As Q1 2026 approaches, analysts are favoring cryptocurrencies with real-world utility over traditional top-tier coins like ETH and SOL. Investors are looking for early adoption and higher ROI potential, and utility-driven DeFi platforms are emerging as the prime choice. Among these, Mutuum Finance (MUTM) stands out. The platform will combine dual lending protocols, staking rewards, and buyback mechanics, creating multiple ways for investors to earn. Crypto charts indicate rising interest in utility tokens, and Mutuum Finance (MUTM) is becoming one of the top crypto options to watch.

Ethereum (ETH)

A potential spot Ethereum (ETH) ETF approval could bring a wave of institutional investment into the network, supported by growing interest from major firms such as State Street and PayPal, which continue to expand their involvement with Ethereum. At the time, ETHUSD was trading at $3,959, reflecting a 1.78% daily gain and a 17% increase in 2025 overall, despite experiencing a 6% dip in October. From a technical perspective, Ethereum is showing a bullish divergence, with lower price lows paired with higher RSI lows, while also forming an ascending triangle pattern—a setup that suggests a potential upward breakout if key resistance levels are surpassed.

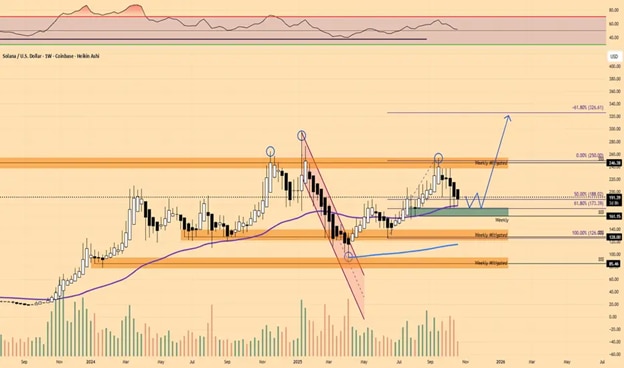

Solana (SOL)

Hong Kong has approved the first Solana (SOL) spot ETF, set to launch on October 27, managed by ChinaAMC. The ETF will trade in HKD, USD, and RMB, and will directly hold SOL tokens, marking a major step for institutional access to Solana. In another development, Fidelity Digital Assets has added Solana (SOLUSD) to its platform, enabling users to buy, sell, and trade SOL alongside Bitcoin, Ethereum, and Litecoin. Meanwhile, Solmate Infrastructure shares jumped 48% to $12.37 in premarket trading after announcing plans for a major acquisition targeting firms with large Solana holdings, further underscoring growing corporate confidence in the Solana ecosystem.

Presale Momentum and Early Investor Advantage

Mutuum Finance (MUTM) will have a total supply of 4 billion tokens. Across all presale phases, the project is expected to raise approximately $18 million. Phase 6 is currently priced at $0.035 per token, with 75% of the 170 million allocated tokens already sold. Over 17,500 holders are participating overall, and the next phase will open at $0.040, a 15% increase that presents a strong incentive for early buyers.

An investor swapped $20,000 in BTC during Phase 2 and purchased Mutuum Finance (MUTM) at $0.015 per token. At the current Phase 6 price of $0.035, that holding will be valued at around $47K, representing a 133% gain. The pace with which the project is heading and hitting the milestones it is inevitable that there will be a day it will hit exchanges, the price projection of $0.06 would increase that same holding to roughly $80,000, delivering a fourfold return. These figures demonstrate why Mutuum Finance (MUTM) is drawing attention as a sub-$0.05 DeFi token with short-term and long-term upside.

Mutuum Finance (MUTM) will provide real-world utility through Peer-to-Contract (P2C) and Peer-to-Peer (P2P) lending. A P2C investor depositing $10,000 ETH will receive mtETH 1:1 and earn 12–15% APY, generating $1,500 in passive income per year. In P2P lending, a user can post $500 DOGE and borrow up to 60%, gaining liquidity without selling while keeping risk isolated. These features allow early adopters to benefit immediately from platform activity.

Key Growth Drivers and Future Potential

Mutuum Finance (MUTM) will grow through its dual lending models, designed to attract both conservative and high-risk investors. The P2C model will rely on secure collateral and predictable interest, encouraging active utilization of the lending pool. As more users deposit assets, interest rates will adjust dynamically, creating a cycle of continued activity and stronger liquidity. This mechanism ensures that the platform maintains steady growth and consistent earning opportunities for users.

Mutuum Finance (MUTM) announced on its official X account that the V1 version of its protocol is set to launch on the Sepolia Testnet by Q4 2025. This first version will include key features such as a liquidity pool, mtToken, debt token, and a liquidator bot to maintain smooth and secure platform operations. At the start, users will be able to lend, borrow, and use ETH or USDT as collateral.

This early testnet launch gives users a chance to explore the platform’s core functions before the full release. Allowing hands-on testing helps build trust and excitement, which could attract more users and positively impact the token’s value.

Revenue generated by the platform will support the buy-and-distribute mechanics. Profits will be used to purchase MUTM tokens from the open market and distribute them to mtToken stakers. This will provide continuous price support and incentivize long-term participation. Stakers will not only benefit from lending and borrowing activity but also from ongoing rewards, creating multiple layers of value for users.

The platform launch will include live lending modules from day one, providing immediate utility. This early activity will attract new participants and increase adoption naturally. Future exchange listings will enhance visibility and liquidity, providing further support for the token price. By combining utility, staking rewards, and market incentives, Mutuum Finance (MUTM) will create a strong growth ecosystem that is both functional and profitable for users.

LTV Ratios & Community Building

Mutuum Finance (MUTM) will also maintain risk and liquidity balance. Loan-to-value ratios will reach 75% for ETH and stablecoins, while volatile tokens will allow 35–75%. Liquidation thresholds will adjust to 75–80% depending on volatility, and reserve factors will range from 10–55% based on risk. This ensures solvency, protects users’ funds, and allows the protocol to handle market swings effectively.

Community engagement will drive further growth. A $100,000 giveaway will reward 10 winners with $10,000 each in MUTM, while the 24-hour leaderboard will give a $500 daily bonus to the top performer. These incentives will promote active participation and enhance the overall platform ecosystem.

Final Words

With Phase 6 already 75% sold out and Phase 7 opening at $0.040 (+15%), Mutuum Finance (MUTM) will combine early presale adoption, dual lending utility, staking, and buyback mechanics. Missing this phase means you will be getting the tokens with comparatively expensive pricing. Experts are matching this presale with the known coins and some of them say that investing in MUTUM now is like choosing ETH in 2020. Finally, analysts expect this combination to outperform ETH and SOL in Q1 2026. Investors should lock in Mutuum Finance (MUTM) at presale pricing before the next phase surge to secure early-stage adoption and exponential growth.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

Disclaimer: This is a sponsored article. ABP Network Pvt. Ltd. and/or ABP Live do not endorse/subscribe to its contents and/or views expressed herein. Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Cryptocurrency is not a legal tender and is subject to market risks. Readers are advised to seek expert advice and read offer document(s) along with related important literature on the subject carefully before making any kind of investment whatsoever. Cryptocurrency market predictions are speculative and any investment made shall be at the sole cost and risk of the readers.