China’s manufacturing activity contracted for a sixth consecutive month in September, with PMI data showing persistent weakness amid muted domestic demand and uncertainty over a US trade deal

China’s manufacturing activity shrank for a sixth month in September, an official survey showed on Tuesday, suggesting producers are waiting for further stimulus to boost domestic demand, as well as clarity on a US trade deal.

The official purchasing managers’ index (PMI) rose to 49.8 in September versus 49.4 in August, below the 50-mark separating growth from contraction, but beating a median forecast of 49.6 in a Reuters poll.

Policy measures and persistent challenges weigh on recovery

The non-manufacturing PMI, which includes services and construction, fell to 50.0 from 50.3 in August, according to the National Bureau of Statistics (NBS).

The NBS composite PMI of manufacturing and non-manufacturing came in at 50.6 in September, compared with 50.5 in August.

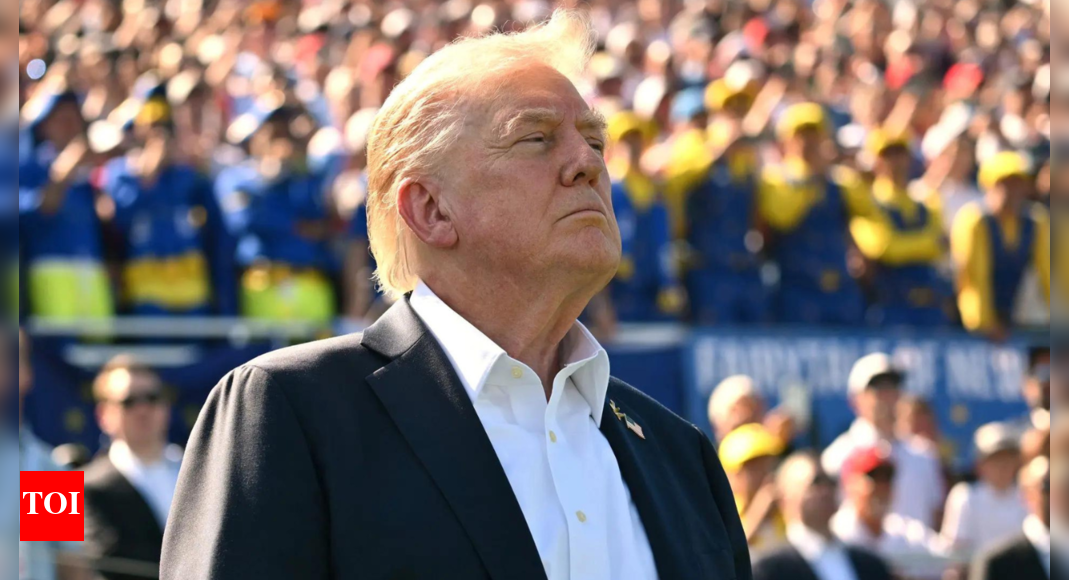

The prolonged slump in headline factory activity underlines the twin pressures on China’s economy: domestic demand has failed to mount a durable recovery in the years since the pandemic while US President Donald Trump’s tariffs have squeezed Chinese factories as well as overseas firms that buy components.

Policymakers rolled out a series of consumer loan subsidies in mid-August, a decision vindicated by separate factory output and retail sales data, opens new tab for the month, which saw their weakest growth in 12 months.

Pan Gongsheng, opens new tab, the governor of the People’s Bank of China, said last week a range of monetary policy tools to support the economy remained available, but refrained from following the US Federal Reserve with a rate cut, as some economists speculated the central bank might.

Despite signs the $19 trillion economy is losing momentum, authorities appear in no hurry to roll out major stimulus measures, given resilient exports and a stock market rally, market watchers say.

China’s exports to regional rival India hit an all-time high in August, customs data showed, while shipments to Africa and Southeast Asia are on track for annual records.

But no other country comes close to the consumption power of the US, where Chinese producers sell more than $400 billion worth of goods annually, accounting for around 14% of total exports.

Chinese leader Xi Jinping phoned Trump on September 19 for the first time in three months, and while the call appeared to ease tensions, it remains unclear whether it yielded the expected agreement on popular short-video app TikTok, which analysts see as key to a broader trade deal.

Disagreements on technical details appeared to be weighing on negotiations, as Chinese and US trade officials met again, opens new tab last Thursday to revisit issues discussed in talks before this month’s Madrid summit, where a framework TikTok deal was reached.

The private sector RatingDog manufacturing PMI came in at 51.2, up from 50.5 a month prior.

(Except for the headline, this story has not been edited by Firstpost staff.)

End of Article

)

)