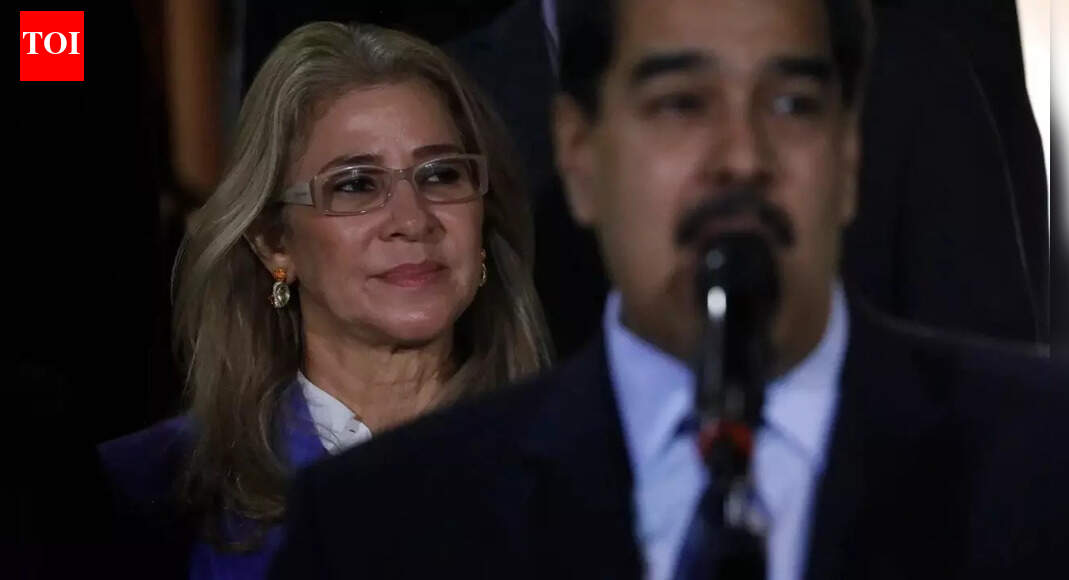

Global oil markets are closely monitoring developments in Venezuela after the United States said it had “captured” President Nicolás Maduro during a military operation, triggering concerns over potential disruptions to crude supplies from the oil-rich nation.

Despite the political shock, international crude prices have remained relatively steady, hovering near the $60-a-barrel mark. Venezuela holds some of the world’s largest proven oil reserves, but its influence on global prices has been muted in recent years due to long-standing US sanctions that have restricted exports.

Trump Signals Strong US Role in Venezuela’s Oil Sector

US President Donald Trump said Washington would be “very strongly involved” in Venezuela’s oil industry following the operation. Speaking to Fox News, Trump said American oil companies would play a major role in the country’s energy sector, describing them as “the biggest and greatest in the world”.

PDVSA Says Oil Production, Refining Unaffected

Venezuela’s state-run oil company PDVSA said its production and refining activities were operating normally. According to a Reuters report, the company stated that its key oil facilities had not been damaged during the US strikes.

Reuters reported that the port of La Guaira, near the capital Caracas, suffered serious damage. However, the port is not used for oil exports.

Sanctions, Blockades and Export Disruptions

In December, Trump announced a blockade on oil tankers entering or leaving Venezuela. The US later seized two cargoes of Venezuelan crude, prompting many ship owners to avoid Venezuelan waters.

These moves led to a sharp increase in oil inventories held by PDVSA, forcing the company to slow deliveries at ports and store crude on tankers to maintain production and refining operations.

Venezuela’s Oil Output: Collapse and Partial Recovery

Venezuela’s oil production fell to record lows in 2020, dropping to about 192 million barrels for the year, according to data from the International Energy Agency and Trading Economics.

Output began to recover in 2021, rising to around 550,000–630,000 barrels per day. Production continued to improve in 2022 and 2023, aided by Iranian diluent swaps and the partial easing of sanctions under US General License 44. Annual output rose to about 217 million barrels in 2022 and 264 million barrels in 2023.

Why Venezuela Matters for India

The developments are also significant for India. While China remains the largest buyer of Venezuelan crude, India had been a key importer in the past. Purchases fell sharply in 2021 and 2022 due to US sanctions.

Oil trade resumed momentum in 2023–24, with India’s petroleum imports from Venezuela rising to nearly $1 billion. In December 2023, India briefly became the top buyer of Venezuelan crude, according to The Financial Express.

Trade data from Indian agencies and the UN COMTRADE database shows imports increased to around 63,000–100,000 barrels per day in 2024, a sharp rise from the previous year. The IEA said India remained the third-largest buyer for much of 2025, though imports later declined as geopolitical tensions resurfaced and US sanctions tightened.

As of Saturday evening, the Indian government had not issued an official response to the developments in Venezuela.