To keep up with the festive rush, automakers have extended their working hours and production schedules.

To keep up with the festive rush, automakers have extended their working hours and production schedules.The GST rate cut and festive cheer have given a strong boost to car sales, with multiple automakers reporting their best-ever monthly performance in October 2025.

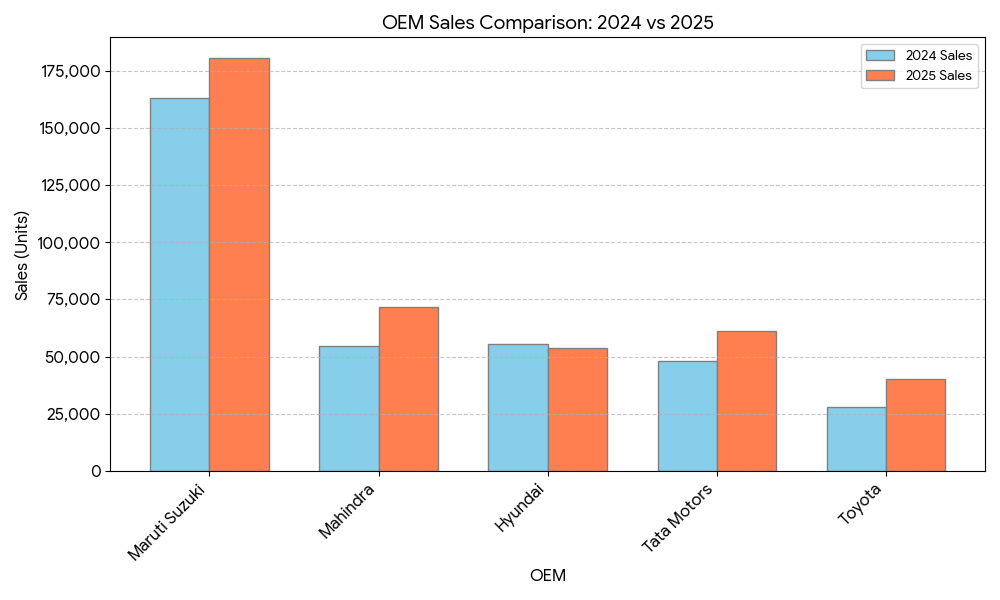

As automakers reported their October sales on Saturday, market leaders like Maruti Suzuki, Tata Motors, and Mahindra & Mahindra continued to post strong growth, while OEMs such as Nissan, Skoda, and Toyota, which have long trailed in volumes, showed renewed momentum, signalling a broad-based recovery in demand.

Maruti Suzuki continued to wear the industry crown, posting its highest-ever monthly domestic sales of 1,63,130 units in October, a 10 per cent growth over last year, reaffirming its dominance in the passenger vehicle market. Exports, however, slipped 5.6 per cent amid logistics challenges.

Maruti Suzuki’s Senior Executive Officer for Marketing and Sales, Partho Banerjee, believes the retail sales of the auto industry are anticipated to report a 10 to 11 per cent increase in October. This is driven by upbeat consumer sentiment during Dussehra, Dhanteras and Diwali.

Compact power takes the lead

Popular models such as Baleno, Swift, and Tata Nexon, which fall under the sub-4-meter segment, reported continued strong demand in the Indian market, indicating high demand for small and entry-level cars.

“The GST cut can be an opportunity for automakers to rethink their product mix and focus on a wider range of models,” indicated R C Bhargava, non-executive Chairman of Maruti Suzuki India, during the company’s post-earnings call on Friday.

This could also help small cars regain some ground from SUVs, which have dominated the market in recent years. As per a Tata Motors Passenger Vehicles spokesperson, Nexon reported an “exceptional 50 per cent YoY growth” fueled by its multiple powertrain options.

| 2024 | OEM | Rank | OEM | 2025 |

| 1,63,130 | Maruti Suzuki | 1 | Maruti Suzuki | 1,80,675 |

| 55,568 | Hyundai | 2 | Mahindra | 71,624 |

| 54,504 | Mahindra | 3 | Tata Motors | 61,134 |

| 48,131 | Tata Motors | 4 | Hyundai | 53,792 |

| 28,138 | Toyota | 5 | Toyota | 40,257 |

Leaderboard gets a rejig

Mahindra & Mahindra grabbed the second spot with a 31 per cent YoY surge as it sold 71,624 units. October also saw new editions of its popular models, including the Thar, Bolero, and Bolero Neo.

The most surprising turn came from Hyundai Motor India, which slipped from second to fourth in October’s tally over last year. The South Korean automaker sold 53,792 units, down 3 per cent YoY from 55,568 units. Yet, the enduring appeal of its Creta and Venue SUVs, which together clocked over 30,000 units, helped cushion the impact.

“We expect to build on this momentum with the upcoming launch of the all-new Hyundai Venue, which is already open for bookings,” said Tarun Garg, Whole-time Director and COO at Hyundai Motor India. “

With its refreshed design, advanced features and segment-leading safety, we’re confident it will set new standards in the compact SUV category,” Garg added.

Tata Motors Passenger Vehicles moved a step higher to third position from fourth compared to last year’s October, posting a double-digit 27 per cent YoY increase to 61,134 units. The Indian automaker saw strengthened demand for Harrier and Safari, which together contributed approximately 7,000 units.

Toyota finds its rhythm again

Toyota Kirloskar Motor India registered a 43 per cent YoY surge to 40,257 units. The sharp increase was fueled by the festive special editions of its popular models, the Urban Cruiser Hyryder Aero Edition and the Fortuner Leader Edition. According to media reports, it also plans to roll out 15 new and updated models to strengthen its market position.

“The government’s GST reforms and the overall positive festive sentiment have boosted customer confidence. This has led to a sharp rise in enquiries and bookings across our dealerships,” said Varinder Wadhwa, Vice President, Sales-Service-Used Car Business at Toyota Kirloskar Motor. Honda Cars India reported domestic sales of 6,394 units in October.

At the time of writing, JSW MG Motor India is yet to disclose their October sales numbers.

Momentum to moderate ahead?

While the October numbers have set new records, industry experts expect a correction in the coming months. “There is some pent-up demand that has played out. Obviously, 20 per cent growth cannot sustain — it will taper off. But the good thing is that we’re seeing a new wave of buyers coming in after the GST cut,” Banerjee said.

To keep up with the festive rush, automakers have extended their working hours and production schedules. Maruti Suzuki, for instance, has been operating on Sundays for four straight months to ensure timely deliveries.