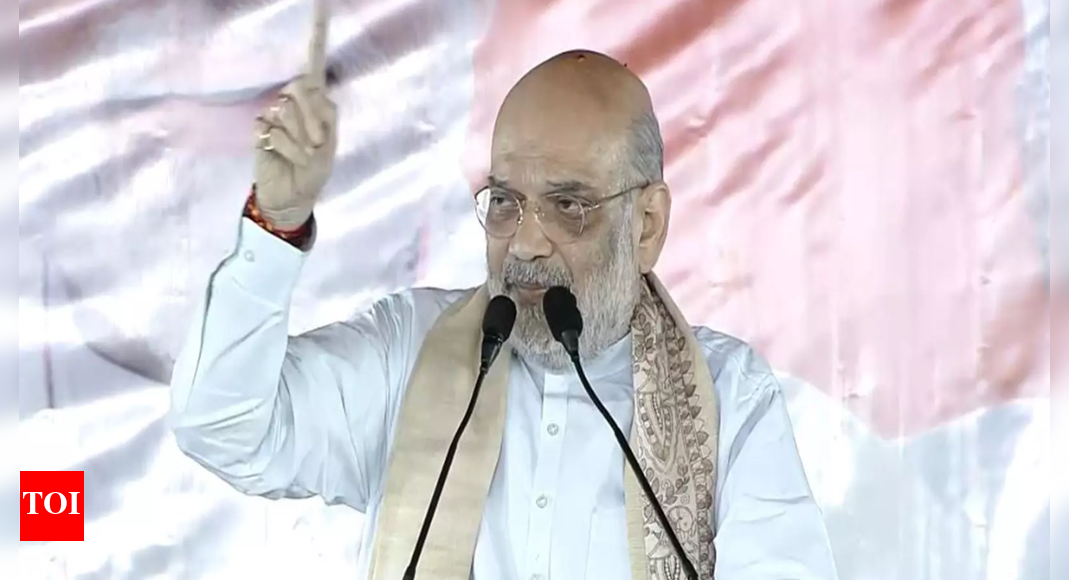

NEW DELHI: Home and cooperation minister Amit Shah Monday launched ‘Sahkar Digi-Pay’ and ‘Sahkar Digi-Loan’ Apps – a digital platform enabling quick, paperless, and transparent access to loans and credit for cooperative members across India – at International Conference on Urban Cooperative Credit Sector, and said efforts should be made to establish an urban cooperative bank within next five years in every town with a population of over two lakh. “With the advent of the new era of digital payments in India, even the smallest urban cooperative societies will now be able to connect through these apps. To facilitate this, umbrella organisations will need to proactively form dedicated teams and aggressively drive the initiative forward,” Shah said while addressing the two-day conference ‘Co-Op Kumbh 2025’. “Digi Pay is the need of the hour. We know payment modes have changed. There is increasing adoption of digital payment, and if urban cooperative banks do not match, they will be out of the race,” Shah said, setting a target of onboarding 1,500 banks to the platform within two years. Highlighting govt’s efforts to professionalise urban cooperative banks (UCBs) and cooperative credit societies, Shah said the move has succeeded in reducing Non-Performing Assets (NPA) from 2.8% to 0.06% in two years. The minister set an ambitious target for National Federation of Urban Cooperative Banks & Credit Societies Limited to establish at least one additional UCB in every town with a population exceeding two lakh within five years. Shah directed federation to convert successful cooperative credit societies into UCBs.

Wednesday, December 17, 2025

16.1

C

New Delhi

Lionel Messi Visits Vantara Wildlife Centre In Jamnagar, Meets Anant Ambani | Videos

Messi spent several hours at the centre interacting with caregivers and observing animal care and conservation efforts underway at the facility. Read More

‘Should’ve Played In Kerala’: Tharoor After India vs South Africa Lucknow T20 Called Off Due To Fog

The Air Quality Index (AQI) remained in the hazardous range, above 400 in Lucknow on Wednesday, raising serious questions about the BCCI’s commitment to players’ welfare. Read More

Retired UPPCL Official, Wife Duped Of ₹53 Lakh In 69-Day ‘Digital Arrest’ Scam In Kanpur

Ramesh Chandra, retired UPPCL official, and his wife in Kanpur were duped of ₹53 lakh over 69 days by cybercriminals posing as police and CBI, keeping them under digital arrest. Read More

‘Waiting in vain’: Tharoor reacts to IND-SA match cancellation; cites Kerala’s AQI

Shashi Tharoor (PTI image)

NEW DELHI: Congress MP Shashi Tharoor on Wednesday questioned the decision to host the fourth India–South Africa T20I in Lucknow amid dense fog and severe air pollution, after the match was eventually cal Read More

‘Belong To the Nation, Not A Family’: Centre Targets Sonia Gandhi Over Nehru Papers Row

Show Quick Read

Key points generated by AI, verified by newsroom

The Union government on Wednesday sharply criticised Congress leader Sonia Gandhi over the custody of 51 cartons of papers belonging to India’s first Prime Minister, J Read More

Lionel Messi Visits Vantara Wildlife Centre In Jamnagar, Meets Anant Ambani | Videos

Messi spent several hours at the centre interacting with caregivers and observing animal care and conservation efforts underway at the facility. Read More

‘Should’ve Played In Kerala’: Tharoor After India vs South Africa Lucknow T20 Called Off Due To Fog

The Air Quality Index (AQI) remained in the hazardous range, above 400 in Lucknow on Wednesday, raising serious questions about the BCCI’s commitment to players’ welfare. Read More

Retired UPPCL Official, Wife Duped Of ₹53 Lakh In 69-Day ‘Digital Arrest’ Scam In Kanpur

Ramesh Chandra, retired UPPCL official, and his wife in Kanpur were duped of ₹53 lakh over 69 days by cybercriminals posing as police and CBI, keeping them under digital arrest. Read More

‘Waiting in vain’: Tharoor reacts to IND-SA match cancellation; cites Kerala’s AQI

Shashi Tharoor (PTI image)

NEW DELHI: Congress MP Shashi Tharoor on Wednesday questioned the decision to host the fourth India–South Africa T20I in Lucknow amid dense fog and severe air pollution, after the match was eventually cal Read More

‘Belong To the Nation, Not A Family’: Centre Targets Sonia Gandhi Over Nehru Papers Row

Show Quick Read

Key points generated by AI, verified by newsroom

The Union government on Wednesday sharply criticised Congress leader Sonia Gandhi over the custody of 51 cartons of papers belonging to India’s first Prime Minister, J Read More

Lionel Messi Visits Vantara Wildlife Centre In Jamnagar, Meets Anant Ambani | Videos

Messi spent several hours at the centre interacting with caregivers and observing animal care and conservation efforts underway at the facility. Read More

‘Should’ve Played In Kerala’: Tharoor After India vs South Africa Lucknow T20 Called Off Due To Fog

The Air Quality Index (AQI) remained in the hazardous range, above 400 in Lucknow on Wednesday, raising serious questions about the BCCI’s commitment to players’ welfare. Read More

Retired UPPCL Official, Wife Duped Of ₹53 Lakh In 69-Day ‘Digital Arrest’ Scam In Kanpur

Ramesh Chandra, retired UPPCL official, and his wife in Kanpur were duped of ₹53 lakh over 69 days by cybercriminals posing as police and CBI, keeping them under digital arrest. Read More

‘Waiting in vain’: Tharoor reacts to IND-SA match cancellation; cites Kerala’s AQI

Shashi Tharoor (PTI image)

NEW DELHI: Congress MP Shashi Tharoor on Wednesday questioned the decision to host the fourth India–South Africa T20I in Lucknow amid dense fog and severe air pollution, after the match was eventually cal Read More

‘Belong To the Nation, Not A Family’: Centre Targets Sonia Gandhi Over Nehru Papers Row

Show Quick Read

Key points generated by AI, verified by newsroom

The Union government on Wednesday sharply criticised Congress leader Sonia Gandhi over the custody of 51 cartons of papers belonging to India’s first Prime Minister, J Read More

Lionel Messi Visits Vantara Wildlife Centre In Jamnagar, Meets Anant Ambani | Videos

Messi spent several hours at the centre interacting with caregivers and observing animal care and conservation efforts underway at the facility. Read More

‘Should’ve Played In Kerala’: Tharoor After India vs South Africa Lucknow T20 Called Off Due To Fog

The Air Quality Index (AQI) remained in the hazardous range, above 400 in Lucknow on Wednesday, raising serious questions about the BCCI’s commitment to players’ welfare. Read More

Retired UPPCL Official, Wife Duped Of ₹53 Lakh In 69-Day ‘Digital Arrest’ Scam In Kanpur

Ramesh Chandra, retired UPPCL official, and his wife in Kanpur were duped of ₹53 lakh over 69 days by cybercriminals posing as police and CBI, keeping them under digital arrest. Read More

‘Waiting in vain’: Tharoor reacts to IND-SA match cancellation; cites Kerala’s AQI

Shashi Tharoor (PTI image)

NEW DELHI: Congress MP Shashi Tharoor on Wednesday questioned the decision to host the fourth India–South Africa T20I in Lucknow amid dense fog and severe air pollution, after the match was eventually cal Read More

‘Belong To the Nation, Not A Family’: Centre Targets Sonia Gandhi Over Nehru Papers Row

Show Quick Read

Key points generated by AI, verified by newsroom

The Union government on Wednesday sharply criticised Congress leader Sonia Gandhi over the custody of 51 cartons of papers belonging to India’s first Prime Minister, J Read More

Lionel Messi Visits Vantara Wildlife Centre In Jamnagar, Meets Anant Ambani | Videos

Messi spent several hours at the centre interacting with caregivers and observing animal care and conservation efforts underway at the facility. Read More

‘Should’ve Played In Kerala’: Tharoor After India vs South Africa Lucknow T20 Called Off Due To Fog

The Air Quality Index (AQI) remained in the hazardous range, above 400 in Lucknow on Wednesday, raising serious questions about the BCCI’s commitment to players’ welfare. Read More

Retired UPPCL Official, Wife Duped Of ₹53 Lakh In 69-Day ‘Digital Arrest’ Scam In Kanpur

Ramesh Chandra, retired UPPCL official, and his wife in Kanpur were duped of ₹53 lakh over 69 days by cybercriminals posing as police and CBI, keeping them under digital arrest. Read More

‘Waiting in vain’: Tharoor reacts to IND-SA match cancellation; cites Kerala’s AQI

Shashi Tharoor (PTI image)

NEW DELHI: Congress MP Shashi Tharoor on Wednesday questioned the decision to host the fourth India–South Africa T20I in Lucknow amid dense fog and severe air pollution, after the match was eventually cal Read More

‘Belong To the Nation, Not A Family’: Centre Targets Sonia Gandhi Over Nehru Papers Row

Show Quick Read

Key points generated by AI, verified by newsroom

The Union government on Wednesday sharply criticised Congress leader Sonia Gandhi over the custody of 51 cartons of papers belonging to India’s first Prime Minister, J Read More

Lionel Messi Visits Vantara Wildlife Centre In Jamnagar, Meets Anant Ambani | Videos

Messi spent several hours at the centre interacting with caregivers and observing animal care and conservation efforts underway at the facility. Read More

‘Should’ve Played In Kerala’: Tharoor After India vs South Africa Lucknow T20 Called Off Due To Fog

The Air Quality Index (AQI) remained in the hazardous range, above 400 in Lucknow on Wednesday, raising serious questions about the BCCI’s commitment to players’ welfare. Read More

Retired UPPCL Official, Wife Duped Of ₹53 Lakh In 69-Day ‘Digital Arrest’ Scam In Kanpur

Ramesh Chandra, retired UPPCL official, and his wife in Kanpur were duped of ₹53 lakh over 69 days by cybercriminals posing as police and CBI, keeping them under digital arrest. Read More

‘Waiting in vain’: Tharoor reacts to IND-SA match cancellation; cites Kerala’s AQI

Shashi Tharoor (PTI image)

NEW DELHI: Congress MP Shashi Tharoor on Wednesday questioned the decision to host the fourth India–South Africa T20I in Lucknow amid dense fog and severe air pollution, after the match was eventually cal Read More

‘Belong To the Nation, Not A Family’: Centre Targets Sonia Gandhi Over Nehru Papers Row

Show Quick Read

Key points generated by AI, verified by newsroom

The Union government on Wednesday sharply criticised Congress leader Sonia Gandhi over the custody of 51 cartons of papers belonging to India’s first Prime Minister, J Read More

Lionel Messi Visits Vantara Wildlife Centre In Jamnagar, Meets Anant Ambani | Videos

Messi spent several hours at the centre interacting with caregivers and observing animal care and conservation efforts underway at the facility. Read More

‘Should’ve Played In Kerala’: Tharoor After India vs South Africa Lucknow T20 Called Off Due To Fog

The Air Quality Index (AQI) remained in the hazardous range, above 400 in Lucknow on Wednesday, raising serious questions about the BCCI’s commitment to players’ welfare. Read More

Retired UPPCL Official, Wife Duped Of ₹53 Lakh In 69-Day ‘Digital Arrest’ Scam In Kanpur

Ramesh Chandra, retired UPPCL official, and his wife in Kanpur were duped of ₹53 lakh over 69 days by cybercriminals posing as police and CBI, keeping them under digital arrest. Read More

‘Waiting in vain’: Tharoor reacts to IND-SA match cancellation; cites Kerala’s AQI

Shashi Tharoor (PTI image)

NEW DELHI: Congress MP Shashi Tharoor on Wednesday questioned the decision to host the fourth India–South Africa T20I in Lucknow amid dense fog and severe air pollution, after the match was eventually cal Read More

‘Belong To the Nation, Not A Family’: Centre Targets Sonia Gandhi Over Nehru Papers Row

Show Quick Read

Key points generated by AI, verified by newsroom

The Union government on Wednesday sharply criticised Congress leader Sonia Gandhi over the custody of 51 cartons of papers belonging to India’s first Prime Minister, J Read More

Lionel Messi Visits Vantara Wildlife Centre In Jamnagar, Meets Anant Ambani | Videos

Messi spent several hours at the centre interacting with caregivers and observing animal care and conservation efforts underway at the facility. Read More

‘Should’ve Played In Kerala’: Tharoor After India vs South Africa Lucknow T20 Called Off Due To Fog

The Air Quality Index (AQI) remained in the hazardous range, above 400 in Lucknow on Wednesday, raising serious questions about the BCCI’s commitment to players’ welfare. Read More

Retired UPPCL Official, Wife Duped Of ₹53 Lakh In 69-Day ‘Digital Arrest’ Scam In Kanpur

Ramesh Chandra, retired UPPCL official, and his wife in Kanpur were duped of ₹53 lakh over 69 days by cybercriminals posing as police and CBI, keeping them under digital arrest. Read More

‘Waiting in vain’: Tharoor reacts to IND-SA match cancellation; cites Kerala’s AQI

Shashi Tharoor (PTI image)

NEW DELHI: Congress MP Shashi Tharoor on Wednesday questioned the decision to host the fourth India–South Africa T20I in Lucknow amid dense fog and severe air pollution, after the match was eventually cal Read More

‘Belong To the Nation, Not A Family’: Centre Targets Sonia Gandhi Over Nehru Papers Row

Show Quick Read

Key points generated by AI, verified by newsroom

The Union government on Wednesday sharply criticised Congress leader Sonia Gandhi over the custody of 51 cartons of papers belonging to India’s first Prime Minister, J Read More

Free News - Where voices unite, stories flourish, and community thrives through open dialogue and meaningful connections.

Headlines

When a teapot became Hitler: The bizarre billboard controversy that took over the internet

In 2013 California, J.C. Read More

PM Modi arrives in Oman, meets Deputy PM Sayyid Shihab to strengthen bilateral ties

PM Modi arrived in Oman at the invitation of Sultan Haitham bin Tarik and is expected to sign an ambitious trade deal. This is his second visit to the Gulf nation. Read More

Lionel Messi Visits Vantara Wildlife Centre In Jamnagar, Meets Anant Ambani | Videos

Messi spent several hours at the centre interacting with caregivers and observing animal care and conservation efforts underway at the facility. Read More

‘Should’ve Played In Kerala’: Tharoor After India vs South Africa Lucknow T20 Called Off Due To Fog

The Air Quality Index (AQI) remained in the hazardous range, above 400 in Lucknow on Wednesday, raising serious questions about the BCCI’s commitment to players’ welfare. Read More

Newsletter

Get important news delivered directly to your inbox and stay connected!