NEW DELHI: Federal auditor CAG, in a first of its kind report on state finances – a decadal study on economic performance of states – has found that 16 states are revenue surplus. Surprisingly, leading them is Uttar Pradesh – once clubbed as a prominent member of Bimaru states – with Rs 37,000 crore surplus in the fiscal year 2023. In fact, UP is joined in the elite club by Madhya Pradesh, another member of the erstwhile sick states, with more revenue receipts than expenditu re.UP is followed by Gujarat (Rs 19,865 crore), Odisha (Rs 19,456 crore), Jharkhand (Rs 13,564 crore), Karnataka (Rs 13,496 crore), Chhattisgarh (Rs 8,592 crore), Telangana (Rs 5,944 crore), Uttarakhand (Rs 5,310 crore), Madhya Pradesh (Rs 4,091 crore) and Goa (Rs 2,399 crore).The northeastern states of Arunachal, Manipur, Mizoram, Nagaland, Tripura and Sikkim are also among the states on this coveted list. Of the 16 states with revenue surplus, at least 10 are led by BJP.

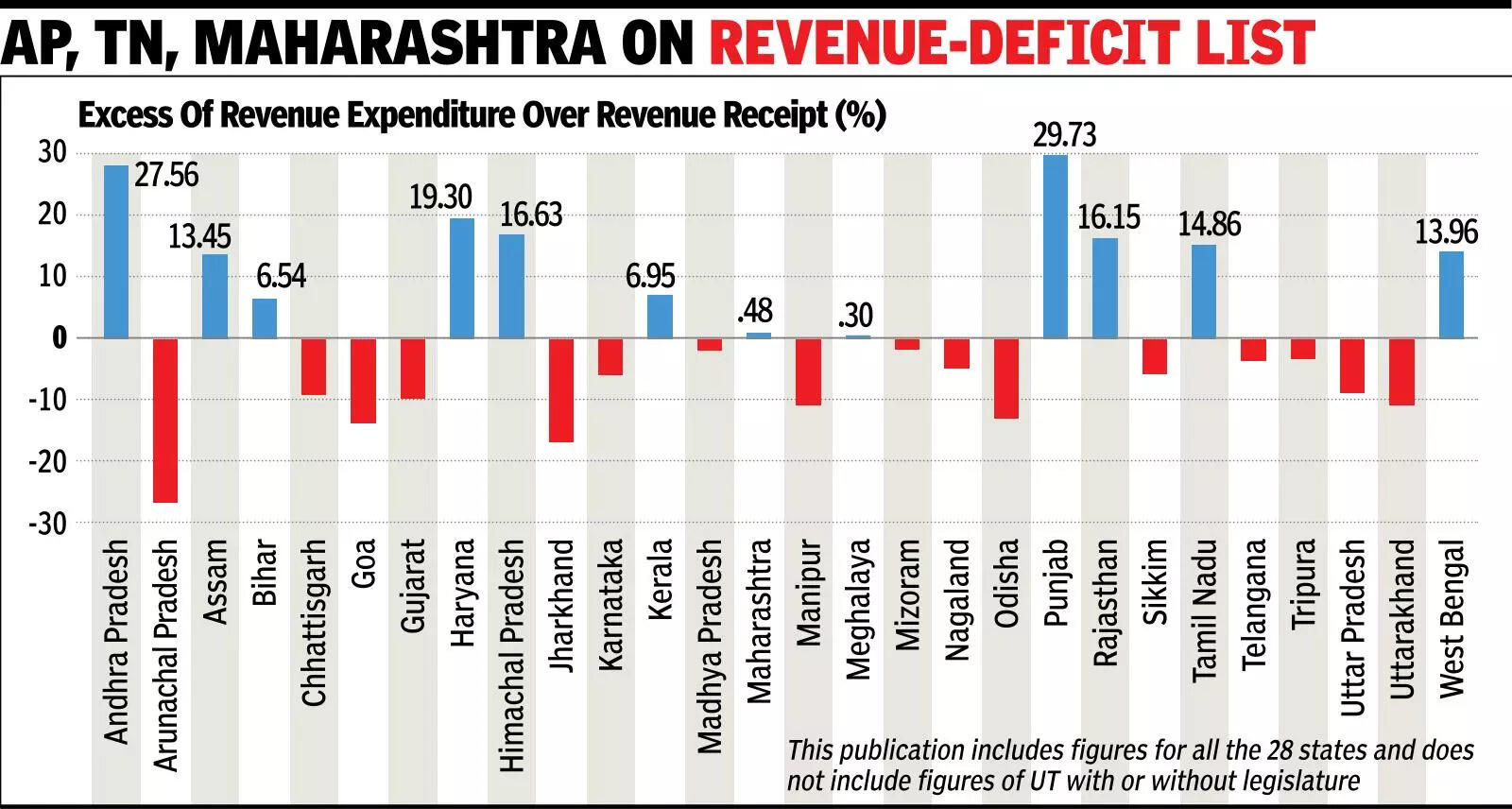

The report, released on Friday by CAG Sanjay Murthy, found that in 2022-23, at least 12 states were in revenue deficit. These included Andhra Pradesh (-Rs 43,488 crore), Tamil Nadu (-Rs 36,215 crore), Rajasthan (-Rs 31,491 crore), West Bengal (-Rs 27,295 crore), Punjab (-Rs 26,045 crore), Haryana (-Rs 17,212 crore), Assam (-Rs 12,072 crore), Bihar (-Rs 11,288 crore), Himachal Pradesh (-Rs 6,336 crore), Kerala (-Rs 9,226 crore), Maharashtra (-Rs 1,936 crore) and Meghalaya (-Rs 44 crore). The composition of revenue deficit states is fast changing with West Bengal, Kerala, Himachal Pradesh and Punjab joining the league of those surviving on Revenue Deficit Grants from the Centre.West Bengal received the largest share of 16% grants in FY 2023 to bridge the gap between its revenue receipts and expenditure, followed by Kerala 15%, Andhra Pradesh 12%, Himachal Pradesh 11%, and Punjab 10%, CAG said.At the same time, there are states that have boosted their own revenue sources, both tax and non-tax. Haryana tops this list, having the highest own tax and non-tax revenue of over 80% of the state’s total revenue. (The other revenue a state receives is through central taxes and grants). Telangana is second with over 79% of its own revenue, followed by Maharashtra 73%, Gujarat 72%, Karnataka 69%, TN 69% and Goa 68%.”In 2022-23, six states: Haryana, Maharashtra, Telangana, Karnataka, Gujarat and TN had States’ Own Tax Revenue (SOTR) of more than 60% of their total revenue receipts. Arunachal, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim & Tripura had SOTR of less than 20%,” CAG noted.The share in Union taxes and grants-in-aid and central assistance, including finance commission grants, constituted 27% and about 17%, respectively, of the states’ revenue receipts. States received a total of Rs 1,72,849 crore as finance commission grants, of which Rs 86,201 crore was Revenue Deficit Grants.The own revenue receipts of Karnataka, TN, Goa and Kerala are in the range of 60%-70%; and Andhra, Rajasthan, Punjab and Chhattisgarh between 50% to 60%. The revenue receipts of Jharkhand, Madhya Pradesh, UP, West Bengal and Uttarakhand are between 40%-50%.”The share of states’ own tax and non-tax revenue in revenue receipts of all eight northeastern states, and Bihar and Himachal Pradesh were below 40%,” CAG said. Among the various streams of states own revenue, a large collection comes from States’ Goods and Services Tax (SGST) as well as from VAT and excise duty on alcoholic drinks, petroleum products and electricity (which are outside the GST framework). Go to Source