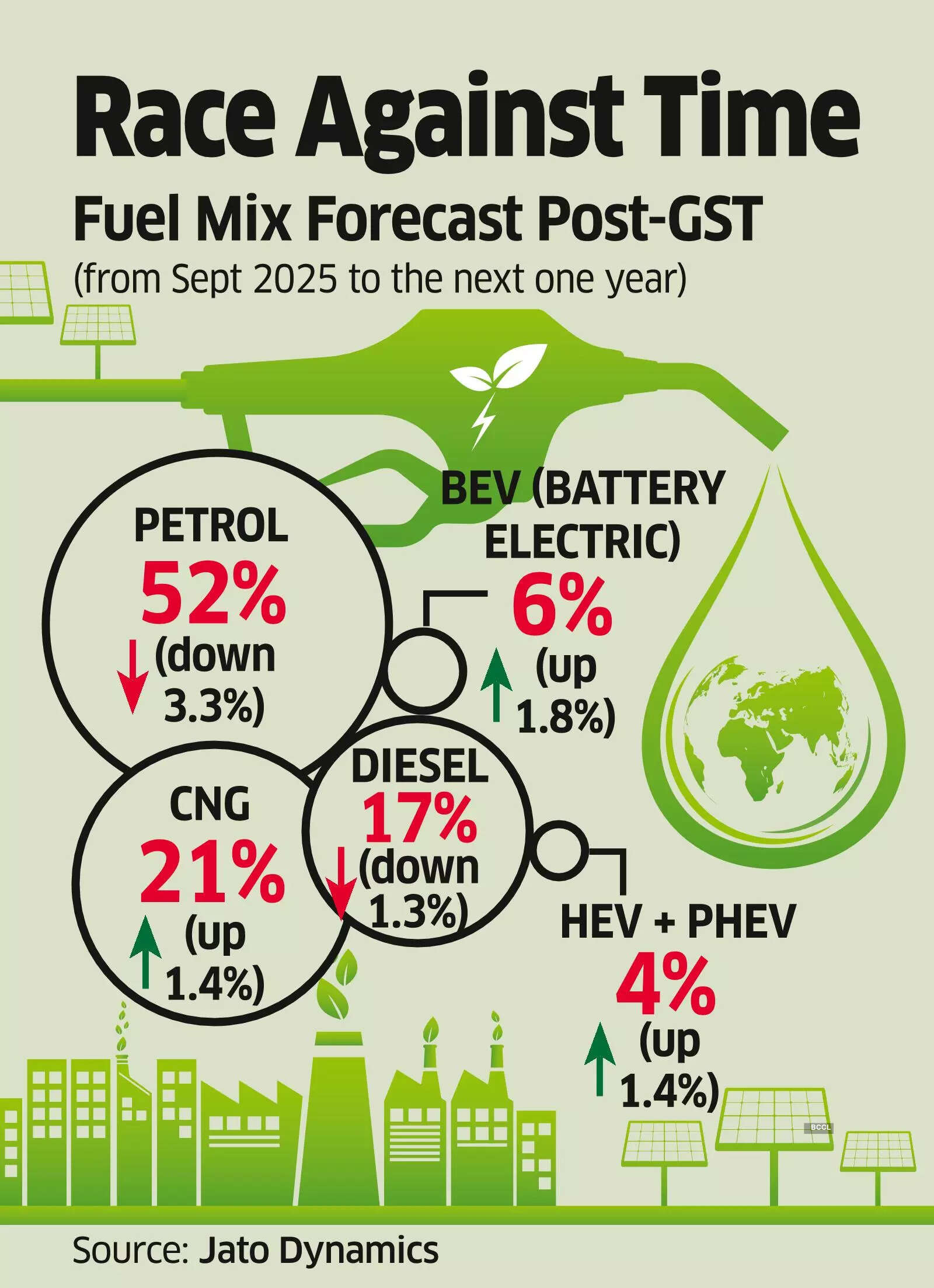

The share of petrol, diesel, and CNG stood at 55.3%, 18.25%, and 19.61% respectively during January-July 2025. EVs and hybrids (including plug-ins) had a 6.25% share, according to Jato Dynamics data.

The share of petrol, diesel, and CNG stood at 55.3%, 18.25%, and 19.61% respectively during January-July 2025. EVs and hybrids (including plug-ins) had a 6.25% share, according to Jato Dynamics data.Indian automakers are shifting gears rapidly to adapt to a multi-fuel future and hedge their bets in an increasingly competitive market.

Fuel policy reforms, changes in transportation economics, and rising inventory pressures are moving companies to devise varied strategies across fuel offerings for their product portfolios.

From petrol-ethanol blends to compressed natural gas (CNG), hybrids, and electric vehicles (EVs), companies in the world’s third-largest automobile market are hedging their bets across a range of technologies, waiting to see which would win over the consumer.

The share of petrol, diesel, and CNG stood at 55.3%, 18.25%, and 19.61% respectively during January-July 2025. EVs and hybrids (including plug-ins) had a 6.25% share, according to Jato Dynamics data.

The roll out of reduced goods and services tax (GST) rate on vehicles is expected to accelerate this shift. The share of petrol cars to drop to 52% and that of diesel to 17% in the 12 months from September 22 when the revised GST rates will be rolled out, according to Jato Dynamics. However, the share of CNG vehicles is forecast to rise to 21%, while EVs and hybrids (including plug-ins) would touch 10%.

Despite the churn, most carmakers are reluctant to comment publicly on government policies and their future plans.

These companies are optimising production and supply chains while navigating rising inventory pressures across the ecosystem, from manufacturers to dealers.

Multifuel lineups take centre stage

Recent launches underscore this pivot. Maruti Suzuki’s latest model, Victoris SUV, for instance, comes in petrol, strong hybrid, and CNG variants, giving customers flexibility as fuel dynamics evolve.

Tata Motors, a longtime champion of multi-powertrain strategies, is leading the charge. “As a pioneer of the multi-powertrain approach in India, Tata Motors currently offers a well-balanced portfolio across petrol, diesel, CNG, and EV options,” said a company spokesperson.

Tata expects CNG vehicles and EVs to continue posting robust growth, supported by government direction and rising demand for sustainable mobility. Its CNG offerings Punch, Altroz, Tiago, Tigor, and Nexon have benefited from the innovative twin-cylinder iCNG technology, which preserves boot space.

CNG vehicles comprised 27% of Tata’s portfolio sales so far this fiscal year. This translates to a 17% market share in the CNG passenger vehicle segment, according to data from the government’s Vahan portal.

The GST rate changes have also overhauled the relative tax treatment of varied fuel types. “EVs now find themselves in a situation where the differential with ICE vehicles has reduced,” said Naveen Soni, former president of Lexus India. “To attract rational buyers, EV makers may have to pass on battery cost savings through price corrections.”

EVs have gained from early adopters and new launches but now the segment faces the challenge of swaying the next layer of sceptical buyers.

Hybrids, once buoyed by a 5% GST advantage over ICE vehicles, have since lost that edge. Manufacturers must instead persuade customers through benefits like fuel efficiency and the convenience of no external charging, said Ravi Bhatia, president, Jato Dynamics.

CNG, meanwhile, remains the most preferred alternative fuel, aided by design innovations like underfloor tanks, and a fast-growing network of over 7,600 filling stations.

Fuel efficiency drives decisions

For many consumers, fuel efficiency and the resulting cost per kilometre remains the ultimate deciding factor. CNG costs Rs 2–3/km, half that of petrol. Hybrids offer Rs 4–5/km without needing charging infrastructure. EVs, especially with falling battery prices and FAME-III incentives, are gaining ground, but affordability is still key.

The ethanol push, particularly E20 blending, presents a mixed picture. While government tests claim only a 1–3% mileage drop in new E20-ready vehicles, real-world studies suggest 6–8% drops in older cars, affecting per-km costs and purchase decisions.

“The mileage drop is real, and customers are noticing,” said Bhatia. “It’s pushing them to explore CNG, hybrids, and even EVs sooner than expected.”

Automakers are reworking their supply chains and production plans to adapt to this diversified fuel mix. Inventory management is becoming complex, with an estimated 6 lakh vehicles worth Rs 72000 crore at end of August, amid the changing fuel preferences.

Maruti Suzuki, India’s CNG market leader, reported 22% festive season growth in the segment. Meanwhile, Tata and Maruti are pouring investments into multi-fuel platforms. Tata’s ₹9,000 crore capex plan spans battery localisation and R&D into alternative fuels.

Still, there are headwinds of crude oil price volatility, ethanol supply constraints, and limited charging infrastructure. These factors may slow the momentum for certain technologies even as the overall direction remains clear.

“Total cost of ownership is now the battleground,” said a senior executive of a Delhi-based car maker. “The winners will be those who can deliver affordable solutions across fuels.”

As the lines between powertrains blur, and consumer preferences evolve, the game is no longer about a single technology, but by how well companies adjust their strategies to address them, say automotive experts.