a strategic insurance policy that shows it can help build alternative circuits without officially joining any “anti-dollar” bloc.

New sanctions and lower oil prices

The crude truth of oil is behind the financial engineering.Before the war in Ukraine, Russia supplied India with almost no crude oil. By the middle of 2025, it was supplying about 35–40% of India’s crude oil, making it the country’s biggest supplier and saving Delhi billions of dollars in import costs thanks to big discounts.But that deal is now running into a wall of tougher sanctions. A new US-EU-UK package aimed at Russian companies like Rosneft and Lukoil is making Indian refiners rethink how much they are exposed. According to Reuters, Indian imports of Russian crude rose to about 1.85 million barrels per day in November, a last-minute rush to stock up. In December, however, they are expected to drop to nearly 600,000-650,000 bpd, the lowest level in three years, as sanctions take effect.Reliance, India’s largest private refiner, has already stopped using Russian crude at its SEZ refinery, which is focused on exports. However, it is still processing some Russian oil for use in India.This is the other “tightrope” that Modi walks. Cheap Russian barrels helped keep India’s inflation in check and protected families from price spikes around the world. But the same flows made the West more and more angry, and now they have led to sanctions that make it harder to get money, ship things, and get insurance.Washington and Brussels will now see every move India makes to protect payments—like RuPay-Mir, changes to the rupee-rouble exchange rate, and new investment options for Russian businesses—through the lens of these energy sanctions. Are they smart hedging, or are they a way for Moscow to get away with it?

Strategic independence or strategic isolation?

Delhi says that nothing important has changed, at least officially. Since 2022, external affairs minister S Jaishankar has said that India is against the war, supports dialogue and diplomacy, and stands for the UN Charter and territorial integrity. However, India will not be told who to buy oil or weapons from.Indian strategists call this “multi-alignment” or “strategic autonomy.” It means working with the US and its allies more on technology and the Indo-Pacific while keeping strong defense and energy ties with Russia and dealing with a difficult relationship with China.But in the capitals of the West, people are less patient than they were in the first few months of the war. A recent article in Foreign Policy said that India’s style of strategic independence is starting to look “aloof,” even opportunistic, at a time when Europe and the US see Ukraine as a fight for survival.That doesn’t mean a crisis is going to happen. India is still a key part of the US plan to keep China in check in Asia. Washington has already shown that it is willing to put up with some discomfort to keep Delhi close, as seen by the 2022 CAATSA waiver and a number of defense tech projects.Still, every new action—more S-400s, deeper trade between the rupee and the rouble, and integration of the card system—adds weight to a set of scales that are already very well balanced.

What the summit will really mean?

A successful visit from Putin will probably be seen as proof that India can’t be pushed around. It buys what it needs from whoever it wants and makes its own financial plans. The S-400 has a special meaning: it was a system that India bought despite public warnings from the US, and it seems to have worked well in battle.People at home who don’t like the idea will have other problems. Does India’s long-term goal of diversifying and indigenizing slow down when it renews its dependence on Russia for big-ticket defense items? Are Indian banks and exporters being asked to take on too much risk as sanctions get tougher? And what if a future US government decides that waivers and quiet agreements have gone too far?The Modi government seems to think that India’s economic power and usefulness in world politics give it some freedom of action for now. That basic bet won’t change because of the 23rd annual summit. What it will do is raise the stakes even higher, with more hardware in the air and more plumbing in the financial system.When Modi and Putin meet in Delhi this week, the news will be about missiles and credit cards, fighter jets, and oil flows. The real story is below: Can India make a partnership with a sanctioned Russia without damaging its relationship with a cautious West?(With help from agencies) Go to Source