Eleven years after the Pradhan Mantri Jan Dhan Yojana (PMJDY), a nationwide scheme to drive financial inclusion, was launched in August 2014, Jan Dhan accounts have surged to 57 crore.

Of these, rural–urban female beneficiaries account for 31.78 crore, while public sector banks (PSBs) command the largest share of deposits in Jan Dhan accounts, amounting to Rs 214,765.98 crore, as per the latest progress report of the Department of Financial Services, Ministry of Finance.

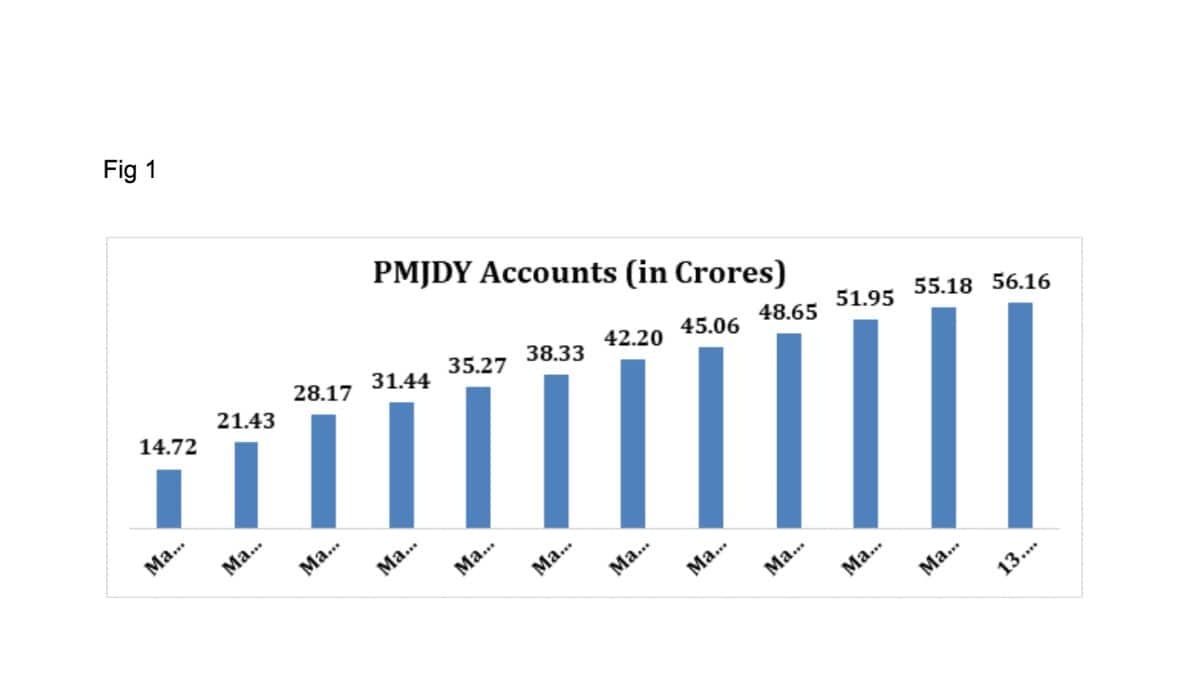

There has been a significant scale-up from 2014, when only 53 per cent of adults had formal financial access. The total balance in over 12.7 crore accounts stood at Rs 10,713 crore in March 2015, and only 14.48 crore (58.7 per cent) households had access to banking services. At the time, India’s banking network consisted of 115,082 branches and 160,055 ATMs. (See Fig 1)

Inclusive Revolution

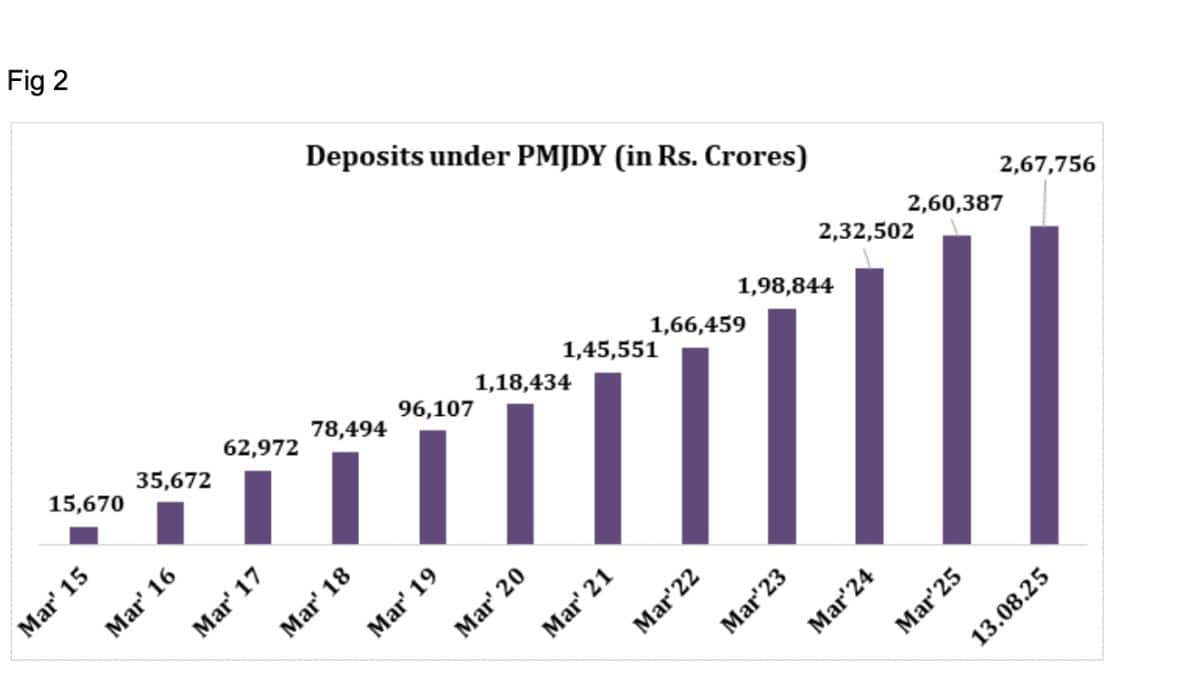

Continuing its 11-year transformative impact on India’s financial landscape, by August 2025, the programme recorded more than 56 crore Jan Dhan accounts with a total deposit balance of Rs 2.68 lakh crore as of 13 August 2025.

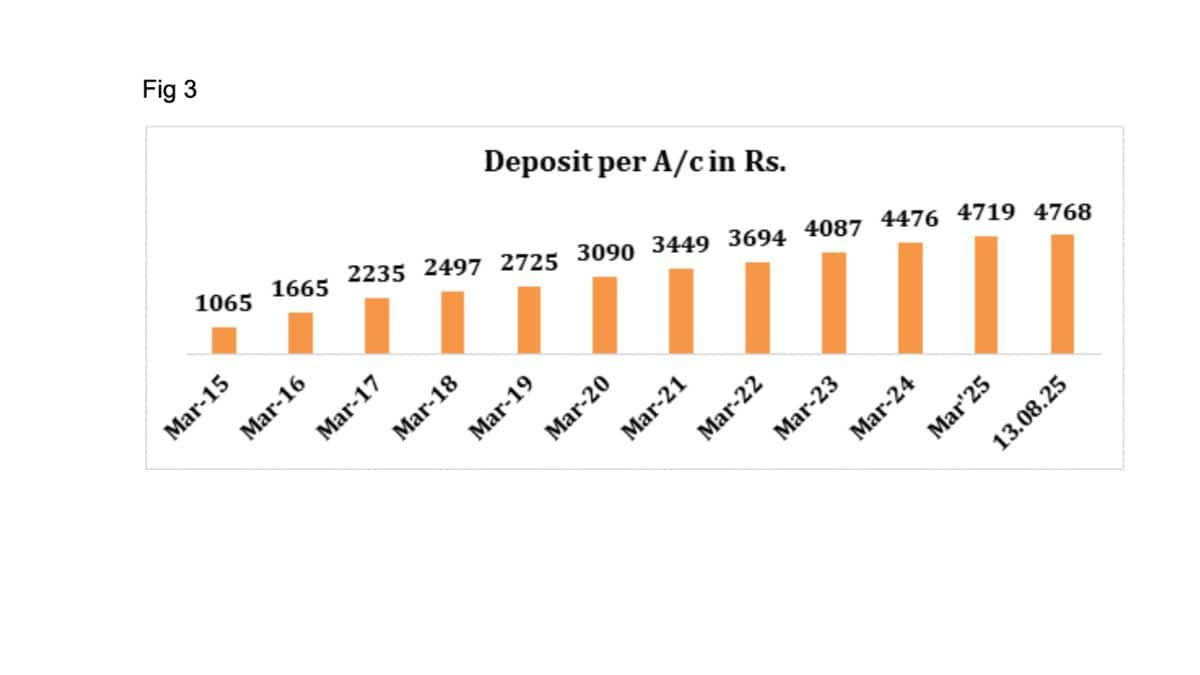

While the number of accounts has increased threefold, total deposits have grown nearly 12 times between August 2015 and August 2025. The average deposit per account now stands at Rs 4,768, a 3.7-fold rise compared to August 2015. The increase in average balances signals rising account usage and a stronger savings habit among beneficiaries.

Additionally, 67 per cent of PMJDY accounts have been opened in rural or semi-urban areas, 56 per cent are owned by women, and millions of underprivileged individuals in remote areas have entered the formal financial ecosystem.

According to the report dated November 12, 2025, PSBs continue to anchor the Jan Dhan expansion with 34.28 crore beneficiaries in rural/semi-urban branches and 9.85 crore beneficiaries in urban/metro branches. Regional rural banks (RRBs) cater to 9.31 crore beneficiaries in their rural/semi-urban branches, 1.45 crore in their urban/metro branches, and 6.27 crore women account holders, with deposits totalling Rs 50,985.70 crore.

Private sector banks still have considerable room to expand, servicing 0.80 crore beneficiaries in rural/semi-urban branches, 1.11 crore in urban/metro branches, and 1.07 crore women account holders with deposits of Rs 8,257.86 crore. (See Fig 2)

RuPay Dividends

Over the years, PMJDY has ensured that every unbanked adult can access a basic bank account with zero balance requirements and no maintenance charges. The initiative has been substantially strengthened, with each account receiving a free RuPay debit card offering accident insurance cover of Rs 2 lakh, encouraging digital payments and financial security. Account holders are eligible for an overdraft facility of up to Rs 10,000, offering a crucial safety net during emergencies.

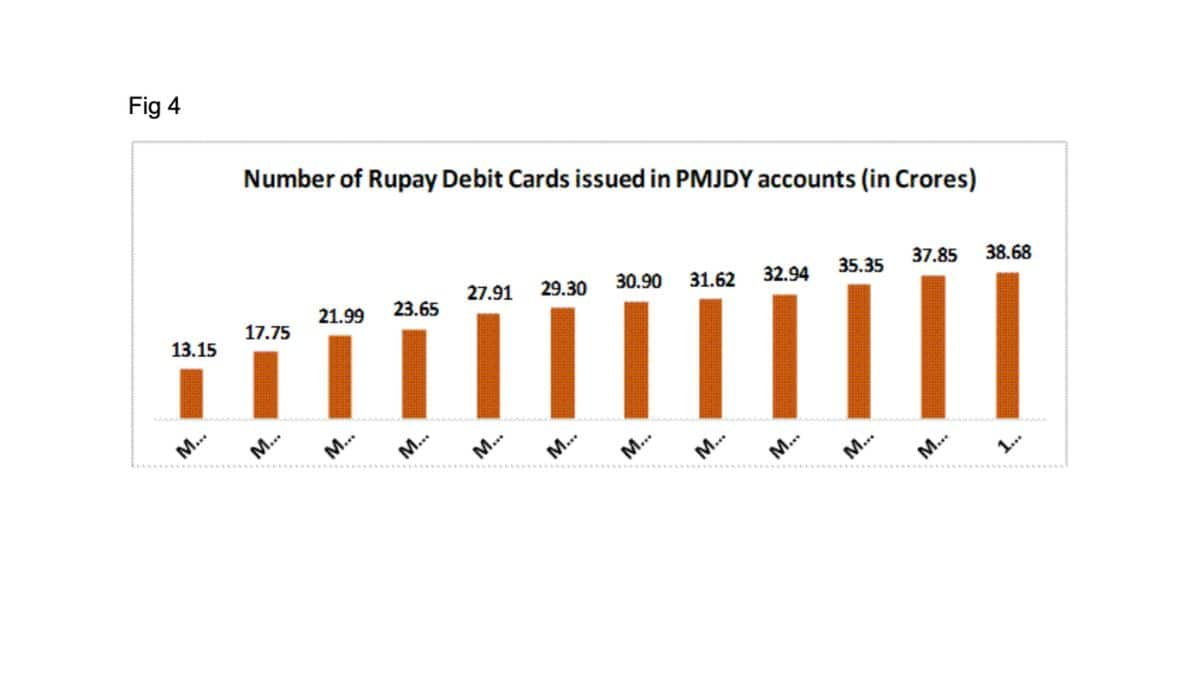

More than 38.68 crore RuPay debit cards have been issued under PMJDY. With the installation of 1.11 crore mobile PoS machines and the rollout of mobile-based payment systems such as UPI, digital transaction volumes have soared, from 2,338 crore in FY 2018–19 to 22,198 crore in FY 2024–25. (See Fig 4)

UPI transactions alone have grown from 535 crore in FY 2018–19 to 18,587 crore in FY 2024–25. RuPay card transactions at PoS and e-commerce platforms have also risen from 67 crore in FY 2017–18 to 93.85 crore in FY 2024–25. (See Fig 3)

This massive expansion has translated into savings, credit access and financial security for millions previously excluded from formal finance. PSBs have deepened their traditional role as drivers of financial inclusion while adapting to India’s rapid digital banking transformation, facilitating direct benefit transfers (DBTs) and expanding UPI usage across semi-urban and rural regions.

“With increased openness, innovation and technology adoption, the country’s digital payments ecosystem is rapidly maturing and positioning itself to drive the Viksit Bharat vision. UPI now accounts for nearly 80 per cent of digital payments, indicating affordability and wider reach,” observed M Nagaraju, Secretary, Department of Financial Services (DFS), at the CII Financing Summit 2025.

The Jan-Dhan-Aadhaar-Mobile (JAM) trinity continues to serve as a strong backbone for DBT delivery, providing credit access, social security, savings and investment opportunities. This integrated architecture has helped strengthen India’s banking ecosystem to reach even the poorest citizens, ensuring transparent, efficient and corruption-free delivery of government subsidies. In FY 2024–25, Rs 6.9 lakh crore was credited to bank accounts under various DBT schemes.

New Initiatives

The Government has intensified its financial inclusion agenda, using technology and alternative data sources to launch several new initiatives. A Grameen Credit Score is being introduced to support credit appraisal for self-help groups, rural households, farmers and marginalised communities. The aim is to enhance credit decision-making quality and broaden formal credit access in rural regions.

The MSME New Digital Credit Assessment Framework by PSBs integrates data from income tax returns, GST filings and utility payments to make credit evaluation faster and more precise. The Jan Samarth Portal, a unified digital credit platform, links borrowers to eligible government schemes, increasing transparency and reducing processing times.

Nationwide camps (the first round held from July to September 2025) are being organised to update KYC records, open new accounts and promote micro-insurance and pension schemes. Banks are also working to reduce PMJDY dormancy by actively engaging account holders. Since July, 1,77,102 camps have been conducted across districts to support enrolments and financial literacy.

Nagaraju also highlighted fintech’s role in advancing inclusion, saying fintech innovations can strengthen fraud prevention and cybersecurity while expanding reach to underserved regions.

Rural Gaps Curb Success

Despite major gains, deep bottlenecks remain. Shaji KV, Chairman of NABARD, believes progress will accelerate only when rural populations become active stakeholders in the nation’s economic journey. Rising aspirations in rural communities must be met through more efficient financial operations and innovation.

“There is need for disruptive innovation in the sector and focused efforts to address challenges such as interoperability and KYC norms with economic activities,” said Shaji.

A key reform underway is the integration of all regional rural banks into a common digital infrastructure. NABARD is also digitising agricultural value chains to bridge the rural–urban divide.

Sameer Nigam, Co-Chair of the CII National Committee on Fintech and Founder & CEO of PhonePe, stressed the need for technology that responds better to customer behaviour, from shifting to text-based interfaces to designing fintech products that “matchmake” customers with the most suitable financial services.

As PMJDY enters its 12th year, it stands as a symbol of inclusive growth, digital innovation and economic empowerment, reaffirming India’s commitment to ensuring that no citizen is left behind in the journey toward financial independence.