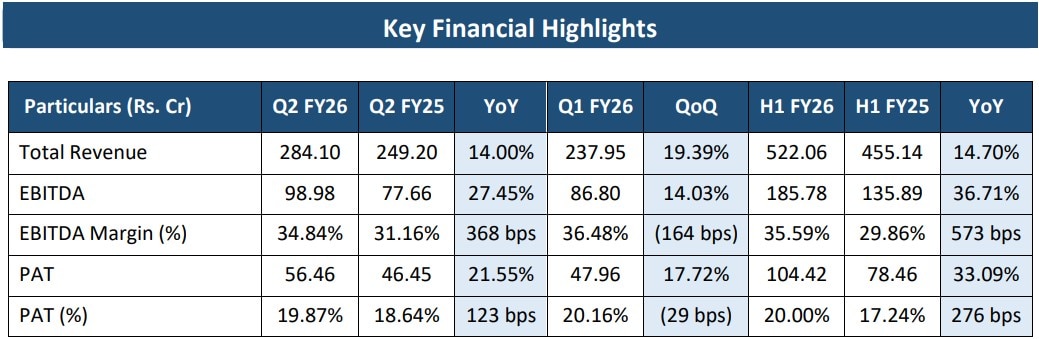

Choice International Limited, one of India’s prominent financial services firms, announced its financial results for the quarter and half-year ended September 30, 2025, showcasing consistent growth across its business verticals.

The company’s revenue mix for the period highlighted the growing dominance of its stock broking operations, contributing 59% of total revenue, followed by 26% from advisory services and 15% from its NBFC arm.

Choice reported a sharp 29% year-on-year increase in the number of Demat accounts, reaching 12.05 lakh. Client assets under the stock broking division surged 25% year-on-year to Rs. 57,600 crore, underlining strong investor confidence.

The wealth management segment also saw a remarkable upswing, with assets under management (AUM) for wealth products soaring 327% year-on-year to Rs. 4,807 crore. Meanwhile, insurance premium collections reached Rs. 66 crore, a modest 2% increase, with 68,896 policies sold during the quarter.

NBFC and Advisory Businesses Maintain Steady Growth

Choice’s non-banking financial company (NBFC) division ended the second quarter of FY26 with a total loan book of Rs. 716 crore. The retail loan portfolio alone accounted for Rs. 536 crore, underscoring the company’s focus on expanding retail credit access.

The advisory arm continued to perform well, with an order book valued at Rs. 666 crore. This segment benefited from multiple project wins across various development sectors, reflecting the company’s growing role as a strategic advisor in public and private projects.

‘Confident of Sustaining Growth Trajectory’

Commenting on the results, Kamal Poddar, Managing Director of Choice International, said, “Building on a strong start to the year, Choice sustained its growth momentum in Q2 & H1 FY26, with robust performance across businesses and an expanding national footprint. Our continued focus on operational excellence and customer-centricity remains key to our progress.”

He added that Choice Consultancy Services Private Limited (CCSPL) secured project mandates worth approximately Rs. 140 crore during the quarter, covering sectors such as housing, agriculture, MSME development, water resource management, and urban planning. “These wins reinforce CCSPL’s position as a trusted partner for high-impact development initiatives nationwide,” Poddar said.

Poddar further noted that Choice AMC Private Limited received final SEBI approval to operate as the Asset Management Company for Choice Mutual Fund, marking the company’s formal entry into the investment management space.

“With a solid first half behind us, we remain confident of sustaining our growth trajectory and creating long-term value for all stakeholders,” he concluded.