Dealers and industry executives told ET that the impact will be the most pronounced on EVs that have comparable ICE versions such as Tata Punch EV, Nexon EV, Curvv EV, Hyundai Creta EV, and MG ZS EV.

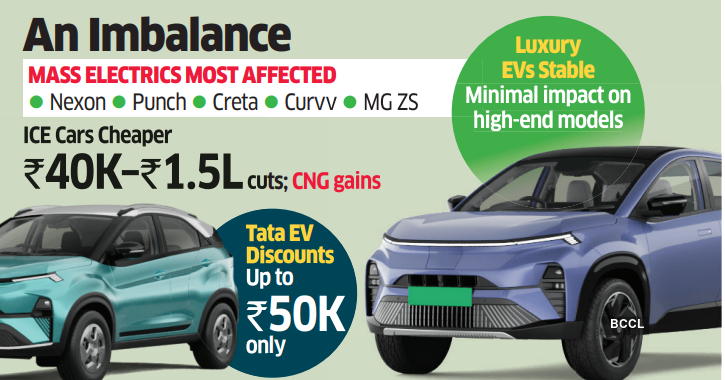

Dealers and industry executives told ET that the impact will be the most pronounced on EVs that have comparable ICE versions such as Tata Punch EV, Nexon EV, Curvv EV, Hyundai Creta EV, and MG ZS EV.Mumbai: Electric carmakers may be forced to offer more discounts or adjust pricing strategies this festive season following the goods and services tax (GST) rate rationalisation. With automakers announcing price cuts on petrol, diesel, and CNG cars to pass on the benefits of lower GST rates wth effect from September 22, the price gap of internal combustion engine (ICE) cars has widened with electric vehicles, making the latter less attractive to buyers, at least in near term. Dealers and industry executives told ET that the impact will be the most pronounced on EVs that have comparable ICE versions such as Tata Punch EV, Nexon EV, Curvv EV, Hyundai Creta EV, and MG ZS EV. These models are likely to face sharper consumer scrutiny as their ICE siblings get substantially cheaper.

For instance, post-GST, the price gap between Tata Motors’ Nexon and its EV variant has stretched to ₹5.49 lakh from ₹4.59 lakh earlier. Similarly, the difference between Punch and Punch EV has widened to ₹4.59 lakh from ₹3.79 lakh. Hyundai’s Creta ICE variant, after a ₹69,624 reduction, is now priced at ₹19.49 lakh, further improving its affordability against the electric version. The correction in ICE prices is significant, with reductions ranging between ₹40,000 and ₹1.5 lakh, depending on the model.

Compact SUVs, large diesel SUVs, and entry-level cars are among the biggest beneficiaries. The dual advantage for buyers is that not only are ICE cars now cheaper, but CNG models, already a popular alternative among cost-conscious consumers, have become more attractive. This dynamic poses a challenge for Tata Motors, the market leader in EVs with over 70% share. Its multi-powertrain strategy-with identical nameplates available across ICE, CNG, petrol, diesel and EV powertrains-makes it particularly exposed.

“So far there has been no communication by the company on festive EV offers, but we do expect some additional schemes,” said a Tata Motors dealer in western India. Currently, Tata EVs carry discounts of up to ₹50,000.

According to Vivek Srivatsa, chief commercial officer, Tata Passenger Electric Mobility, adoption drivers for EVs have shifted. “A few years ago, affordability and low running costs drove EV adoption. Prices have since fallen, but now the narrative has moved beyond just price parity to tech, range, performance and comfort,” he said. Srivatsa said EV penetration in India has risen from 0.1% six years ago to nearly 5% currently, with the country now approaching the inflection point where global markets like China, US, and Europe saw exponential growth.

At luxury end, the impact of the tax cut is expected to be muted. Santosh Iyer, MD, Mercedes-Benz India, said: “If I look at a G-Wagon, the price delta with the electric version has narrowed from about ₹1 crore to ₹90 lakh, which doesn’t change the equation. Similarly, the EQS SUV at around ₹1.33 crore remains competitive against a GLS at ₹1.60 crore.”

)