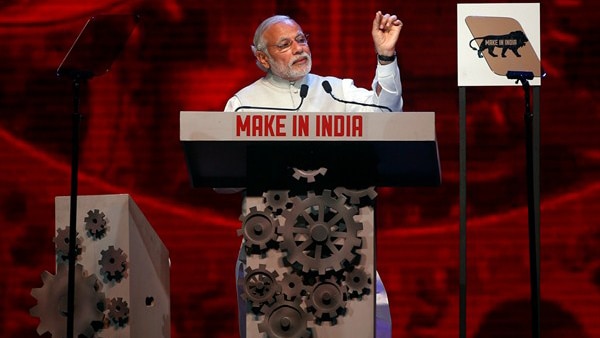

India’s Make in India initiative, launched in 2014, had ambitious goals: to increase the contribution of manufacturing to 25% of GDP by 2022, generate 100 million jobs in manufacturing, and spur innovation in all industries. Yet, by 2023–24, the contribution of manufacturing to GDP was down from 16.7% (2013–14) to just 15.9%. Semiconductor chip imports surged 18.5% in fiscal 2023–24, reaching ₹1.71 lakh crore, underscoring continued reliance on foreign supply. However, logistics costs, long a drag on competitiveness, are estimated at 7.8–8.9% of GDP in 2021–22, despite industry-wide concerns that they hover between 13–14%. Yet, while the achievements are visible, critical gaps remain, highlighting the road still ahead.

Information Technology & Electronics: Scale without Depth

India’s IT services sector has thrived under Make in India, turning the country into a global software powerhouse. Electronics manufacturing, too, has gained momentum, as India is now assembling smartphones at scale, making it the world’s second-largest mobile manufacturer.

Gap: However, the semiconductor ecosystem is still evolving. Despite the policy push, fabs are yet to take off, leaving India dependent on imports for chips, the backbone of all modern electronics. Similarly, while India exports IT services globally, core product innovation and IP creation remain limited. Without building a strong R&D culture, India risks being a service provider rather than a product leader.

Defence & Homeland Security: Progress vs. Certification Bottlenecks

India has seen a surge in domestic defence production, with indigenous aircraft, drones, and advanced security systems taking shape. The country has become the world’s fourth-largest defence spender, and exports have touched record highs in recent years.

Gaps: But in Homeland Security and Aviation, India still lacks certified facilities and laboratories to test certain Homeland Security equipment used in Aviation security. For advanced systems like Computed Tomography machines for baggage scanning and mmWave scanners, Indian manufacturers still rely on approvals from the US & European agencies, as mandated by India’s Bureau of Civil Aviation Security. This not only increases costs and delays but also undermines the very idea of self-reliance. Another gap is the reliance on legacy infrastructure. A majority of India’s defence and aviation hardware remains reliant on older systems. Despite technological advancements, the sluggish rate of upgrading important infrastructure risks not just efficiency but human lives, too. Until India can build its own accredited labs, native innovation will never be able to keep pace on level terms, even domestically.

Logistics & Infrastructure: Strong Push, Slow Execution

The National Logistics Policy, PM Gati Shakti plan, and freight corridors are the major gains under Make in India. Warehousing, cold storage, and last-mile connectivity have been enhanced, facilitating manufacturing and exports.

But still, India’s logistics cost remains at 13-14% of GDP, compared to 8-9% in developed economies. Multimodal transport inefficiencies, old port infrastructure, and supply chain fragmentation continue to damage global competitiveness. Indian products will lose their competitive edge in global markets unless logistics costs are significantly reduced.

Retail & Consumer Goods: From Import-Heavy to Indian-Made

Make in India has greatly increased home appliances, fashion, and FMCG production. Indian brands are now competing with, and even beating, international names in the eyes of consumers today. D2C startups in the personal care, lifestyle, and kitchen appliances segments are a testament to an increasing domestic manufacturing presence.

Gap: However, a majority of consumer industries remain import-dependent for raw materials and key components. For instance, though air coolers, mixers, and electronics are being assembled in India, motors, sensors, and chips tend to originate from outside the country. To transition from “Assembled in India” to “Truly Made in India,” the depth of the supply chain and processing of raw materials requires immediate attention.

The Make in India spirit has taken hold, but the journey is much more than halfway. The next phase must go beyond numbers and focus on depth of capability, speed of adoption, and global competitiveness. Only this enables India to move from being the world’s service assembly workshop and the factory for services to an actual manufacturing and innovation hub.