The savings festival ushered in by the GST 2.0 reform on the first day of Navratri unlocking a Rs 2 lakh crore bonanza for consumers, promises to be a game changer in India’s consumption driven growth narrative with money in middle class wallets to spend on cars, groceries, clothes, travel and housing and projections of household spending in India set to post strong growth over 2025.

Even as the great Indian consumption story rolls out with the take-off of the next-gen goods and services tax (GST) reform aimed at unleashing the consumption power of India’s expanding middle class, manufacturers across the country and sectors are estimating the footfalls that would keep the goodies flying off the shelves and showrooms.

Anticipating the rush, a slew of companies already had in place offers to entice buyers way before the commencement of GST 2.0, like Mahindra, which has passed on the full GST benefits to customers across its entire ICE SUV portfolio from September 6, just three days following the announcement of GST 2.0.

Kia India, another auto manufacturer, stepped in briskly with pre-GST special festive benefits with total savings of up to a whopping Rs 2.25 lakh on select models. Similarly, going ahead, Britannia, Bajaj Consumer, Hindustan Unilever, Colgate, and Dabur, among others, are readying to offer fast-moving consumer goods (FMCG) such as biscuits, toothpastes, soaps, shampoos, and hair oils, which have become less costlier at a lower GST slab of 5 per cent from 18 per cent.

Focus On Purchasing Power

Though the Government has, over the years, been refining India’s tax system in step with evolving needs of consumers and producers, and the 2025 exercise is a step in this direction, GST 2.0 has strongly focused on providing an impetus to consumption for reasons other than just to boost the festive environment for consumers and for industry to make a bumper harvest.

The GST revamp is an imperative to strengthen the domestic economy, a potential buffer against global geopolitical or trade-induced challenges, which are intensifying currently as India battles US tariffs and global economic uncertainties. India’s burgeoning young working class population, rising aspirations and demographic dividend, serving as a critical base for India’s place among the fastest growing emerging economies, has long needed a strong stimulus and hence, as Rumki Majumdar, Economist, Deloitte India, suggests, “The GST cuts have been targeted to boost the consumption of the poor and middle-income classes.”

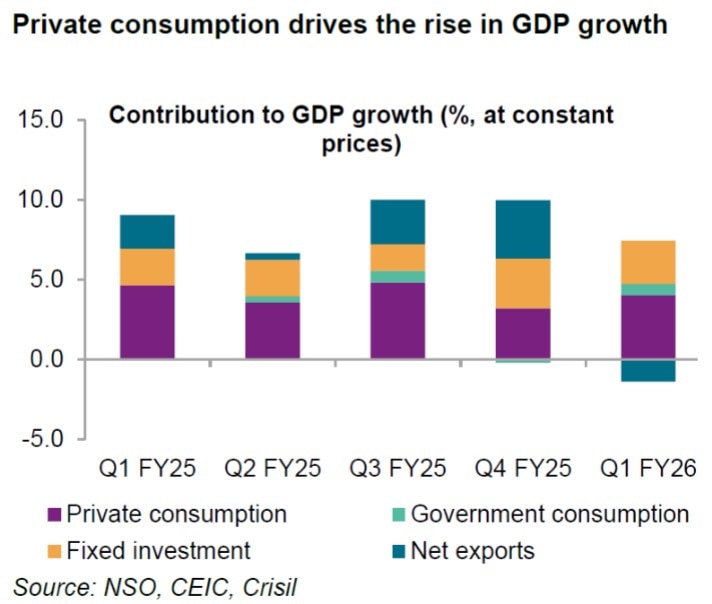

While private consumption accounts for a greater share of India’s GDP (56.5 per cent in fiscal 2025) and rural demand seems to be healthy with real agricultural and rural wages picking up, there is worry that urban demand may have been weaker. Private consumption is poised to be the primary driver of GDP growth in fiscal 2026, and thus pushing the consumerist urban classes to open up and spend has become important in line with the Government’s ambitious growth targets.

Most of these goods, Majumdar points out, are price-sensitive categories, such as essential items, small durables, personal care and entry-level automobiles and two-wheelers. “This would be more powerful in stimulating consumption than personal income tax or corporate tax cuts since the GST multiplier on elastic consumer goods is higher. This, along with tax exemptions announced earlier in the year and aggressive monetary policy, has the power to boost GDP by over 90 basis points,” says the Deloitte economist.

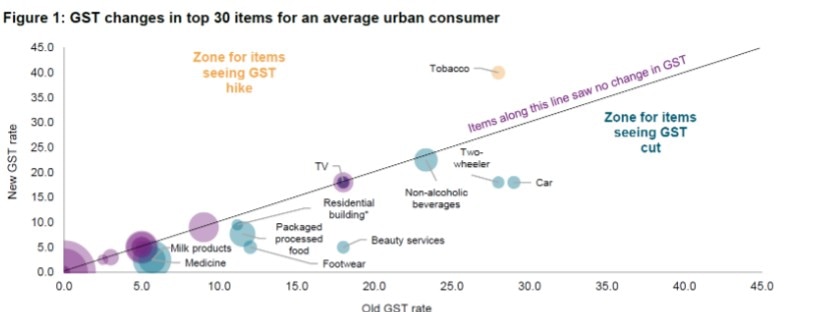

The middle class comes out on top, as in an effort to boost purchasing power and maximise the festive yield, the impact of the new GST rates has been kept broad, benefiting 11 of the top 30 consumption items and a third of an average consumer’s monthly expenditure, as per CRISIL Ratings.

These 11 items include milk products, which are taxed at above 5 per cent and have been reduced to 0 per cent, butter and ghee, which are down to 5 per cent from 12 per cent, and medicines with GST above 5 per cent are down to 0 per cent or 5 per cent.

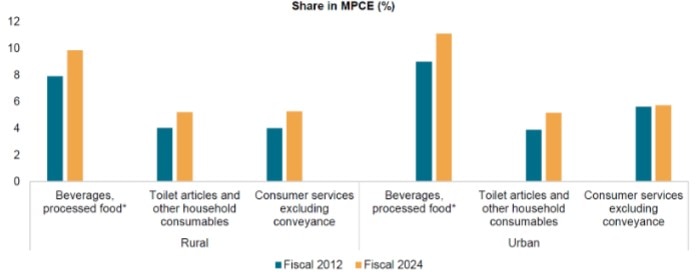

The Government has also factored in products witnessing a massive surge in demand over the past few years, like processed foods, with the GST rate reduced from 12 per cent to 0-5 per cent for several items. The tax burden has also declined for fast-growing toilet articles and personal beauty services.

Bright Outlook For Consumption Growth

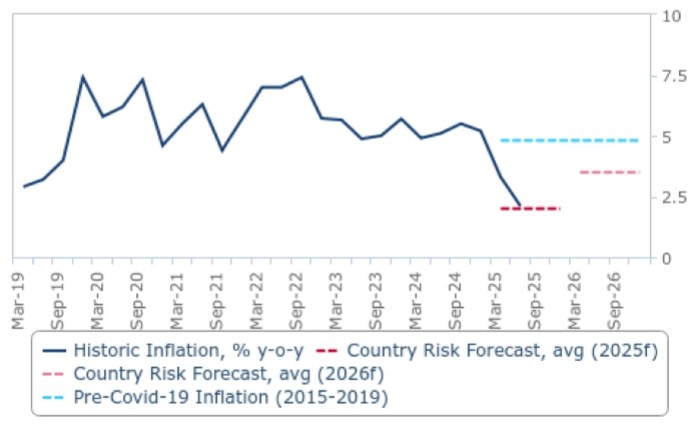

Importantly, the consumption story is also well timed to stay the course this year and the next, though the change in consumption will depend on the degree to which producers pass the rate cuts to people. For India, CRISIL expects the impact of GST cuts on consumption to play out over this fiscal and the next, since there are other macro tailwinds for consumption this fiscal, such as low inflation.

Inflation has already eased significantly to 2.4 per cent so far this fiscal (April-July average) compared to 4.6 per cent in the last fiscal. Along with the RBI’s 100-bps cut in the repo rate so far in 2025, accompanied by a cut in the cash reserve ratio (CRR) to be carried out in four tranches between September and December 2025, they make for a strong combo to support consumption in the urban segment. Transmission of rate cuts to bank lending and deposit rates is going on.

Lowering GST rates would have a deflationary effect, emphasises Majumdar, since it brings down prices of intermediate goods and inputs for production. “Producers can then pass on the benefits of lower production costs to consumers, thereby easing inflation and opening the way for further monetary policy easing,” reports the Economist.

Even if producers do not pass the benefits by reducing final product prices, Majumdar points out that it helps improve the margins of producers. This would improve investment and lead to job creation. Both of these have a strong multiplier effect on income generation. Besides, higher taxable corporate profits will help offset the decline in GST revenue due to lower GST collections, adds Majumdar.

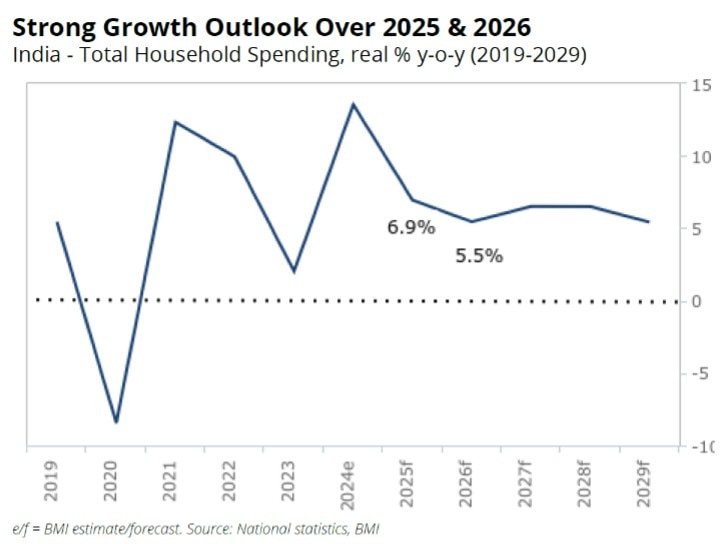

Forecasts from BMI (a unit of Fitch Solutions) also hold out a very positive outlook for consumers in India over 2025 and 2026, as the wider Indian economy recovers and growth figures return to a more stable medium-term trajectory. High-frequency data indicate that consumer confidence is improving across all areas (urban, semi-urban and rural) whilst inflation is at one of the lowest levels in eight years.

Household spending in India will post strong growth over 2025, with real household spending (measured at 2010 prices) rising 6.9 per cent y-o-y over the year as India’s wider economy growth continues and approaches a more stable medium-term (2025-2029) trajectory, supported by growing domestic demand brought about by the continuous expansion of the Indian middle class. Unemployment remains manageable in the world’s most populous economy, which will further support household spending.

Auto Sector To Benefit From Easier Credit

Support for higher household spending is also seen coming from an easier borrowing proposition with bank credit expected to grow 11–12 per cent this fiscal, and retail credit gaining the most.

“Retail credit, which comprises 33 per cent of bank loans, is expected to grow higher at 13 per cent this fiscal from 11.7 per cent last fiscal, says Krishnan Sitaraman, Chief Ratings Officer, Crisil Ratings. “The reduction in the GST should boost consumption, spurring retail credit demand. Lower interest rates, benign inflation and income tax cuts introduced in the Union Budget are spurs, too,” informs Sitaraman.

This has significant implications for the auto industry as it suggests that consumer spending on big-ticket items will strengthen, and given that companies are banking on these drivers to push up sales in the festive season. As Rajesh Menon, Director General, SIAM, points out, sales of passenger vehicles in August 2025 de-grew by 8.8 per cent, posting sales of 3.22 lakh units as compared to August of the previous year.

On the upside, three-wheelers posted their highest ever sales of August 2025 at 0.76 lakh units, with a growth of 8.3 per cent as compared to August 2024, and the two-wheeler segment grew by 7.1 per cent in August 2025, as compared to August 2024, with sales of 18.34 lakh units. “The landmark decision of the Government of India to reduce the GST rates on Vehicles will go a long way in enabling broader access to mobility and inject fresh momentum into the Indian automotive sector in the upcoming festive season,” says Menon.

The automotive industry will benefit, with GST on small cars, two-wheelers and commercial vehicles falling to 18% from 28%. A decline in product prices because of the lower GST will unlock demand among price-sensitive consumers. Currently, SUVs and luxury cars are subject to 28 per cent GST and an additional cess tax ranging from 15 per cent to 22 per cent, resulting in an effective tax of 43 per cent to 50 per cent.

The overhaul entails a 40 per cent GST for SUVs and luxury cars and the removal of cess. Despite the higher GST rate, the removal of cess will lower the overall tax burden, making such vehicles relatively more affordable for aspirational buyers.

The rollout of GST 2.0 from 22nd September is no doubt set to be a game-changer — lowering household expenses and lifting consumption – with beneficiaries hopeful of a quick passthrough of the proposed simplified two-tier structure translated into lower prices and robust consumption.

(Mukherjee is a Contributing Writer for ABP Live English. A business journalist for more than 15 years, she has written extensively on economy, policy, and international relations)