With the December 31 deadline fast approaching, taxpayers across India are racing to ensure that their Permanent Account Number (PAN) is correctly linked with Aadhaar.

With barely days left on the clock, the focus has now shifted from simply linking the two IDs to resolving mismatches that could derail the process at the last minute.

The Central Board of Direct Taxes (CBDT) has made Aadhaar-PAN linkage mandatory for individuals whose PAN was issued on the basis of an Aadhaar Enrolment ID filed before October 1, 2024. Missing the deadline could have far-reaching consequences, as an unlinked PAN will become inoperative from January 1, 2026.

Who Needs to Link PAN With Aadhaar and Who Doesn’t

The Aadhaar-PAN linking rule applies to most resident taxpayers. However, certain categories of individuals are exempt from this requirement. These include non-resident Indians (NRIs), individuals aged 80 years and above, and residents of Assam, Jammu and Kashmir, and Meghalaya.

For everyone else, linking Aadhaar and PAN before the year-end is essential to keep financial and tax-related activities running smoothly.

What Happens If Your PAN Becomes Inoperative

If Aadhaar and PAN are not linked by December 31, 2025, the PAN will be rendered inoperative from January 1, 2026. This can cause a series of disruptions that go beyond filing income tax returns.

An inoperative PAN means income tax returns cannot be filed, and refunds may be blocked. KYC checks for bank accounts, mutual funds, insurance policies and loans may fail. Tax deducted at source (TDS) and tax collected at source (TCS) may be applied at higher rates. Even everyday transactions such as SIP auto-debits, salary credits and large-value banking transactions could be impacted.

Why Aadhaar-PAN Linking Often Fails

One of the most common reasons for failed linking requests is a mismatch in personal details between Aadhaar and PAN records. Small differences, such as spelling variations in names, missing middle names, incorrect dates of birth or mismatched gender details, are enough to trigger a rejection.

In many cases, these discrepancies date back several years, when PAN cards were issued using limited documentation or handwritten forms. As a result, taxpayers are now discovering errors only when they attempt to link the two IDs.

How to Fix Mismatched Details

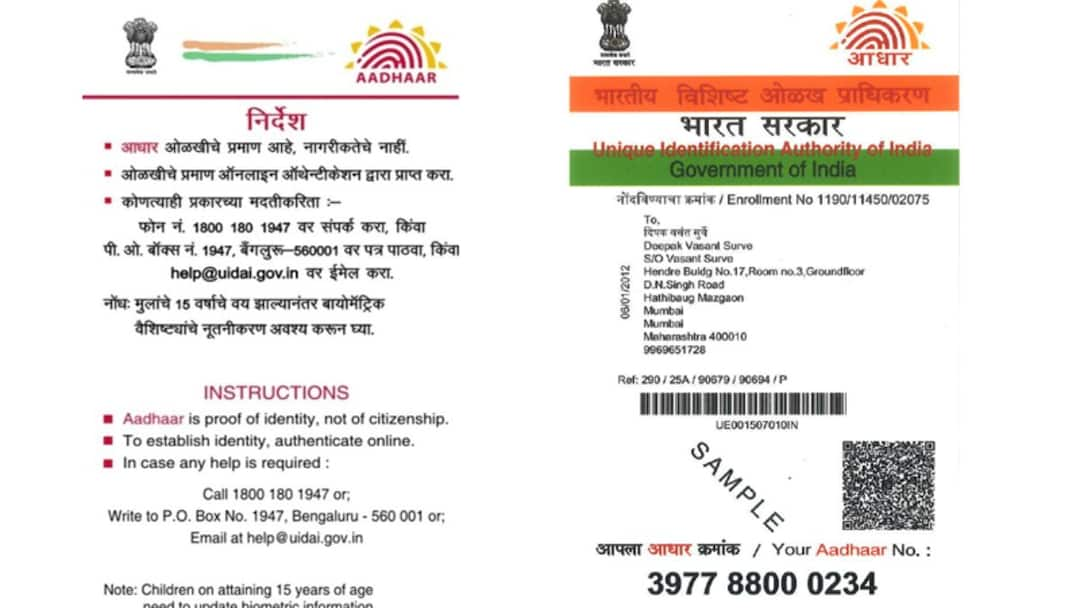

Before attempting to link Aadhaar and PAN, it is important to verify that the personal details on both documents are identical.

If Aadhaar details are incorrect, they can be updated online through the UIDAI portal. Name, date of birth and gender corrections can be requested, subject to document verification.

If the error lies in PAN details, taxpayers can file a correction request through authorised service providers Protean (NSDL) or UTIITSL. PAN corrections typically involve submitting an online application along with supporting documents.

Making these corrections first can significantly reduce the risk of a failed linking attempt.

How to Link Aadhaar and PAN: Online and Offline Options

Taxpayers can link Aadhaar and PAN through both online and offline methods.

Online method:

Visit the Income Tax e-filing portal and select the ‘Link Aadhaar’ option

Enter your PAN and Aadhaar numbers

Verify the details using the OTP sent to the mobile number linked with Aadhaar

Once submitted, users can check their linking status on the portal. The system will show whether Aadhaar is already linked, the linking request is pending, or Aadhaar is not linked.

Offline methods:

For those who prefer offline options, Aadhaar–PAN linking can also be done via SMS or by visiting PAN service centres.

SMS option: Send a message in the format UIDPAN <12-digit Aadhaar> <10-digit PAN> to 567678 or 56161

PAN service centres: Visit the nearest Protean (NSDL) or UTIITSL office with original documents and self-attested copies. A nominal fee may be charged

Penalty for Missing the Deadline

Taxpayers who fail to link Aadhaar and PAN by December 31 will have to pay a penalty of Rs 1,000 to reactivate their PAN and complete the linking process. Once the fine is paid, linking is usually completed within a few days.

With the deadline just days away, experts advise taxpayers not to wait until the last minute. Fixing mismatches can take time, especially if document verification is required.

Ensuring that Aadhaar and PAN details match, and completing the linking process well before December 31, can help taxpayers avoid penalties, prevent disruptions to financial transactions, and start 2026 with one less compliance worry.