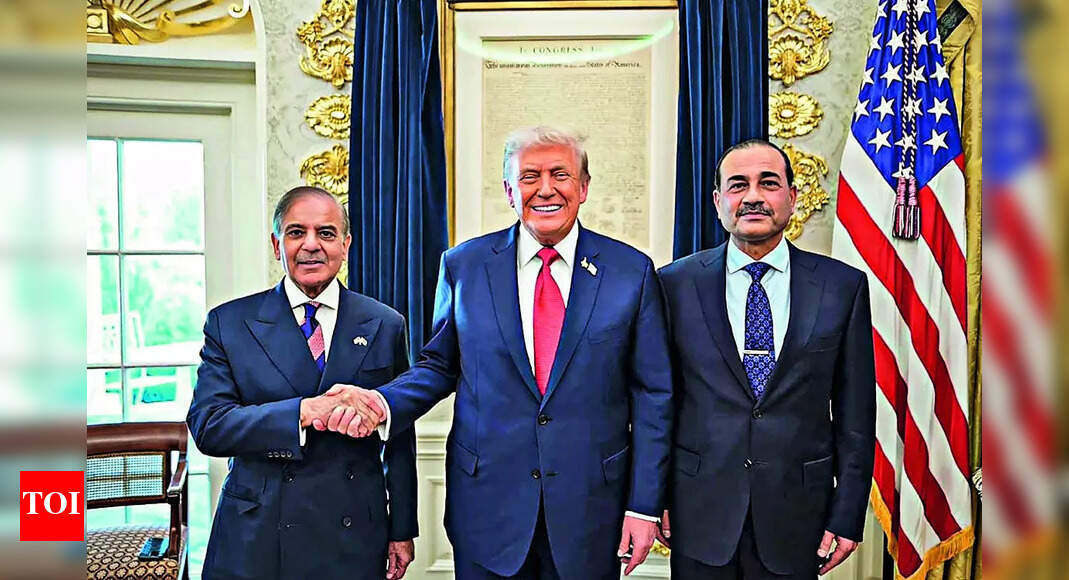

Pakistan PM Shehbaz Sharif Friday turned in a bizarre performance at the United Nations, where he said Pakistan was ready for a composite dialogue with India while making claims about downing Indian jets during Operation Sindoor, and “delivering a bloody nose”. Predictably, he glossed over Pakistan’s losses, including the loss of warplanes and destruction of almost all of its strategic air bases by the IAF during Operation Sindoor, launched May 7.He also turned into a fanboy of Trump, calling the US president a “man of peace”, and backing his claims of mediation to bring about the ceasefire – something repeatedly rejected by India. “Though in a position of strength, Pakistan agreed to a ceasefire facilitated by President Trump’s bold and visionary leadership,” Sharif claimed. PM Modi has made it clear in Parliament no country asked India to stop Op Sindoor.

Vitamin T

It isn’t clear whether Trump’s 100% tariff on imported “branded or patented” drugs will affect India, but markets turned cautious on Friday. Pharma stocks fell between 1% and 5%. The tariff isn’t entirely unexpected – Trump has been talking about imposing it since April. In July, he threatened to tax imported pharmaceuticals at 200%. In Aug, he said the tariff could go up to 250%. What stumped the market was the timing, as he had earlier hinted at starting with a “small tariff” and peaking in 12 to 18 months.The impact on India will depend on how “branded” is interpreted. US is India’s biggest pharma market, buying roughly $10bn worth of drugs last year. But these are largely low-cost generics, including drugs for cardiovascular and neurological disorders. Experts believe these off-patent formulations – even if shipped under a brand name – may be exempt from the new tariff. However, clarity on this point will emerge only after US issues enforcement rules.For Trump, making US aatmanirbhar in medicines has been a priority since his first term. According to a White House release, US makes 40% of its finished drugs, but the share of locally made APIs is just 10%. This explains the exemption offered to pharma firms setting up plants in US. But the abruptness of Trump’s decisions – like with H-1B visas last week, and the penal tariff on India in July – is unsettling. Countries like Ireland, Switzerland, and Germany, which supply high-value branded and patented drugs, will clearly bear the brunt of his latest tariff. But if branded generics are also taxed, 40% of India’s pharma exports will be at risk. Even if Indian generics are spared for now, Trump’s sword will hang over them. So, the search for new markets should begin immediately.