The Reserve Bank of India (RBI) on Friday announced its decision to cut the repo rate by 25 basis points (bps) by its six-member panel or its Monetary Policy Committee (MPC) after a three-day meeting which started on December 3 to conclude today.

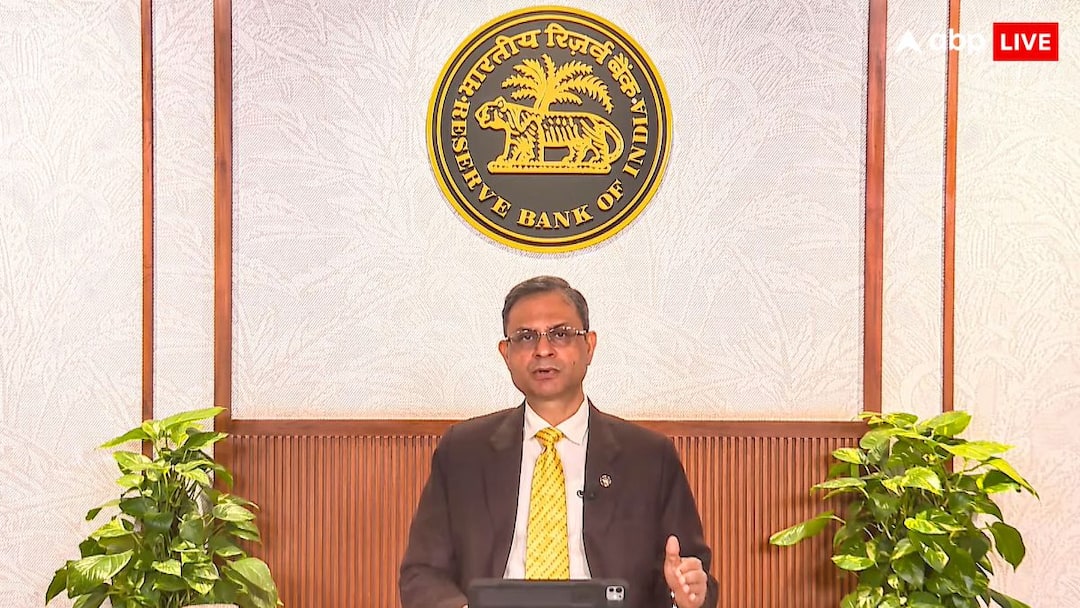

Here are some key highlights from central bank’s Governor Sanjay Malhotra’s address:

Repo Rate

- RBI MPC delivered a 25 bps rate cut, bringing the repo rate to 5.25 per cent, while maintaining a neutral stance.

- SDF revised to 5 per cent.

- MSF and Bank Rate adjusted to 5.5 per cent.

GDP Growth Forecast

- FY2025–26 growth outlook raised to 7.3 per cent, up from 6.8 per cent estimated in October.

- RBI projects 6.7 per cent growth for Q1 FY27 and 6.8 per cent for Q2 FY27.

- Services exports remain strong, merchandise exports face external headwinds, and overall growth is supported by robust domestic demand.

Inflation

- Headline inflation has fallen sharply and is expected to stay softer than earlier projections.

- FY26 inflation forecast cut to 2 per cent (a 0.6-point downward revision).

- Inflation for Q2 FY27 is projected at 4 per cent.

- Malhotra noted that Q2 FY26 inflation averaged 1.7 per cent, breaching the 2 per cent lower tolerance band, and dropped further to 0.3 per cent in October 2025, even as GDP growth hit 8.2 per cent.

- Improved food supplies, strong reservoir levels, favourable soil moisture and easing global commodity prices are aiding disinflation.

RBI’s Liquidity Push

- RBI to undertake Rs 1 lakh crore OMO purchases and a $5 billion, three-year buy–sell swap in December to bolster durable liquidity.

- Policy stance remains neutral.

RBI’s Focus On Consumers

- Surge in customer complaints has increased pendency with the RBI Ombudsman.

- Malhotra urged regulated entities to prioritise customer-centric practices and reduce grievances.

- A two-month campaign from 1 January aims to clear all Ombudsman cases pending for over a month.

Bank Credit Rises

- Bank credit has accelerated, supported by strong lending to retail and services sectors.

- Credit to MSMEs remains buoyant, and large industries have also seen improved credit offtake.

RBI KYC Drive

- RBI has intensified customer service initiatives, including Re-KYC drives, financial inclusion measures, and the “Aapki Poonji, Aapka Adhikar” campaign.

- The Citizens Charter was reviewed earlier this year to improve service standards.

- All applications for RBI services are now fully online.

- Monthly disclosures of disposal and pendency data are published on the 1st of every month, with over 99.8 per cent of applications resolved within stipulated timelines.