The market is preparing for the next major breakout cycle. Many investors are trying to decide which crypto to buy now before momentum returns. As older tokens slow down and show weak charts, one new DeFi project is racing toward a full Phase 6 sellout with only 5 percent of its current allocation still available. The contrast between fading performance and fresh demand is becoming clearer with each passing day.

Pepecoin (PEPE)

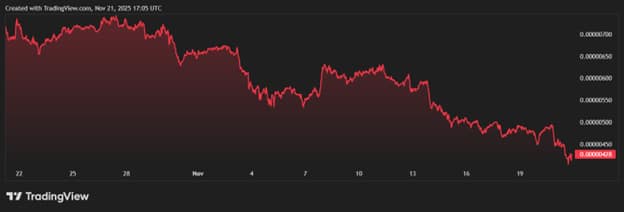

Pepecoin trades near $0.00000414 and holds a market cap close to $1.7B. The chart has been losing strength for several weeks. Resistance sits around $0.00000550 and another zone appears near $0.00000600. Pepecoin has failed to break these levels, and most attempts to climb higher have been rejected. Support is located around $0.00000400, but even this level looks unstable.

Many analysts give PEPE a weak short term prediction. With a supply of nearly 420 trillion tokens, the room for strong moves is limited. To raise even a small amount, the token needs massive inflows. Without a clear use case or new catalyst, some analysts believe it may only rise 5% to 10% at most in the near future. Investors who want high upside often search for new crypto opportunities with smaller valuations and stronger use cases, which is why interest is shifting toward new DeFi projects.

Solana (SOL)

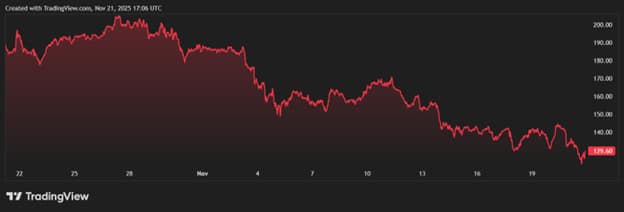

Solana is trading near $125 with a market cap of about $70B. This places it among the biggest crypto coins, but it also creates a limit on how far it can climb during the next cycle. The resistance zone between $175 and $185 continues to block upward moves. Solana has attempted to reclaim this level many times, yet each attempt has fallen short.

Support sits around $120, and analysts warn that Solana may move sideways unless a major catalyst appears. Some forecasts show possible movement toward $140, but not much beyond that in the short term. With Solana still more than 50% below its all time high, the path ahead requires significant buying power. Many long term investors believe that while Solana is a strong network, the upside from this level is limited compared to smaller early stage tokens.

Mutuum Finance (MUTM)

Mutuum Finance (MUTM) is moving fast as investors search for the best crypto to invest in before the next bull run. The project aims to build a full on chain lending system that includes liquidity pools, automated liquidations and collateral backed borrowing. The structure gives users predictable APY through mtTokens. When depositors supply assets, they receive mtTokens that grow as borrowers repay interest.

Borrowers use specific Loan to Value limits, which keeps debt positions safe. If the collateral drops too low, the system liquidates part of the position to protect the protocol. These features place Mutuum Finance in the DeFi category with a strong focus on stability.

The presale has raised about $18.85M. More than 18,100 holders have already purchased roughly 805M tokens. Out of the total 4B supply, about 45.5% is dedicated to the presale. Phase 6 is now almost sold out at $0.035, and only about 5 percent of the allocation remains. This creates a sense of urgency because the next stage will increase the price.

The Mutuum Finance team also confirmed on its official X account that V1 is planned for the Sepolia Testnet in Q4 2025. The code is finalized and is being reviewed by Halborn Security. The testnet will include mtTokens, liquidity pools, the debt token and the liquidation bot. ETH and USDT will be the first assets.

mtTokens, Buy and Distribute Model and Oracle Support

One of the reasons analysts believe MUTM could outperform PEPE and Solana in the next cycle is the token design. mtTokens increase in value through real protocol activity. This means yield comes from borrowers, not inflated emissions.

Mutuum Finance also has a buy and distribute system. MUTM purchased on the open market is redistributed to users who stake mtTokens in the safety module. This long term buying pressure helps support price growth as the protocol becomes more active.

Accurate price feeds are another part of the design. Mutuum Finance plans to use strong oracle systems with fallback sources and aggregated feeds. This improves liquidation accuracy and protects users during volatile market conditions. Many analysts view this as essential for long term DeFi stability.

With this structure, price models show a possible move toward $0.10 to $0.15 after launch as long as demand remains strong. This aligns with investor interest in the next crypto to explode as the market cycle restarts.

Stablecoin and Layer 2 Plans Boost Long Term Outlook

Mutuum Finance plans to create a USD pegged stablecoin backed by collateralized on chain assets. Borrower interest will go into the treasury, creating a long term revenue system that benefits the ecosystem. Stablecoins often attract large user bases because they provide predictable borrowing and repayment conditions.

The roadmap also includes future deployment on Layer 2 networks. Lower transaction costs allow more users to borrow, lend and interact with the protocol. This expansion is important for investors searching for the best crypto to buy now with long term potential. Layer 2 scaling and stablecoin usage often play major roles in DeFi growth.

Analysts believe these features could push MUTM toward a long term move into the $0.20 to $0.30 range by late 2026 or early 2027 once adoption continues.

Pepecoin is slowing down. Solana is facing strong resistance. Mutuum Finance is rising quickly with only a small part of Phase 6 still available. For many investors, the choice between these three tokens is becoming clearer as the next market cycle approaches.

Only about 5% of MUTM tokens remain at $0.035. Once the final allocation is taken, the next stage begins and the entry price increases. Investors who wait may lose access to the lowest price before the next major move.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

Disclaimer: This is a sponsored article. ABP Network Pvt. Ltd. and/or ABP Live do not endorse/subscribe to its contents and/or views expressed herein. Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Cryptocurrency is not a legal tender and is subject to market risks. Readers are advised to seek expert advice and read offer document(s) along with related important literature on the subject carefully before making any kind of investment whatsoever. Cryptocurrency market predictions are speculative and any investment made shall be at the sole cost and risk of the readers.